Harley Davidson 2015 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2015 Harley Davidson annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.62

amount that reflects the consideration to which the company expects to be entitled in exchange for those goods or services. In

August 2015, the FASB issued ASU No. 2015-14 Revenue from Contracts with Customers: Deferral of Effective Date (ASU

No. 2015-14) to defer the effective date of the new revenue recognition standard by one year to fiscal years beginning after

December 15, 2017 and for interim periods therein. The Company is currently evaluating the impact of adoption.

In February 2015, the FASB issued ASU No. 2015-02 Amendments to the Consolidation Analysis (ASU 2015-02). ASU

No. 2015-02 amends the guidance within Accounting Standards Codification (ASC) Topic 810, "Consolidation,” to change the

analysis that a reporting entity must perform to determine whether it should consolidate certain legal entities. The Company is

required to adopt ASU No. 2015-02 for fiscal years, and for interim periods within those fiscal years, beginning after December

15, 2015. The Company believes the adoption of ASU No. 2015-02 will not have an impact on its financial results and will

only impact the content of the current disclosure.

In April 2015, the FASB issued ASU No. 2015-03 Simplifying the Presentation of Debt Issuance Costs (ASU 2015-03).

ASU No. 2015-03 amends the guidance within ASC Topic 835, "Interest", to require that debt issuance costs related to a

recognized debt liability be presented in the balance sheet as a direct deduction from the carrying amount of that debt liability,

consistent with debt premiums and discounts. In August 2015, the FASB further clarified their views on debt costs incurred in

connection with a line of credit arrangement by issuing ASU No. 2015-15 Presentation and Subsequent Measurement of Debt

Issuance Costs Associated with Line-of-Credit Arrangements (ASU 2015-15). ASU No. 2015-15 amends the guidance within

ASC Topic 835, “Interest”, to allow an entity to defer and present debt issuance costs associated with a line of credit

arrangement as an asset, regardless of whether there are any outstanding borrowings on the line of credit arrangement. The

Company plans to adopt both ASUs for fiscal years beginning after December 15, 2015 and for interim periods therein, on a

retrospective basis. Upon adoption, the Company will reclassify debt issuance costs, other than debt issuance costs related to

line of credit arrangements, from other assets to debt on the balance sheet. The Company intends to continue to classify debt

issuance costs related to the line of credit arrangements as an asset, regardless of whether it has any outstanding borrowings on

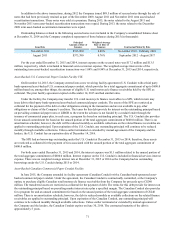

the line of credit arrangements. At December 31, 2015, the Company had $20.4 million of debt issuance costs, which includes

$2.1 million of debt issuance costs related to line of credit arrangements, recorded as assets on the balance sheet.

In September 2015, the FASB issued ASU No. 2015-16 Business Combinations (Topic 805): Simplifying the Accounting

for Measurement-Period Adjustments (ASU No. 2015-16). ASU No. 2015-16 eliminates the requirement for an acquirer in a

business combination to account for measurement-period adjustments retrospectively. Acquirers must recognize measurement-

period adjustments during the period in which they determine the amounts. This would include any amounts they would have

recorded in previous periods if the accounting had been completed at the acquisition date. The Company is required to adopt

ASU 2015-16 for fiscal years, and for interim periods within those fiscal years, beginning after December 15, 2015. Early

adoption is permitted. The Company does not anticipate any material impacts upon adopting this standard in 2016.

In November 2015, the FASB issued ASU No. 2015-17 Income Taxes (Topic 740): Balance Sheet Classification of

Deferred Taxes (ASU No. 2015-17). ASU No. 2015-17 eliminates the requirement for a Company to separate deferred income

tax liabilities and assets into current and noncurrent amounts on a classified statement of financial position and requires that

deferred tax liabilities and assets be classified as noncurrent. The Company is required to adopt ASU 2015-17 for fiscal years,

and for interim periods within those fiscal years, beginning after December 15, 2016 on either a retrospective or prospective

basis. Early adoption is permitted. The Company is currently evaluating the timing and basis of adoption.

In January 2016, the FASB issued ASU No. 2016-01 Financial Instruments-Overall (Subtopic 825-10): Recognition and

Measurement of Financial Assets and Financial Liabilities (ASU No. 2016-01). ASU No. 2016-01 enhances the existing

financial instruments reporting model by modifying fair value measurement tools, simplifying impairment assessments for

certain equity instruments, and modifying overall presentation and disclosure requirements. The Company is required to adopt

ASU 2016-01 for fiscal years, and for interim periods within those fiscal years, beginning after December 15, 2017 on a

prospective basis. The Company is currently evaluating the impact of adoption.

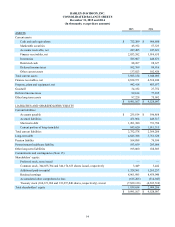

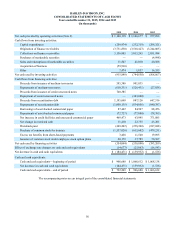

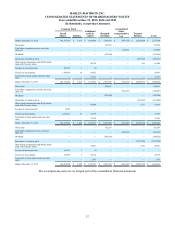

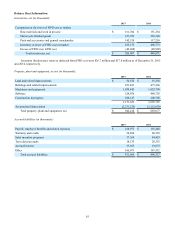

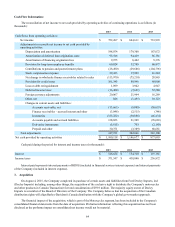

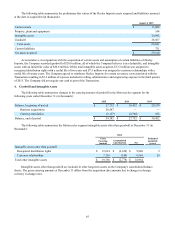

2. Additional Balance Sheet and Cash Flow Information

The following information represents additional detail for selected line items included in the consolidated balance sheets

at December 31, and the statements of cash flows for the years ended December 31.