Hasbro 2009 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2009 Hasbro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

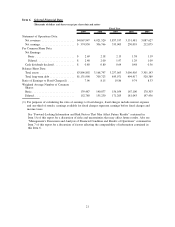

Other (Income) Expense, Net

Other (income) expense, net of $156 in 2009 compares to $23,752 in 2008. Other (income) expense, net

in 2009 includes income of $(3,856) representing the Company’s 50% share in the earnings of the joint

venture with Discovery. The remainder of the change in other (income) expense in 2009 as compared to 2008

primarily reflects the impact of foreign exchange gains and losses.

Other (income) expense, net of $23,752 in 2008 compares to $52,323 in 2007. In 2007 the major

component of other (income) expense related to the change in fair value of the Lucas warrants, which were

required to be classified as a liability. These warrants were required to be adjusted to their fair value each

quarter through earnings. In May 2007, the Company exercised the call option on these warrants and

repurchased them for $200,000 in cash, which approximated fair value at that date. As these warrants were

repurchased in 2007, there was no fair value adjustment in 2008. For 2007, expense related to the change in

fair value of these warrants was $44,370. Absent the impact of the fair value adjustments, increased expense

in 2008 primarily relates to increased foreign exchange losses arising from the impact of the large downward

movement in foreign exchange rates, primarily in the fourth quarter of 2008, on non-U.S. denominated

intercompany balances.

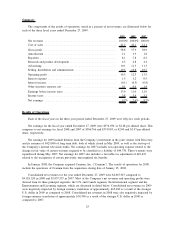

Income Taxes

Income tax expense totaled 29.2% of pretax earnings in 2009 compared with 30.4% in 2008 and 28.0%

in 2007. Income tax expense for 2009 is net of a benefit of approximately $2,300 of discrete tax events,

primarily related to the expiration of state statutes and settlement of various tax examinations in multiple

jurisdictions. Income tax expense for 2008 is net of a benefit of approximately $10,200 related to discrete tax

events, primarily comprised of a benefit from the repatriation of certain foreign earnings, as well as the

settlement of various tax examinations in multiple jurisdictions. Income tax expense for 2007 was net of a

benefit of $29,999 related to discrete tax events, primarily relating to the recognition of previously

unrecognized tax benefits. Absent these items and potential interest and penalties related to uncertain tax

positions in 2009, 2008 and 2007, the effective tax rates would have been 29.0%, 32.8% and 30.5%,

respectively. The decrease in the adjusted tax rate from 32.8% in 2008 compared to 29.0% in 2009 primarily

reflects the decision to provide for the repatriation of a portion of 2008 international earnings to the U.S. The

increase in the adjusted rate to 32.8% in 2008 from 30.5% in 2007 primarily reflects the change in the mix of

where the Company earned its profits.

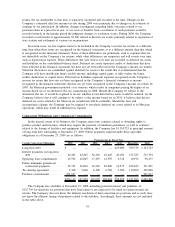

Liquidity and Capital Resources

The Company has historically generated a significant amount of cash from operations. In 2009, the

Company funded its operations and liquidity needs primarily through cash flows from operations, and, when

needed, using borrowings under its available lines of credit and proceeds from its accounts receivable

securitization program. During 2010, the Company expects to continue to fund its working capital needs

primarily through cash flows from operations and, when needed, using borrowings under its available lines of

credit and proceeds from its accounts receivable securitization program. The Company believes that the funds

available to it, including cash expected to be generated from operations and funds available through its

available lines of credit and accounts receivable securitization program are adequate to meet its working

capital needs for 2010, however, unexpected events or circumstances such as material operating losses or

increased capital or other expenditures may reduce or eliminate the availability of external financial resources.

In addition, significant disruptions to credit markets may also reduce or eliminate the availability of external

financial resources. Although we believe the risk of nonperformance by the counterparties to our financial

facilities is not significant, in times of severe economic downturn in the credit markets it is possible that one

or more sources of external financing may be unable or unwilling to provide funding to us.

At December 27, 2009, cash and cash equivalents, net of short-term borrowings, were $621,932 compared

to $622,804 and $764,257 at December 28, 2008 and December 30, 2007, respectively. Hasbro generated

$265,623, $593,185 and $601,794 of cash from its operating activities in 2009, 2008 and 2007, respectively.

The decrease in 2009 operating cash flows as compared to 2008 primarily reflects an increase in accounts

31