Harley Davidson 2015 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2015 Harley Davidson annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.61

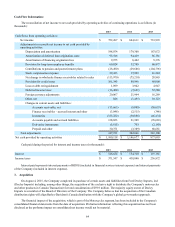

effectiveness. Derivative instruments that do not qualify for hedge accounting are recorded at fair value and any changes in fair

value are recorded in current period earnings. Refer to Note 9 for a detailed description of the Company’s derivative

instruments.

Motorcycles and Related Products Revenue Recognition – Sales are recorded when title and ownership is transferred,

which is generally when products are shipped to wholesale customers (independent dealers). The Company may offer sales

incentive programs to both wholesale and retail customers designed to promote the sale of motorcycles and related products.

The total costs of these programs are generally recognized as revenue reductions and are accrued at the later of the date the

related sales are recorded or the date the incentive program is both approved and communicated.

Financial Services Revenue Recognition – Interest income on finance receivables is recorded as earned and is based on

the average outstanding daily balance for wholesale and retail receivables. Accrued and uncollected interest is classified with

finance receivables. Certain loan origination costs related to finance receivables, including payments made to dealers for

certain retail loans, are deferred and recorded within finance receivables, and amortized over the estimated life of the contract.

Retail finance receivables are contractually delinquent if the minimum payment is not received by the specified due date.

Retail finance receivables are generally charged-off when the receivable is 120 days or more delinquent, the related asset is

repossessed or the receivable is otherwise deemed uncollectible. All retail finance receivables accrue interest until either

collected or charged-off. Accordingly, as of December 31, 2015 and 2014, all retail finance receivables are accounted for as

interest-earning receivables.

Wholesale finance receivables are delinquent if the minimum payment is not received by the contractual due date.

Wholesale finance receivables are written down once management determines that the specific borrower does not have the

ability to repay the loan in full. Interest continues to accrue on past due finance receivables until the date the finance receivable

becomes uncollectible and the finance receivable is placed on non-accrual status. The Company will resume accruing interest

on these accounts when payments are current according to the terms of the loans and future payments are reasonably assured.

While on non-accrual status, all cash received is applied to principal or interest as appropriate.

Insurance and protection product commissions as well as commissions on the sale of extended service contracts are

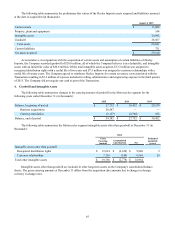

recognized when contractually earned. Deferred revenue related to extended service contracts was $4.6 million and $5.7

million as of December 31, 2015 and 2014, respectively.

Research and Development Expenses – Expenditures for research activities relating to product development and

improvement are charged against income as incurred and included within selling, administrative and engineering expenses in

the consolidated statement of income. Research and development expenses were $161.2 million, $138.3 million and $152.2

million for 2015, 2014 and 2013, respectively.

Advertising Costs – The Company expenses the production cost of advertising the first time the advertising takes place.

Advertising costs relate to the Company’s efforts to promote its products and brands through the use of media. During 2015,

2014 and 2013, the Company incurred $119.8 million, $107.4 million and $90.7 million in advertising costs, respectively.

Shipping and Handling Costs – The Company classifies shipping and handling costs as a component of cost of goods

sold.

Share-Based Award Compensation Costs – The Company recognizes the cost of its share-based awards in its statement of

income. The total cost of the Company’s equity awards is equal to their grant date fair value and is recognized as expense on a

straight-line basis over the service periods of the awards. The total cost of the Company’s liability for cash-settled awards is

equal to their settlement date fair value. The liability for cash-settled awards is revalued each period based on a recalculated fair

value adjusted for vested awards. Total share-based award compensation expense recognized by the Company during 2015,

2014 and 2013 was $29.4 million, $37.9 million and $41.2 million, respectively, or $18.5 million, $23.9 million and $26.0

million net of taxes, respectively.

Income Tax Expense – The Company recognizes interest and penalties related to unrecognized tax benefits in the

provision for income taxes.

New Accounting Standards

Accounting Standards Not Yet Adopted

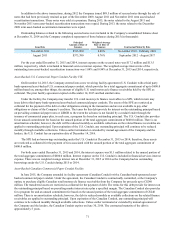

In May 2014, the Financial Accounting Standards Board (FASB) issued Accounting Standards Update (ASU)

No. 2014-09 Revenue from Contracts with Customers (ASU No. 2014-09). ASU No. 2014-09 is a comprehensive new revenue

recognition model that requires a company to recognize revenue to depict the transfer of goods or services to customers in an