Hasbro 2009 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2009 Hasbro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

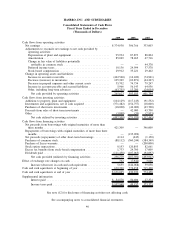

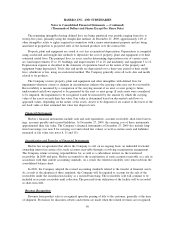

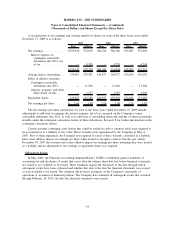

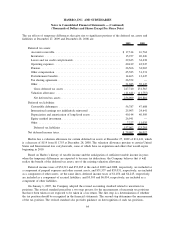

A reconciliation of net earnings and average number of shares for each of the three fiscal years ended

December 27, 2009 is as follows:

Basic Diluted Basic Diluted Basic Diluted

2009 2008 2007

Net earnings .............. $374,930 374,930 306,766 306,766 333,003 333,003

Interest expense on

contingent convertible

debentures due 2021, net

oftax................ — 4,328 — 4,238 — 4,248

$374,930 379,258 306,766 311,004 333,003 337,251

Average shares outstanding.... 139,487 139,487 140,877 140,877 156,054 156,054

Effect of dilutive securities:

Contingent convertible

debentures due 2021 ..... — 11,566 — 11,566 — 11,568

Options, warrants, and other

share-based awards ...... — 1,727 — 2,787 — 3,583

Equivalent shares ........... 139,487 152,780 140,877 155,230 156,054 171,205

Net earnings per share ....... $ 2.69 2.48 2.18 2.00 2.13 1.97

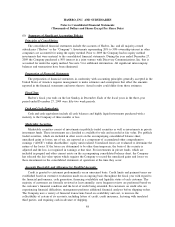

The net earnings per share calculations for each of the three years ended December 27, 2009 include

adjustments to add back to earnings the interest expense, net of tax, incurred on the Company’s senior

convertible debentures due 2021, as well as to add back to outstanding shares the amount of shares potentially

issuable under the contingent conversion feature of these debentures. See note 8 for further information on the

contingent conversion feature.

Certain warrants containing a put feature that could be settled in cash or common stock were required to

be accounted for as a liability at fair value. These warrants were repurchased by the Company in May of

2007. Prior to their repurchase, the Company was required to assess if these warrants, classified as a liability,

had a more dilutive impact on earnings per share when treated as an equity contract. For the year ended

December 30, 2007 the warrants had a more dilutive impact on earnings per share assuming they were treated

as a liability and no adjustment to net earnings or equivalent shares was required.

Subsequent Events

In May 2009, the Financial Accounting Standard Board (“FASB”) established general standards of

accounting for and disclosure of events that occur after the balance sheet date but before financial statements

are issued or are available to be issued. These standards require the disclosure of the date through which

subsequent events have been evaluated and whether that date is the date the financial statements were issued

or were available to be issued. The adoption did not have an impact on the Company’s statements of

operations or statement of financial position. The Company has evaluated all subsequent events that occurred

through February 24, 2010, the date the financial statements were issued.

54

HASBRO, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements — (Continued)

(Thousands of Dollars and Shares Except Per Share Data)