Harley Davidson 2015 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2015 Harley Davidson annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

66

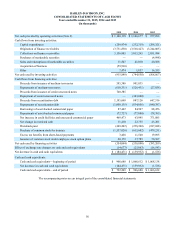

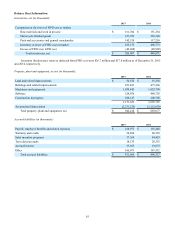

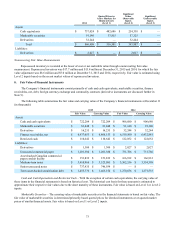

Total amortization expense of other intangible assets for 2015 was $2.8 million. There was no amortization expense of

other intangible assets for 2014. The Company estimates future amortization to be as follows (in thousands):

Estimated Amortization

2016 6,756

2017 4,091

2018 360

2019 360

2020 360

Thereafter 5,027

Total $ 16,954

The Financial Services segment had no goodwill or intangible assets at December 31, 2015 and December 31, 2014.

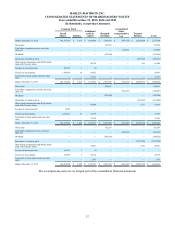

5. Finance Receivables

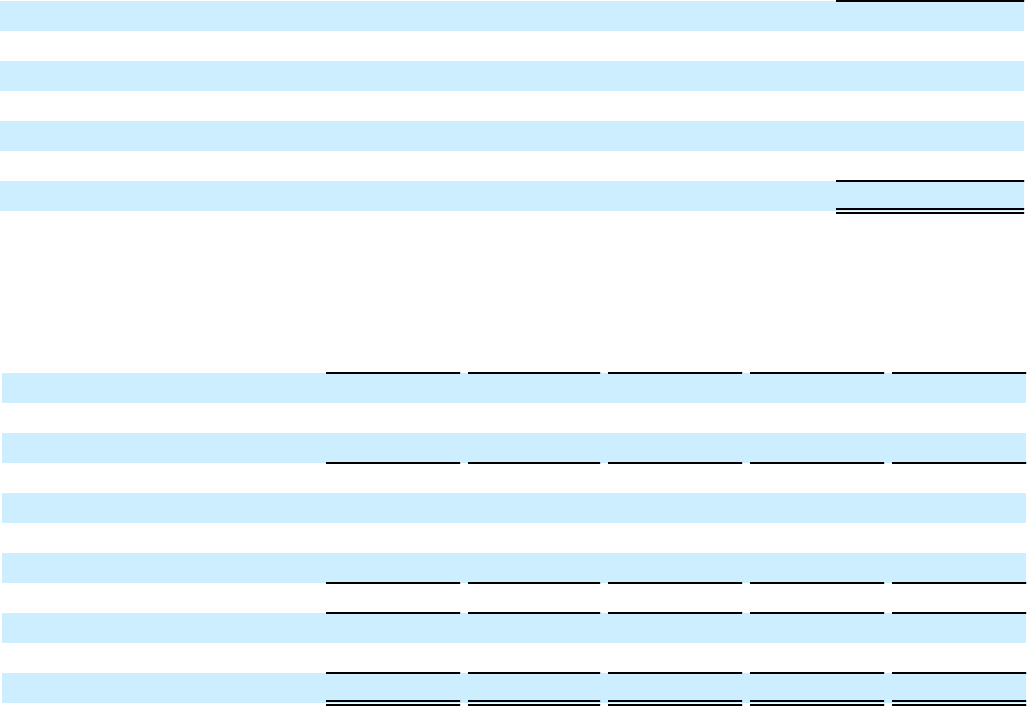

Finance receivables, net at December 31 for the past five years were as follows (in thousands):

2015 2014 2013 2012 2011

Wholesale

United States $ 965,379 $ 903,380 $ 800,491 $ 776,633 $ 778,320

Canada 58,481 48,941 44,721 39,771 46,320

Total wholesale 1,023,860 952,321 845,212 816,404 824,640

Retail

United States 5,803,071 5,398,006 5,051,245 4,850,450 4,858,781

Canada 188,400 209,918 213,799 222,665 228,709

Total retail 5,991,471 5,607,924 5,265,044 5,073,115 5,087,490

7,015,331 6,560,245 6,110,256 5,889,519 5,912,130

Allowance for credit losses (147,178) (127,364)(110,693)(107,667)(125,449)

Total finance receivables, net $ 6,868,153 $ 6,432,881 $ 5,999,563 $ 5,781,852 $ 5,786,681

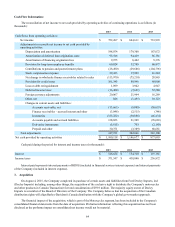

HDFS offers wholesale financing to the Company’s independent dealers. Wholesale loans to dealers are generally

secured by financed inventory or property and are originated in the U.S. and Canada. Wholesale finance receivables are related

primarily to motorcycles and related parts and accessories sales.

HDFS provides retail financial services to customers of the Company’s independent dealers in the U.S. and Canada. The

origination of retail loans is a separate and distinct transaction between HDFS and the retail customer, unrelated to the

Company’s sale of product to its dealers. Retail finance receivables consist of secured promissory notes and secured installment

contracts and are primarily related to sales of motorcycles to the dealers’ customers. HDFS holds either titles or liens on titles to

vehicles financed by promissory notes and installment sales contracts. As of December 31, 2015 and 2014, approximately 12%

of gross outstanding finance receivables were originated in Texas; there were no other states that accounted for more than 10%.

Unused lines of credit extended to the Company's wholesale finance customers totaled $1.27 billion and $1.01 billion at

December 31, 2015 and 2014, respectively. Approved but unfunded retail finance loans totaled $169.6 million and $168.7

million at December 31, 2015 and 2014, respectively.