Harley Davidson 2015 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2015 Harley Davidson annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

60

machinery and equipment – 3 to 10 years; furniture and fixtures – 5 years; and software – 3 to 7 years. Accelerated methods of

depreciation are used for income tax purposes.

Goodwill – Goodwill represents the excess of acquisition cost over the fair value of the net assets purchased. Goodwill is

tested for impairment, based on financial data related to the reporting unit to which it has been assigned, at least annually or

whenever events or changes in circumstances indicate that the carrying value may not be recoverable. The impairment test

involves comparing the estimated fair value of the reporting unit associated with the goodwill to its carrying amount, including

goodwill. If the carrying amount of the reporting unit exceeds its fair value, goodwill must be adjusted to its implied fair value.

During 2015 and 2014, the Company performed a quantitative test on its goodwill balances for impairment and no adjustments

were recorded to goodwill as a result of those reviews.

Long-lived Assets – The Company periodically evaluates the carrying value of long-lived assets to be held and used when

events and circumstances warrant such review. If the carrying value of a long-lived asset is considered impaired, a loss is

recognized based on the amount by which the carrying value exceeds the fair value of the long-lived asset for assets to be held

and used. The Company also reviews the useful life of its long-lived assets when events and circumstances indicate that the

actual useful life may be shorter than originally estimated. In the event that the actual useful life is deemed to be shorter than

the original useful life, depreciation is adjusted prospectively so that the remaining book value is depreciated over the revised

useful life.

Asset groups classified as held for sale are measured at the lower of carrying amount or fair value less cost to sell, and a

loss is recognized for any initial adjustment required to reduce the carrying amount to the fair value less cost to sell in the

period the held for sale criteria are met. The fair value less cost to sell must be assessed each reporting period the asset group

remains classified as held for sale. Gains or losses not previously recognized resulting from the sale of an asset group will be

recognized on the date of sale.

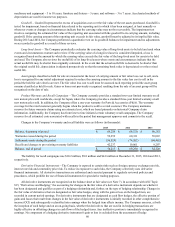

Product Warranty and Recall Campaigns – The Company currently provides a standard two-year limited warranty on all

new motorcycles sold worldwide, except for Japan, where the Company provides a standard three-year limited warranty on all

new motorcycles sold. In addition, the Company offers a one-year warranty for Parts & Accessories (P&A). The warranty

coverage for the retail customer generally begins when the product is sold to a retail customer. The Company maintains

reserves for future warranty claims using an estimated cost, which are based primarily on historical Company claim

information. Additionally, the Company has from time to time initiated certain voluntary recall campaigns. The Company

reserves for all estimated costs associated with recalls in the period that management approves and commits to the recall.

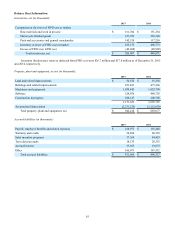

Changes in the Company’s warranty and recall liability were as follows (in thousands):

2015 2014 2013

Balance, beginning of period $ 69,250 $ 64,120 $ 60,263

Warranties issued during the period 59,259 60,331 59,022

Settlements made during the period (96,529)(74,262)(64,462)

Recalls and changes to pre-existing warranty liabilities 42,237 19,061 9,297

Balance, end of period $ 74,217 $ 69,250 $ 64,120

The liability for recall campaigns was $10.2 million, $9.8 million and $4.0 million at December 31, 2015, 2014 and 2013,

respectively.

Derivative Financial Instruments – The Company is exposed to certain risks such as foreign currency exchange rate risk,

interest rate risk and commodity price risk. To reduce its exposure to such risks, the Company selectively uses derivative

financial instruments. All derivative transactions are authorized and executed pursuant to regularly reviewed policies and

procedures, which prohibit the use of financial instruments for speculative trading purposes.

All derivative instruments are recognized on the balance sheet at fair value (see Note 7). In accordance with ASC Topic

815, “Derivatives and Hedging,” the accounting for changes in the fair value of a derivative instrument depends on whether it

has been designated and qualifies as part of a hedging relationship and, further, on the type of hedging relationship. Changes in

the fair value of derivatives that are designated as fair value hedges, along with the gain or loss on the hedged item, are

recorded in current period earnings. For derivative instruments that are designated as cash flow hedges, the effective portion of

gains and losses that result from changes in the fair value of derivative instruments is initially recorded in other comprehensive

income (OCI) and subsequently reclassified into earnings when the hedged item affects income. The Company assesses, at both

the inception of each hedge and on an on-going basis, whether the derivatives that are used in its hedging transactions are

highly effective in offsetting changes in cash flows of the hedged items. Any ineffective portion is immediately recognized in

earnings. No component of a hedging derivative instrument’s gain or loss is excluded from the assessment of hedge