Hasbro 2009 Annual Report Download - page 44

Download and view the complete annual report

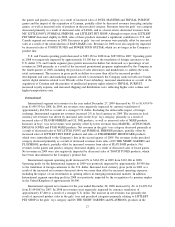

Please find page 44 of the 2009 Hasbro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.December 27, 2009 were approximately $1,400. Amounts available and unused under the committed line at

December 27, 2009 were approximately $298,600. The Company also has other uncommitted lines from

various banks, of which approximately $42,100 was utilized at December 27, 2009. Of the amount utilized

under the uncommitted lines, approximately $13,500 and $28,600 represent outstanding borrowings and letters

of credit, respectively.

Net cash provided by financing activities was $236,779 in 2009. Of this amount, $421,309 reflects net

proceeds from the issuance of long-term notes in May 2009. In addition, cash receipts from the exercise of

employee stock options in 2009 were $9,193. These sources of cash were partially offset by $88,112, which

includes transaction costs, used to repurchase shares of the Company’s common stock. During 2009, the

Company repurchased 3,172 shares at an average price per share of $28.67. At December 27, 2009, $161,434

remained under the February 2008 authorization. Dividends paid were $111,458 in 2009 compared to

$107,065 in 2008.

Net cash utilized by financing activities was $457,391 in 2008. Of this amount, $360,244, which includes

transaction costs, was used to repurchase shares of the Company’s common stock. In February 2008 the

Company’s Board of Directors authorized the repurchase of an additional $500,000 in common stock after

three previous authorizations dated May 2005, July 2006 and August 2007 with a cumulative authorized

repurchase amount of $1,200,000 were fully utilized. During 2008, the Company repurchased 11,736 shares at

an average price per share of $30.44. Dividends paid were $107,065 in 2008 compared to $94,097 in 2007,

reflecting the increase in the Company’s quarterly dividend rate to $0.20 per share in 2008 from $0.16 per

share in 2007, and net of the effect of decreased shares outstanding in 2008 as a result of the share

repurchases. In addition, $135,092 was used to repay long-term debt. These uses of cash were partially offset

by cash receipts of $120,895 from the exercise of employee stock options.

Net cash utilized by financing activities was $433,917 in 2007. Of this amount, $584,349, which includes

transaction costs, was used to repurchase shares of the Company’s common stock. During 2007, the Company

repurchased 20,795 shares at an average price per share of $28.20. In addition, the Company purchased certain

warrants in May 2007 for $200,000 in accordance with the terms of the call provision of the amended Lucas

warrant agreement. Dividends paid were $94,097 in 2007. These uses of cash were partially offset by net

proceeds of $346,009 from the issuance of $350,000 of notes that are due in 2017. The proceeds from the

notes were primarily used to repay short-term borrowings. The uses of cash were also partially offset by cash

receipts of $82,661 from the exercise of employee stock options.

At December 27, 2009, the Company has outstanding $249,828 in principal amount of senior convertible

debentures due 2021. The senior convertible debentures bear interest at 2.75%, which could be subject to an

upward adjustment in the rate, not to exceed 11%, should the price of the Company’s common stock trade at

or below $9.72 per share for 20 of the 30 trading days preceding the fifth day prior to an interest payment

date. This contingent interest feature represents a derivative instrument that is recorded on the balance sheet at

its fair value, with changes in fair value recognized in the statement of operations. If the closing price of the

Company’s common stock exceeds $23.76 for at least 20 trading days, within the 30 consecutive trading day

period ending on the last trading day of the calendar quarter, or upon other specified events, the debentures

will be convertible at an initial conversion price of $21.60 in the next calendar quarter. At December 31, 2008

and each of the calendar quarters in 2009 this conversion feature was met and the debentures were convertible

throughout 2009. There were no debentures converted during 2009. At December 31, 2009, this conversion

feature was met again and the bonds are convertible through March 31, 2010 at which time the requirements

of the conversion feature will be reevaluated. In addition, if the closing price of the Company’s common stock

exceeds $27.00 for at least 20 trading days in any 30 day period, the Company has the right to call the

debentures by giving notice to the holders of the debentures. During a prescribed notice period, the holders of

the debentures have the right to convert their debentures in accordance with the conversion terms described

above. At certain times during 2009, based on the Company’s common stock price, the Company had the right

to call the debentures under this provision. As of December 27, 2009, the Company had the right to call the

debentures. The Company believes a call would result in conversion by the holders of the debentures and

issuance of the shares, thereby increasing the number of shares outstanding. Historically, based on the

Company’s targeted capital structure and the low cost of the debentures, when the debentures have been

34