Harley Davidson 2015 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2015 Harley Davidson annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

57

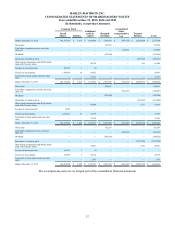

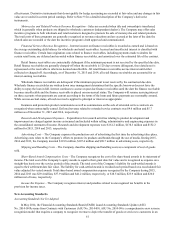

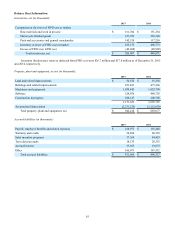

HARLEY-DAVIDSON, INC.

CONSOLIDATED STATEMENTS OF SHAREHOLDERS’ EQUITY

Years ended December 31, 2015, 2014 and 2013

(In thousands, except share amounts)

Common Stock Additional

paid-in

capital Retained

Earnings

Accumulated

Other

comprehensive

loss Treasury

Balance Total

Issued

Shares Balance

Balance December 31, 2012 341,265,838 $ 3,413 $ 1,066,069 $ 7,306,424 $ (607,678) $ (5,210,604) $ 2,557,624

Net income — — — 733,993 — — 733,993

Total other comprehensive loss, net of tax

(Note 10) — — — — 275,002 — 275,002

Dividends — — — (187,688) — — (187,688)

Repurchase of common stock — — — — — (479,231)(479,231)

Share-based compensation and 401(k) match

made with Treasury shares — — 40,724 — — 784 41,508

Issuance of nonvested stock 492,755 5 (5) — — — —

Exercise of stock options 1,398,638 14 50,553 — — — 50,567

Tax benefit of stock options and nonvested

stock — — 17,711 — — — 17,711

Balance December 31, 2013 343,157,231 $ 3,432 $ 1,175,052 $ 7,852,729 $ (332,676) $ (5,689,051) $ 3,009,486

Net income — — — 844,611 — — 844,611

Total other comprehensive income, net of tax

(Note 10) — — — — (182,267) — (182,267)

Dividends — — — (238,300) — — (238,300)

Repurchase of common stock — — — — — (615,602)(615,602)

Share-based compensation and 401(k) match

made with Treasury shares — — 40,848 — — 1,143 41,991

Issuance of nonvested stock 15,891 — — — — — —

Exercise of stock options 1,001,531 10 37,775 — — — 37,785

Tax benefit of stock options and nonvested

stock — — 11,582 — — — 11,582

Balance December 31, 2014 344,174,653 $ 3,442 $ 1,265,257 $ 8,459,040 $ (514,943) $ (6,303,510) $ 2,909,286

Net income — — — 752,207 — — 752,207

Total other comprehensive loss, net of tax

(Note 10) — — — — (100,262) — (100,262)

Dividends — — — (249,262) — — (249,262)

Repurchase of common stock — — — — — (1,537,020)(1,537,020)

Share-based compensation and 401(k) match

made with Treasury shares — — 39,457 — — 1,394 40,851

Issuance of nonvested stock 162,193 2 (2) — — — —

Exercise of stock options 518,858 5 20,174 — — — 20,179

Tax benefit of stock options and nonvested

stock — — 3,675 — — — 3,675

Balance December 31, 2015 344,855,704 $ 3,449 $ 1,328,561 $ 8,961,985 $ (615,205) $ (7,839,136) $ 1,839,654

The accompanying notes are an integral part of the consolidated financial statements.