Harley Davidson 2015 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2015 Harley Davidson annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

58

HARLEY-DAVIDSON, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

1. Summary of Significant Accounting Policies

Principles of Consolidation and Basis of Presentation – The consolidated financial statements include the accounts of

Harley-Davidson, Inc. and its wholly-owned subsidiaries (the Company), including the accounts of the groups of companies

doing business as Harley-Davidson Motor Company (HDMC) and Harley-Davidson Financial Services (HDFS). In addition,

certain variable interest entities (VIEs) related to secured financing are consolidated as the Company is the primary beneficiary.

All intercompany accounts and transactions are eliminated.

All of the Company’s subsidiaries are wholly owned and are included in the consolidated financial statements.

Substantially all of the Company’s international subsidiaries use their respective local currency as their functional currency.

Assets and liabilities of international subsidiaries have been translated at period-end exchange rates, and revenues and expenses

have been translated using average exchange rates for the period.

The Company operates in two principal reportable segments: Motorcycles & Related Products (Motorcycles) and

Financial Services.

Use of Estimates – The preparation of financial statements in conformity with U.S. generally accepted accounting

principles (U.S. GAAP) requires management to make estimates and assumptions that affect the amounts reported in the

financial statements and accompanying notes. Actual results could differ from those estimates.

Cash and Cash Equivalents – The Company considers all highly liquid investments with a maturity of three months or

less when purchased to be cash equivalents.

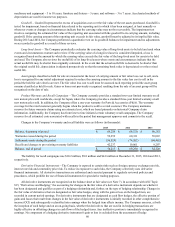

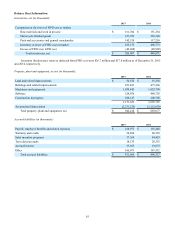

Marketable Securities – The Company’s marketable securities consisted of the following at December 31 (in thousands):

2015 2014

Available-for-sale securities: corporate bonds $ 45,192 $ 57,325

Trading securities: mutual funds 36,256 33,815

Total marketable securities $ 81,448 $ 91,140

The Company’s available-for-sale securities are carried at fair value with any unrealized gains or losses reported in other

comprehensive income. During 2015 and 2014, the Company recognized gross unrealized losses of $0.6 million and $0.7

million, respectively, or losses of $0.4 million and $0.4 million, net of tax, respectively, to adjust amortized cost to fair value.

The marketable securities have contractual maturities that generally come due over the next 4 to 16 months.

The Company's trading securities relate to investments held by the Company to fund certain deferred compensation

obligations. The trading securities are carried at fair value with gains and losses recorded in net income and investments are

included in other long-term assets on the consolidated balance sheets.

Accounts Receivable, Net – The Company’s motorcycles and related products are sold to independent dealers outside the

U.S. and Canada generally on open account and the resulting receivables are included in accounts receivable in the Company’s

consolidated balance sheets. The allowance for doubtful accounts deducted from total accounts receivable was $2.9 million and

$3.5 million as of December 31, 2015 and 2014, respectively. Accounts receivable are written down once management

determines that the specific customer does not have the ability to repay the balance in full. The Company’s sales of motorcycles

and related products in the U.S. and Canada are financed by the purchasing dealers through HDFS and the related receivables

are included in finance receivables in the consolidated balance sheets.

Finance Receivables, Net – Finance receivables include both retail and wholesale finance receivables, net, including

amounts held by VIEs. Finance receivables are recorded in the financial statements at amortized cost net of an allowance for

credit losses. The provision for credit losses on finance receivables is charged to earnings in amounts sufficient to maintain the

allowance for credit losses at a level that is adequate to cover estimated losses of principal inherent in the existing portfolio.

Portions of the allowance for credit losses are specified to cover estimated losses on finance receivables specifically identified

for impairment. The unspecified portion of the allowance covers estimated losses on finance receivables which are collectively

reviewed for impairment. Finance receivables are considered impaired when management determines it is probable that the

Company will be unable to collect all amounts due according to the terms of the loan agreement.

The retail portfolio primarily consists of a large number of small balance, homogeneous finance receivables. The

Company performs a periodic and systematic collective evaluation of the adequacy of the retail allowance for credit losses. The