Harley Davidson 2015 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2015 Harley Davidson annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.37

Critical Accounting Estimates

The Company’s financial statements are based on the selection and application of significant accounting policies, which

require management to make significant estimates and assumptions. Management believes that the following are some of the

more critical judgment areas in the application of accounting policies that currently affect the Company’s financial condition

and results of operations. Management has discussed the development and selection of these critical accounting estimates with

the Audit Committee of the Board of Directors.

Allowance for Credit Losses on Finance Receivables – The allowance for uncollectible accounts is maintained at a level

management believes is adequate to cover the losses of principal in the existing finance receivables portfolio.

The retail portfolio consists of a large number of small balance, homogeneous finance receivables. The Company

performs a periodic and systematic collective evaluation of the adequacy of the retail allowance. The Company utilizes loss

forecast models which consider a variety of factors including, but not limited to, historical loss trends, origination or vintage

analysis, known and inherent risks in the portfolio, the value of the underlying collateral, recovery rates and current economic

conditions including items such as unemployment rates.

The wholesale portfolio is primarily composed of large balance, non-homogeneous finance receivables. The Company's

wholesale allowance evaluation is first based on a loan-by-loan review. A specific allowance is established for wholesale

finance receivables determined to be individually impaired when management concludes that the borrower will not be able to

make full payment of contractual amounts due based on the original terms of the loan agreement. The impairment is determined

based on the cash that the Company expects to receive discounted at the loan’s original interest rate or the fair value of the

collateral, if the loan is collateral-dependent. In establishing the allowance, management considers a number of factors

including the specific borrower’s financial performance as well as ability to repay. Finance receivables in the wholesale

portfolio that are not individually evaluated for impairment are segregated, based on similar risk characteristics, according to

the Company’s internal risk rating system and collectively evaluated for impairment. The related allowance is based on factors

such as the Company’s past loan loss experience, current economic conditions as well as the value of the underlying collateral.

Product Warranty – Estimated warranty costs are reserved for motorcycles, motorcycle parts and motorcycle accessories

at the time of sale. The warranty reserve is based upon historical Company claim data used in combination with other known

factors that may affect future warranty claims. The Company updates its warranty estimates quarterly to ensure that the

warranty reserves are based on the most current information available.

The Company believes that past claim experience is indicative of future claims; however, the factors affecting actual

claims can be volatile. As a result, actual claims experience may differ from estimated which could lead to material changes in

the Company’s warranty provision and related reserves. The Company’s warranty liability is discussed further in Note 1 of

Notes to Consolidated Financial Statements.

Pensions and Other Postretirement Healthcare Benefits – The Company has a defined benefit pension plan and several

postretirement healthcare benefit plans, which cover employees of the Motorcycles segment. The Company also has unfunded

supplemental employee retirement plan agreements (SERPA) with certain employees which were instituted to replace benefits

lost under the Tax Revenue Reconciliation Act of 1993.

U.S. GAAP requires that companies recognize in their statement of financial position a liability for defined benefit

pension and postretirement plans that are underfunded or an asset for defined benefit pension and postretirement benefit plans

that are overfunded.

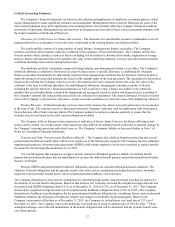

Pension, SERPA and postretirement healthcare obligations and costs are calculated through actuarial valuations. The

valuation of benefit obligations and net periodic benefit costs relies on key assumptions including discount rates, mortality,

long-term expected return on plan assets, future compensation and healthcare cost trend rates.

The Company determines its discount rate assumptions by referencing high-quality long-term bond rates that are matched to

the duration of its own benefit obligations. Based on this analysis, the Company increased the weighted-average discount rate

for pension and SERPA obligations from 4.21% as of December 31, 2014 to 4.53% as of December 31, 2015. The Company

increased the weighted-average discount rate for postretirement healthcare obligations from 3.99% to 4.29%. The Company

determines its healthcare trend assumption for the postretirement healthcare obligation by considering factors such as estimated

healthcare inflation, the utilization of healthcare benefits and changes in the health of plan participants. Based on the

Company’s assessment of this data as of December 31, 2015, the Company set its healthcare cost trend rate at 7.5% as of

December 31, 2015. The Company expects the healthcare cost trend rate to reach its ultimate rate of 5.0% by 2021.(1) These

assumption changes were reflected immediately in the benefit obligation and will be amortized into net periodic benefit costs

over future periods.