Harley Davidson 2015 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2015 Harley Davidson annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

75

contracts were settled in July 2015. The loss at settlement was recorded in accumulated other comprehensive loss and will be

reclassified into earnings over the life of the debt.

The Company utilized interest rate swaps to reduce the impact of fluctuations in interest rates on its unsecured

commercial paper by converting a portion from a floating rate basis to a fixed rate basis. The interest rate swaps expired during

the second quarter of 2013, and as of December 31, 2013, there were no interest rate swaps outstanding.

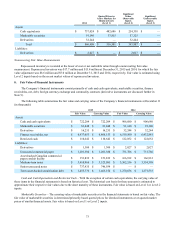

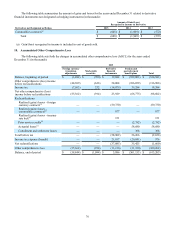

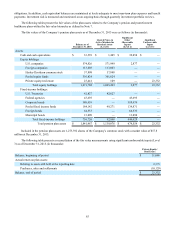

The following tables summarize the fair value of the Company’s derivative financial instruments at December 31 (in

thousands):

2015 2014

Derivatives Designated As Hedging

Instruments Under ASC Topic 815 Notional

Value Asset

Fair Value(a) Liability

Fair Value(b) Notional

Value Asset

Fair Value(a) Liability

Fair Value(b)

Foreign currency contracts(c) $ 436,352 $ 16,167 $ 181 $ 339,077 $ 32,244 $ —

Commodities contracts(c) 968 — 159 1,728 — 414

Total $ 437,320 $ 16,167 $ 340 $ 340,805 $ 32,244 $ 414

2015 2014

Derivatives Not Designated As Hedging

Instruments Under ASC Topic 815 Notional

Value Asset

Fair Value(a) Liability

Fair Value(b) Notional

Value Asset

Fair Value(a) Liability

Fair Value(b)

Commodities contracts $ 6,510 $ 68 $ 960 $ 11,804 $ — $ 1,613

Total $ 6,510 $ 68 $ 960 $ 11,804 $ — $ 1,613

(a) Included in other current assets

(b) Included in accrued liabilities

(c) Derivative designated as a cash flow hedge

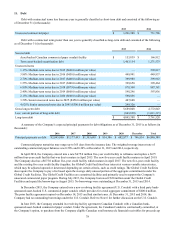

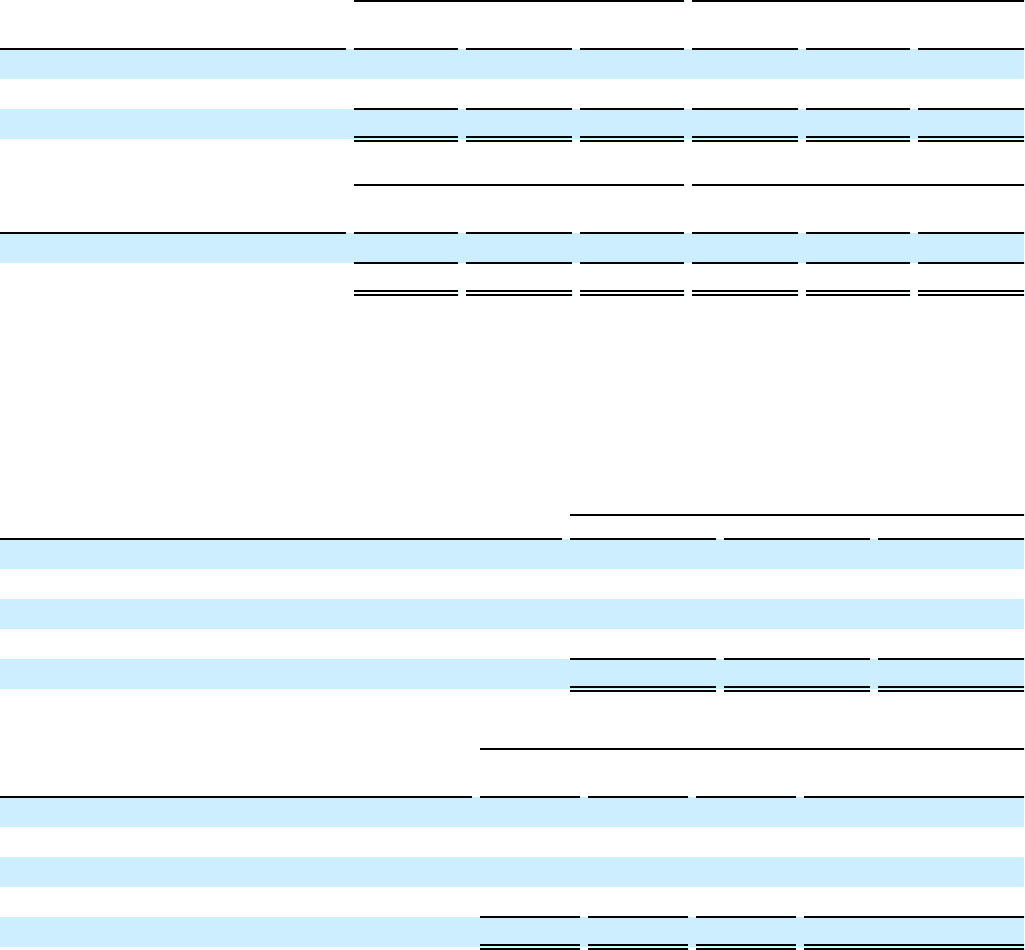

The following tables summarize the amount of gains and losses for the following years ended December 31 related to

derivative financial instruments designated as cash flow hedges (in thousands):

Amount of Gain/(Loss)

Recognized in OCI, before tax

Cash Flow Hedges 2015 2014 2013

Foreign currency contracts $ 45,810 $ 47,037 $ 3,468

Commodities contracts (421)(262) 39

Treasury rate locks (7,381) — —

Interest rate swaps – unsecured commercial paper — — (2)

Total $ 38,008 $ 46,775 $ 3,505

Amount of Gain/(Loss)

Reclassified from AOCL into Income

Cash Flow Hedges 2015 2014 2013 Expected to be Reclassified

Over the Next Twelve Months

Foreign currency contracts(a) $ 59,730 $ 13,635 $ 482 $ 16,738

Commodities contracts(a) (677) 228 (51)(159)

Treasury rate locks(b) (151) — — (362)

Interest rate swaps – unsecured commercial paper(c) — — (345) —

Total $ 58,902 $ 13,863 $ 86 $ 16,217

(a) Gain/(loss) reclassified from accumulated other comprehensive loss (AOCL) to income is included in cost of goods sold.

(b) Gain/(loss) reclassified from AOCL to income is included in interest expense

(c) Gain/(loss) reclassified from AOCL to income is included in financial services interest expense.

For the years ended December 31, 2015 and 2014, the cash flow hedges were highly effective and, as a result, the amount

of hedge ineffectiveness was not material. No amounts were excluded from effectiveness testing.