Hasbro 2009 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2009 Hasbro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

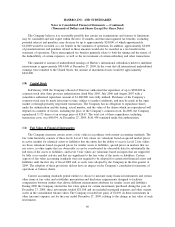

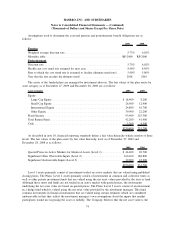

For 2009, 2008 and 2007, the Company measured the assets and obligations of the Plans as of the fiscal

year-end. The following is a detail of the components of the net periodic benefit cost (benefit) for the three

years ended December 27, 2009.

2009 2008 2007

Components of Net Periodic Cost

Pension

Service cost.......................................... $ 1,642 1,597 9,437

Interest cost.......................................... 17,358 17,714 17,435

Expected return on assets ................................ (18,982) (23,961) (23,064)

Amortization of prior service cost ......................... 266 282 634

Amortization of actuarial loss ............................ 4,495 993 1,768

Curtailment/settlement losses . ............................ 3,957 1,213 908

Net periodic benefit cost (benefit) ......................... $ 8,736 (2,162) 7,118

Postretirement

Service cost.......................................... $ 627 570 597

Interest cost.......................................... 1,903 2,065 2,105

Amortization of actuarial loss ............................ 12 115 364

Net periodic benefit cost ................................ $ 2,542 2,750 3,066

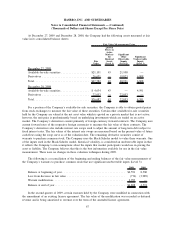

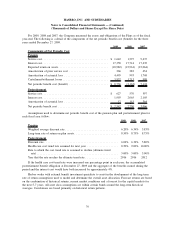

Assumptions used to determine net periodic benefit cost of the pension plan and postretirement plan for

each fiscal year follow:

2009 2008 2007

Pension

Weighted average discount rate .................................. 6.20% 6.34% 5.83%

Long-term rate of return on plan assets ............................ 8.50% 8.75% 8.75%

Postretirement

Discount rate ............................................... 6.02% 6.32% 5.80%

Health care cost trend rate assumed for next year .................... 8.50% 9.00% 10.00%

Rate to which the cost trend rate is assumed to decline (ultimate trend

rate) .................................................... 5.00% 5.00% 5.00%

Year that the rate reaches the ultimate trend rate ..................... 2016 2016 2012

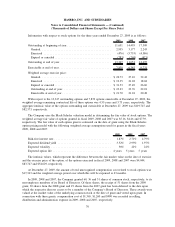

If the health care cost trend rate were increased one percentage point in each year, the accumulated

postretirement benefit obligation at December 27, 2009 and the aggregate of the benefits earned during the

period and the interest cost would have both increased by approximately 4%.

Hasbro works with external benefit investment specialists to assist in the development of the long-term

rate of return assumptions used to model and determine the overall asset allocation. Forecast returns are based

on the combination of historical returns, current market conditions and a forecast for the capital markets for

the next 5-7 years. All asset class assumptions are within certain bands around the long-term historical

averages. Correlations are based primarily on historical return patterns.

76

HASBRO, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements — (Continued)

(Thousands of Dollars and Shares Except Per Share Data)