Hasbro 2009 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2009 Hasbro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

The following discussion should be read in conjunction with the audited consolidated financial statements

of the Company included in Part II Item 8 of this document.

This Management’s Discussion and Analysis of Financial Condition and Results of Operations contains

forward-looking statements concerning the Company’s expectations and beliefs. See Item 1A “Forward-

Looking Information and Risk Factors That May Affect Future Results” for a discussion of other uncertainties,

risks and assumptions associated with these statements.

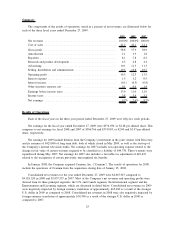

Unless otherwise specifically indicated, all dollar or share amounts herein are expressed in thousands of

dollars or shares, except for per share amounts.

Executive Summary

The Company earns revenue and generates cash through the sale of a variety of toy and game products,

as well as through the out-licensing of rights for use of its properties in connection with non-competing

products, including digital games, offered by third parties. The Company sells its products both within the

United States and in a number of international markets. The Company’s business is highly seasonal with a

significant amount of revenues occurring in the second half of the year. In 2009, 2008 and 2007, the second

half of the year accounted for 65%, 63% and 66% of the Company’s net revenues, respectively. While many

of the Company’s products are based on brands the Company owns or controls, the Company also offers

products which are based on licensed rights from outside inventors. In addition, the Company licenses rights

to produce products based on movie, television, music and other entertainment properties owned by third

parties, such as the MARVEL and STAR WARS properties.

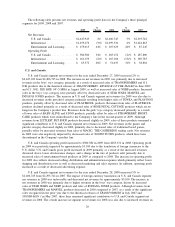

The Company’s business is separated into three principal business segments, U.S. and Canada, Interna-

tional and Entertainment and Licensing. The U.S. and Canada segment develops, markets and sells both toy

and game products in the U.S. and Canada. The International segment consists of the Company’s European,

Asia Pacific and Latin and South American marketing and sales operations. The Company’s Entertainment and

Licensing segment includes the Company’s lifestyle licensing, digital gaming, movie, television and online

entertainment operations. In addition to these three primary segments, the Company’s world-wide manufactur-

ing and product sourcing operations are managed through its Global Operations segment.

The Company seeks to make its brands relevant in all areas important to its consumers. Brand awareness

is amplified through immersive traditional play, digital applications, publishing and lifestyle licensing and

entertainment experiences presented for the consumers’ enjoyment. The Company’s focus remains on growing

core owned and controlled brands, developing new and innovative products which respond to market insights,

offering immersive entertainment experiences which allow consumers to experience the Company’s brands

across different forms and formats, and optimizing efficiencies within the Company to reduce costs, increase

operating profits and maintain a strong balance sheet. The Company’s core brands represent Company-owned

or Company-controlled brands, such as TRANSFORMERS, MY LITTLE PONY, LITTLEST PET SHOP,

MONOPOLY, MAGIC: THE GATHERING, PLAYSKOOL, G.I. JOE, NERF and TONKA, which have been

successful over the long term. The Company has a large portfolio of owned and controlled brands, which can

be introduced in new formats and platforms over time. These brands may also be further extended by pairing a

licensed concept with a core brand. By focusing on core brands, the Company is working to build a more

consistent revenue stream and basis for future growth, and to leverage profitability. During 2009 the Company

had strong revenues from core brands, namely TRANSFORMERS, LITTLEST PET SHOP, NERF, MONOP-

OLY, PLAYSKOOL, PLAY-DOH, MAGIC: THE GATHERING and G.I. JOE. The Company’s strategy of re-

imagining, re-inventing and re-igniting its brands has been instrumental to achieving its overall long-term

growth objectives.

The Company also seeks to drive revenues by increasing the visibility of its core brands through

entertainment. As an example of this, in June of 2009, the TRANSFORMERS: REVENGE OF THE FALLEN

motion picture was released as a sequel to the 2007 motion picture TRANSFORMERS. In addition, in August

2009, the motion picture G.I. JOE: THE RISE OF COBRA was released. The Company developed and

22