Hasbro 2009 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2009 Hasbro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

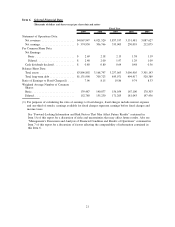

Advertising expense decreased to $412,580 or 10.1% of net revenues in 2009 compared to $454,612 or

11.3% of net revenues in 2008. In years in which the Company has significant sales of products related to

major motion picture releases, such as in 2009, advertising expense as a percentage of revenue is generally

lower, as such products do not require the same level of advertising that the Company spends on non-

entertainment based products. The decrease in advertising expense in 2009 also reflects lower advertisement

placement costs as well as the impact of foreign exchange. Advertising expense increased in dollars to

$454,612 in 2008 from $434,742 in 2007, but remained flat as a percentage of net revenues at 11.3%. The

increase in dollars was primarily the result of higher spending to increase awareness of the Company’s brands.

Selling, distribution and administration expenses decreased to $793,558 or 19.5% of net revenues in 2009,

compared to $797,209 or 19.8% of net revenues in 2008. Absent the impact of foreign exchange, selling,

distribution and administration expenses increased in 2009. Included in selling, distribution and administration

expenses in 2009 were approximately $7,200 in transaction costs related to the Company’s purchase of a 50%

interest in the joint venture with Discovery. The increase in selling, distribution and administration expense in

2009 also reflects higher incentive compensation expense as well as costs related to the start up of the

Company’s television studio and continued investments in emerging markets. Selling, distribution and

administration expense in 2009 was also positively impacted by lower shipping and distribution costs in 2009.

In addition, selling, distribution and administration expenses in 2008 were positively impacted by the

recognition of a pension surplus in the United Kingdom of approximately $6,000. Selling, distribution and

administration expenses increased to $797,209 or 19.8% of net revenues in 2008, compared to $755,127 or

19.7% of net revenues in 2007. The increase reflected increased sales and marketing expenses to support the

growth in the business; increased investment in the expansion into emerging markets, including Brazil, China,

Russia, the Czech Republic and Korea; increased investment in the Company’s digital and entertainment

strategies; and increased shipping and distribution costs associated with both increased sales volume and

higher transportation costs.

Interest Expense

Interest expense increased to $61,603 in 2009 from $47,143 in 2008. The increase in interest expense

reflects both higher outstanding borrowings and a higher average borrowing rate as a result of the issuance of

$425,000 of notes in May 2009. The proceeds from the issuance of notes in May 2009 were primarily used to

purchase a 50% interest in the joint venture with Discovery. Interest expense in 2009 also includes

approximately $4,000 in costs related to a short-term borrowing facility commitment the Company entered

into in April 2009 in connection with the Company’s anticipated investment in the joint venture with

Discovery. In addition, interest expense in 2009 includes amounts related to the Company’s tax sharing

agreement with Discovery.

Interest expense increased to $47,143 in 2008 from $34,618 in 2007. The increase in interest expense was

primarily the result of higher average borrowings in 2008 primarily as a result of the issuance of $350,000 of

notes in September 2007, partially offset by the repayment of $135,092 of notes in July 2008. The increase in

the average borrowing rate for 2008 from the issuance of long-term debt in 2007 was more than offset by

decreases in the average borrowing rate on short-term debt in 2008 as well as the repayment of 6.15% notes in

July 2008.

Interest Income

Interest income was $2,858 in 2009 compared to $17,654 in 2008. The decrease in interest income was

primarily the result of lower returns on invested cash as well as lower average invested cash balances. Interest

income was $17,654 in 2008 compared to $29,973 in 2007. The decrease in interest income in 2008 from

2007 was primarily the result of lower returns on invested cash. In addition, during a portion of 2007, the

Company invested excess cash in auction rate securities, which generated a higher rate of return and

contributed to the higher level of interest income in 2007.

30