Hasbro 2009 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2009 Hasbro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

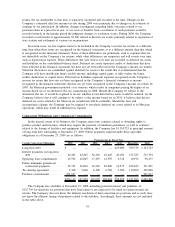

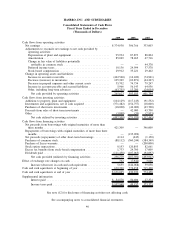

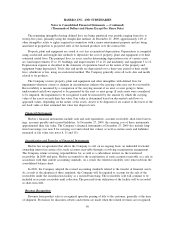

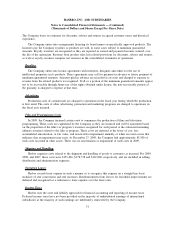

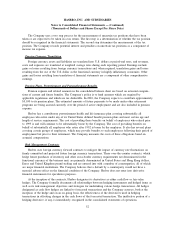

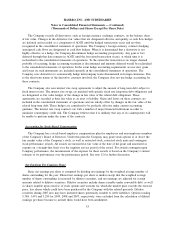

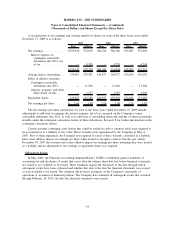

HASBRO, INC. AND SUBSIDIARIES

Consolidated Statements of Cash Flows

Fiscal Years Ended in December

(Thousands of Dollars)

2009 2008 2007

Cash flows from operating activities

Net earnings ............................................ $374,930 306,766 333,003

Adjustments to reconcile net earnings to net cash provided by

operating activities:

Depreciation of plant and equipment ........................ 95,934 87,873 88,804

Amortization .......................................... 85,029 78,265 67,716

Change in fair value of liabilities potentially

settleable in common stock ............................. — — 44,370

Deferred income taxes ................................... 19,136 24,994 37,578

Stock-based compensation ................................ 29,912 35,221 29,402

Change in operating assets and liabilities:

Increase in accounts receivable ............................ (422,560) (14,220) (74,941)

Decrease (increase) in inventories .......................... 105,329 (69,871) (44,267)

Decrease in prepaid expenses and other current assets ........... 35,702 74,734 79,247

Increase in accounts payable and accrued liabilities ............. 5,966 56,143 64,936

Other, including long-term advances ........................ (63,755) 13,280 (24,054)

Net cash provided by operating activities ................... 265,623 593,185 601,794

Cash flows from investing activities

Additions to property, plant and equipment ..................... (104,129) (117,143) (91,532)

Investments and acquisitions, net of cash acquired ................ (371,482) (154,757) (18,000)

Purchases of short-term investments........................... (18,000) (42,000) (43,700)

Proceeds from sales of short-term investments ................... — 42,000 43,700

Other ................................................. (3,898) (20) (2,933)

Net cash utilized by investing activities .................... (497,509) (271,920) (112,465)

Cash flows from financing activities

Net proceeds from borrowings with original maturities of more than

three months .......................................... 421,309 — 346,009

Repayments of borrowings with original maturities of more than three

months .............................................. — (135,092) —

Net proceeds (repayments) of other short-term borrowings .......... 4,114 (645) (1,150)

Purchases of common stock................................. (88,112) (360,244) (584,349)

Purchase of Lucas warrants ................................. — — (200,000)

Stock option transactions ................................... 9,193 120,895 82,661

Excess tax benefits from stock-based compensation ............... 1,733 24,760 17,009

Dividends paid .......................................... (111,458) (107,065) (94,097)

Net cash provided (utilized) by financing activities ............ 236,779 (457,391) (433,917)

Effect of exchange rate changes on cash ......................... 762 (7,942) 3,646

Increase (decrease) in cash and cash equivalents .............. 5,655 (144,068) 59,058

Cash and cash equivalents at beginning of year .................... 630,390 774,458 715,400

Cash and cash equivalents at end of year ......................... $636,045 630,390 774,458

Supplemental information

Interest paid . . ...................................... $ 54,578 50,696 27,374

Income taxes paid .................................... $107,948 49,152 123,325

See note (12) for disclosure of financing activities not affecting cash.

See accompanying notes to consolidated financial statements.

46