Hasbro 2009 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2009 Hasbro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

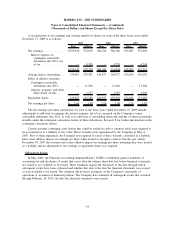

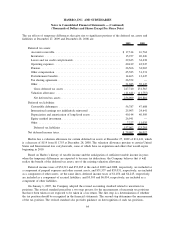

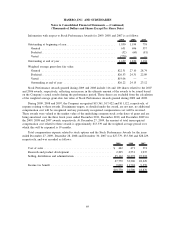

The tax effects of temporary differences that give rise to significant portions of the deferred tax assets and

liabilities at December 27, 2009 and December 28, 2008 are:

2009 2008

Deferred tax assets:

Accounts receivable.......................................... $ 17,314 16,764

Inventories ................................................ 15,937 20,226

Losses and tax credit carryforwards .............................. 29,623 34,438

Operating expenses .......................................... 40,419 42,947

Pension ................................................... 26,566 34,065

Other compensation .......................................... 45,383 31,331

Postretirement benefits........................................ 14,463 12,647

Tax sharing agreement ........................................ 26,352 —

Other .................................................... 31,683 39,147

Gross deferred tax assets .................................... 247,740 231,565

Valuation allowance.......................................... (11,641) (11,755)

Net deferred tax assets ...................................... 236,099 219,810

Deferred tax liabilities:

Convertible debentures ....................................... 56,787 47,608

International earnings not indefinitely reinvested .................... 25,903 24,641

Depreciation and amortization of long-lived assets ................... 40,144 40,509

Equity method investment ..................................... 26,941 —

Other .................................................... 7,227 11,035

Deferred tax liabilities ...................................... 157,002 123,793

Net deferred income taxes ....................................... $ 79,097 96,017

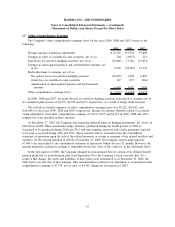

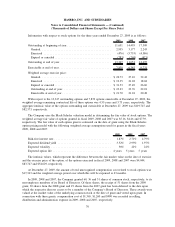

Hasbro has a valuation allowance for certain deferred tax assets at December 27, 2009 of $11,641, which

is a decrease of $114 from $11,755 at December 28, 2008. The valuation allowance pertains to certain United

States and International loss carryforwards, some of which have no expiration and others that would expire

beginning in 2010.

Based on Hasbro’s history of taxable income and the anticipation of sufficient taxable income in years

when the temporary differences are expected to become tax deductions, the Company believes that it will

realize the benefit of the deferred tax assets, net of the existing valuation allowance.

Deferred income taxes of $54,321 and $53,285 at the end of 2009 and 2008, respectively, are included as

a component of prepaid expenses and other current assets, and $31,537 and $53,031, respectively, are included

as a component of other assets. At the same dates, deferred income taxes of $1,456 and $4,245, respectively,

are included as a component of accrued liabilities, and $5,305 and $6,054, respectively, are included as a

component of other liabilities.

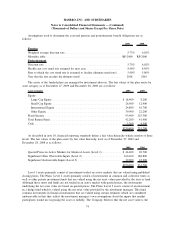

On January 1, 2007, the Company adopted the revised accounting standard related to uncertain tax

positions. The revised standard prescribes a two step process for the measurement of uncertain tax positions

that have been taken or are expected to be taken in a tax return. The first step is a determination of whether

the tax position should be recognized in the financial statements. The second step determines the measurement

of the tax position. The revised standard also provides guidance on derecognition of such tax positions,

64

HASBRO, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements — (Continued)

(Thousands of Dollars and Shares Except Per Share Data)