Harley Davidson 2015 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2015 Harley Davidson annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

85

obligations. In addition, cash equivalent balances are maintained at levels adequate to meet near-term plan expenses and benefit

payments. Investment risk is measured and monitored on an ongoing basis through quarterly investment portfolio reviews.

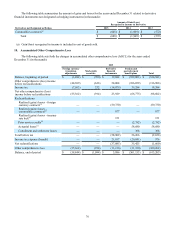

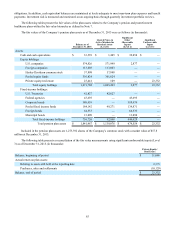

The following tables present the fair values of the plan assets related to the Company’s pension and postretirement

healthcare plans within the fair value hierarchy as defined in Note 7.

The fair values of the Company’s pension plan assets as of December 31, 2015 were as follows (in thousands):

Balance as of

December 31, 2015

Quoted Prices in

Active Markets for

Identical Assets

(Level 1)

Significant

Other

Observable

Inputs

(Level 2)

Significant

Unobservable

Inputs

(Level 3)

Assets:

Cash and cash equivalents $ 33,539 $ 1,485 $ 32,054 $ —

Equity holdings:

U.S. companies 574,826 571,949 2,877 —

Foreign companies 113,803 113,803 — —

Harley-Davidson common stock 57,808 57,808 — —

Pooled equity funds 301,824 301,824 — —

Private equity/real estate 23,441 109 — 23,332

Total equity holdings 1,071,702 1,045,493 2,877 23,332

Fixed-income holdings:

U.S. Treasuries 42,827 42,827 — —

Federal agencies 43,695 — 43,695 —

Corporate bonds 388,439 — 388,439 —

Pooled fixed income funds 184,142 49,271 134,871 —

Foreign bonds 64,533 — 64,533 —

Municipal bonds 13,090 — 13,090 —

Total fixed-income holdings 736,726 92,098 644,628 —

Total pension plan assets $ 1,841,967 $ 1,139,076 $ 679,559 $ 23,332

Included in the pension plan assets are 1,273,592 shares of the Company’s common stock with a market value of $57.8

million at December 31, 2015.

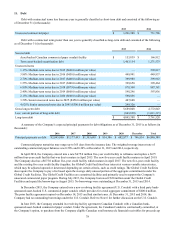

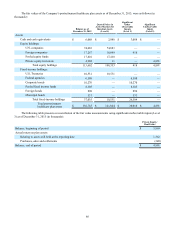

The following table presents a reconciliation of the fair value measurements using significant unobservable inputs (Level

3) as of December 31, 2015 (in thousands):

Private Equity/

Real Estate

Balance, beginning of period $ 31,086

Actual return on plan assets:

Relating to assets still held at the reporting date 2,375

Purchases, sales and settlements (10,129)

Balance, end of period $ 23,332