Hasbro 2009 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2009 Hasbro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

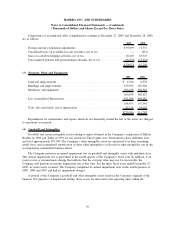

“Seller”) for a total cost of approximately $80,800. Previous to this asset purchase, the Company licensed

these rights from the Seller. The cost was recorded as property rights and included in other intangibles. These

property rights are being amortized over a fifteen year estimated useful life.

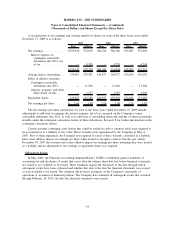

The Company will continue to incur amortization expense related to the use of acquired and licensed

rights to produce various products. The amortization of these product rights will fluctuate depending on related

projected revenues during an annual period, as well as rights reaching the end of their useful lives. The

Company currently estimates continuing amortization expense related to the above intangible assets for the

next five years to be approximately:

2010 ................................................................ $49,000

2011 ................................................................ 49,000

2012 ................................................................ 52,000

2013 ................................................................ 50,000

2014 ................................................................ 49,000

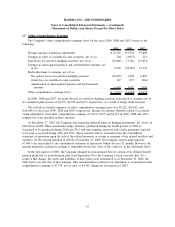

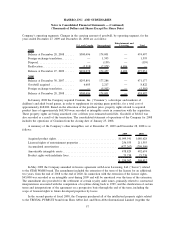

(5) Equity Method Investment

During 2009, the Company entered into an agreement to form a joint venture with Discovery Communi-

cations, Inc. (“Discovery”) to create a television network in the United States dedicated to high-quality

children’s and family entertainment and educational programming. The transaction closed in May 2009 with

the Company’s purchase of a 50% interest in the joint venture, DHJV Company LLC (“DHJV”), which owns

the DISCOVERY KIDS network in the United States. The Company purchased its 50% share in DHJV for a

payment of $300,000 and certain future payments based on the value of certain tax benefits expected to be

received by the Company. The present value of the expected future payments at the acquisition date totaled

approximately $67,900 and was recorded as a component of the Company’s investment in the joint venture.

The balance of the associated liability, including imputed interest, was $71,234 at December 27, 2009 and is

included as a component of other liabilities in the accompanying balance sheet.

Voting control of the joint venture is shared 50⁄50 between the Company and Discovery. However, the

Company believes that the joint venture qualifies as a variable interest entity pursuant to current accounting

standards, and that it qualifies as the primary beneficiary, which would result in the Company consolidating

the joint venture. In June 2009, the FASB revised the accounting guidance related to variable interest entity

consolidation. The revised guidance is effective for the Company at the beginning of fiscal 2010. Under the

revised guidance, the Company has determined that it does not meet the control requirements to consolidate

the joint venture, and would be required to deconsolidate DHJV and utilize the equity method to account for

its investment at the adoption date. The Company has elected to use the equity method in 2009 for financial

statement presentation of the joint venture as it has determined that the difference between using consolidation

and the equity method in 2009 is not material to the overall presentation of the financial statements.

Additionally, there is no impact on net earnings or earnings per share. The Company’s share in the earnings of

the joint venture for the year ended December 27, 2009 totaled $3,856 of income and is included as a

component of other (income) expense in the accompanying consolidated statements of operations.

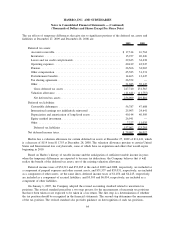

The Company has entered into a license agreement with the joint venture that will require the payment of

royalties by the Company to the joint venture based on a percentage of revenue derived from products related

to television shows broadcast by the joint venture. The license agreement includes a minimum royalty

guarantee of $125,000, payable in 5 annual installments of $25,000 per year, commencing in 2009, which can

be earned out over approximately a 10-year period. During 2009, the Company paid the first annual

installment of $25,000, which is included in other assets on the consolidated balance sheet at December 27,

2009. The Company and the joint venture are also parties to an agreement under which the Company will

58

HASBRO, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements — (Continued)

(Thousands of Dollars and Shares Except Per Share Data)