Harley Davidson 2015 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2015 Harley Davidson annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

29

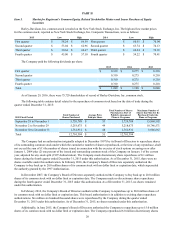

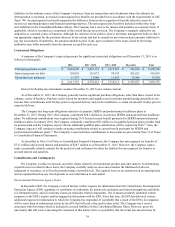

Segment Results

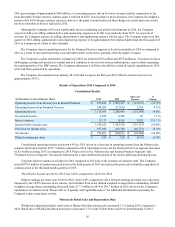

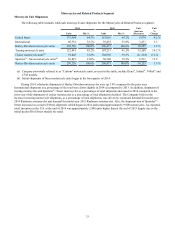

The following table includes the condensed statement of operations for the Motorcycles segment (in thousands):

2015 2014 (Decrease)

Increase %

Change

Revenue:

Motorcycles $ 4,127,739 $ 4,385,863 $ (258,124) (5.9)%

Parts & Accessories 862,645 875,019 (12,374) (1.4)

General Merchandise 292,310 284,826 7,484 2.6

Other 26,050 21,973 4,077 18.6

Total revenue 5,308,744 5,567,681 (258,937) (4.7)

Cost of goods sold 3,356,284 3,542,601 (186,317) (5.3)

Gross profit 1,952,460 2,025,080 (72,620) (3.6)

Selling & administrative expense 916,669 887,333 29,336 3.3

Engineering expense 160,301 134,600 25,701 19.1

Operating expense 1,076,970 1,021,933 55,037 5.4

Operating income from Motorcycles $ 875,490 $ 1,003,147 $ (127,657) (12.7)%

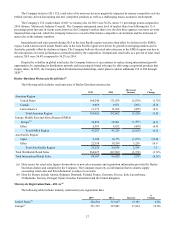

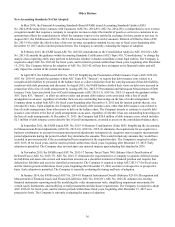

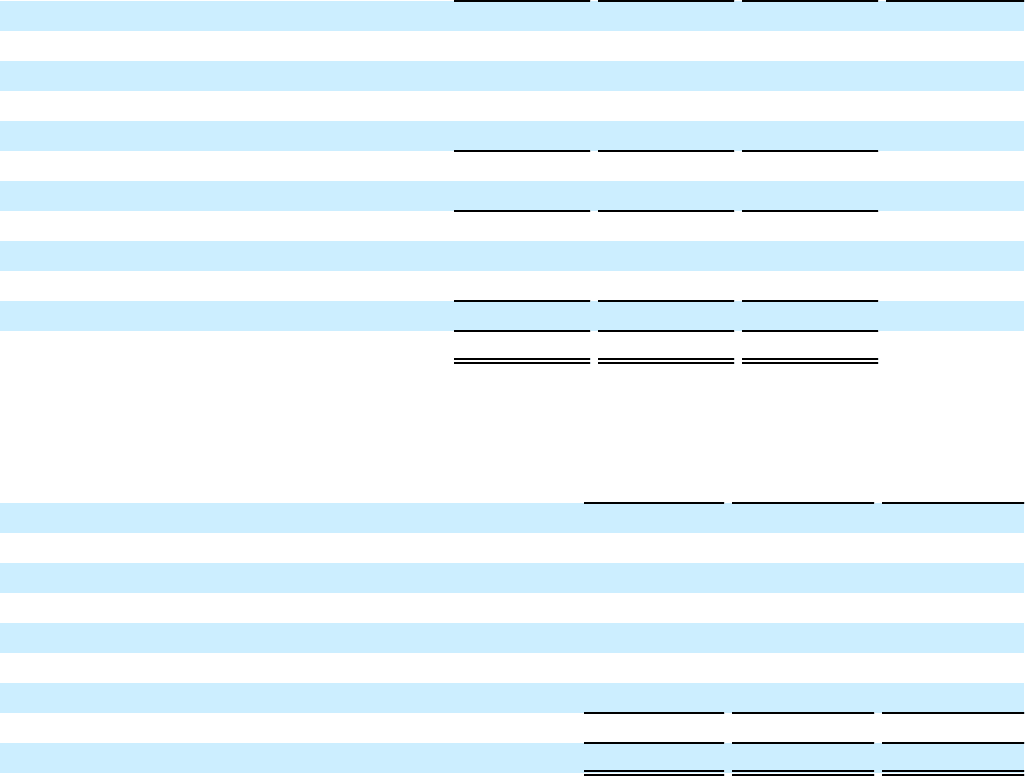

The following table includes the estimated impact of the significant factors affecting the comparability of net revenue,

cost of goods sold and gross profit from 2014 to 2015 (in millions):

Net

Revenue

Cost of

Goods

Sold Gross

Profit

2014 $ 5,568 $ 3,543 $ 2,025

Volume (59)(29)(30)

Price 81 9 72

Foreign currency exchange rates and hedging (231)(110)(121)

Shipment mix (50)(20)(30)

Raw material prices — (19) 19

Manufacturing costs — (17) 17

Total (259)(186)(73)

2015 $ 5,309 $ 3,357 $ 1,952

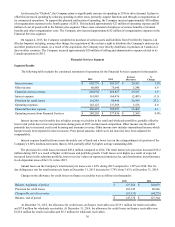

The following factors affected the comparability of net revenue, cost of goods sold and gross profit from 2014 to 2015:

• On average, wholesale prices on the Company’s 2015 and 2016 model-year motorcycles were higher than the prior

model-years resulting in the favorable impact on revenue during the period. The impact of revenue favorability

resulting from model-year price increases on gross profit was partially offset by increases in cost related to the

additional content added to the 2015 and 2016 model-year motorcycles.

• Gross profit was negatively impacted by changes in foreign currency exchange rates during 2015 compared to 2014.

Revenue was negatively impacted by a weighted-average devaluation in the Euro, Japanese yen, Brazilian real and

Australian dollar of 17% compared to 2014. The negative impact to revenue was partially offset by a positive impact

to cost of goods sold as a result of natural hedges, benefits of foreign exchange contracts and a decrease in losses from

the revaluation of foreign-denominated assets on the balance sheet.

• Shipment mix changes negatively impacted gross profit primarily due to changes in motorcycle family mix, driven by

higher shipments of Sportster®/Street motorcycles. The negative motorcycle family mix was partially offset by

positive mix changes within parts and accessories and general merchandise.

• Raw material prices were lower in 2015 compared to 2014.

• Manufacturing costs for 2015 benefited from increased manufacturing efficiencies and the absence of Street

motorcycles start-up costs that were incurred in 2014.

The net increase in operating expense was primarily due to reorganization charges, expenses associated with the

acquisition and operations of its Canadian distribution and higher recall costs.