Harley Davidson 2015 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2015 Harley Davidson annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

83

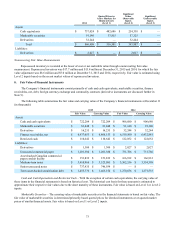

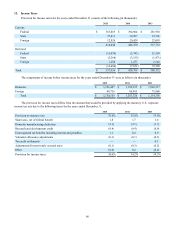

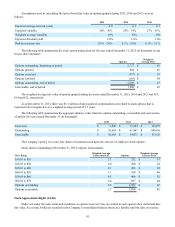

Benefit Costs:

Components of net periodic benefit costs for the years ended December 31 (in thousands):

Pension and

SERPA Benefits Postretirement

Healthcare Benefits

2015 2014 2013 2015 2014 2013

Service cost $ 40,039 $ 31,498 $ 35,987 $ 8,259 $ 7,015 $ 7,858

Interest cost 87,345 86,923 79,248 14,166 16,878 15,599

Special early retirement benefits 10,563 — — 622 — —

Expected return on plan assets (144,929) (136,734)(127,327)(11,506)(10,429)(9,537)

Amortization of unrecognized:

Prior service cost (credit) 435 1,119 1,746 (3,217)(3,853)(3,853)

Net loss 54,709 36,563 58,608 3,971 4,729 8,549

Settlement loss 368 — — — — —

Net periodic benefit cost $ 48,530 $ 19,369 $ 48,262 $ 12,295 $ 14,340 $ 18,616

Net periodic benefit costs are allocated among selling, administrative and engineering expense, cost of goods sold and

inventory.

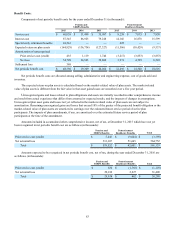

The expected return on plan assets is calculated based on the market-related value of plan assets. The market-related

value of plan assets is different from the fair value in that asset gains/losses are smoothed over a five year period.

Unrecognized gains and losses related to plan obligations and assets are initially recorded in other comprehensive income

and result from actual experience that differs from assumed or expected results, and the impacts of changes in assumptions.

Unrecognized plan asset gains and losses not yet reflected in the market-related value of plan assets are not subject to

amortization. Remaining unrecognized gains and losses that exceed 10% of the greater of the projected benefit obligation or the

market-related value of plan assets are amortized to earnings over the estimated future service period of active plan

participants. The impacts of plan amendments, if any, are amortized over the estimated future service period of plan

participants at the time of the amendment.

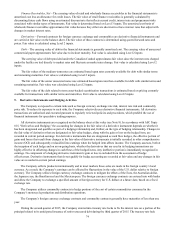

Amounts included in accumulated other comprehensive income, net of tax, at December 31, 2015 which have not yet

been recognized in net periodic benefit cost are as follows (in thousands):

Pension and

SERPA Benefits Postretirement

Healthcare Benefits Total

Prior service cost (credit) $ 5,445 $ (9,044) $ (3,599)

Net actuarial loss 513,107 51,645 564,752

Total $ 518,552 $ 42,601 $ 561,153

Amounts expected to be recognized in net periodic benefit cost, net of tax, during the year ended December 31, 2016 are

as follows (in thousands):

Pension and

SERPA Benefits Postretirement

Healthcare Benefits Total

Prior service cost (credit) $ 636 $ (1,765) $ (1,129)

Net actuarial loss 29,182 2,227 31,409

Total $ 29,818 $ 462 $ 30,280