Harley Davidson 2015 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2015 Harley Davidson annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

27

The Company believes 2015 U.S. retail sales of its motorcycles were negatively impacted by intense competitive activity

behind currency-driven discounting and new competitor products as well as a challenging macro-economic environment.

The Company's U.S. market share of 601+cc motorcycles for 2015 was 50.2%, down 3.1 percentage points compared to

2014 (Source: Motorcycle Industry Council). The Company anticipated some level of market share loss following the 13.4

percentage point increase in recent years; however, the Company's market share over the first three quarters was more severely

impacted than expected, which the Company believes is a result of the intense competitive environment and the inclusion of

autocycles in the industry numbers.

International retail sales growth during 2015 in the Asia Pacific region was more than offset by declines in the EMEA

region, Latin America and Canada. Retail sales in the Asia Pacific region were driven by growth in emerging markets and in

Australia, partially offset by declines in Japan. The Company believes the retail sales decrease in the EMEA region was due to

the introduction of several performance-oriented models by the competition. International retail sales as a percent of total retail

sales in 2015 were 36.4% compared to 36.2% in 2014.

Despite the volatility in global retail sales, the Company believes it can continue to realize strong international growth

opportunities by expanding its distribution network and increasing its brand relevance by delivering exceptional products that

inspire riders. In 2015, the Company added 40 international dealerships, and it plans to add an additional 150 to 200 through

2020.(1)

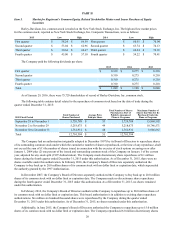

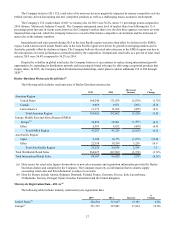

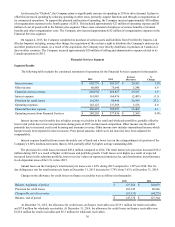

Harley-Davidson Motorcycle Retail Sales(a)

The following table includes retail unit sales of Harley-Davidson motorcycles:

2015 2014 (Decrease)

Increase %

Change

Americas Region

United States 168,240 171,079 (2,839) (1.7)%

Canada 9,669 9,871 (202) (2.0)

Latin America 11,173 11,652 (479) (4.1)

Total Americas Region 189,082 192,602 (3,520) (1.8)

Europe, Middle East and Africa Region (EMEA)

Europe(b) 36,894 38,491 (1,597) (4.1)

Other 6,393 6,832 (439) (6.4)

Total EMEA Region 43,287 45,323 (2,036) (4.5)

Asia Pacific Region

Japan 9,700 10,775 (1,075) (10.0)

Other 22,558 19,299 3,259 16.9

Total Asia Pacific Region 32,258 30,074 2,184 7.3

Total Worldwide Retail Sales 264,627 267,999 (3,372) (1.3)%

Total International Retail Sales 96,387 96,920 (533) (0.5)%

(a) Data source for retail sales figures shown above is new sales warranty and registration information provided by Harley-

Davidson dealers and compiled by the Company. The Company must rely on information that its dealers supply

concerning retail sales and this information is subject to revision.

(b) Data for Europe include Austria, Belgium, Denmark, Finland, France, Germany, Greece, Italy, Luxembourg,

Netherlands, Norway, Portugal, Spain, Sweden, Switzerland and the United Kingdom.

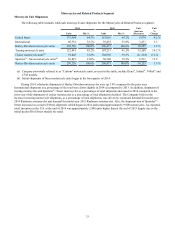

Motorcycle Registration Data - 601+cc(a)

The following table includes industry retail motorcycle registration data:

2015 2014 Increase %

Change

United States(b) 328,818 313,627 15,191 4.8%

Europe(c) 351,735 319,801 31,934 10.0%