Harley Davidson 2015 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2015 Harley Davidson annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

40

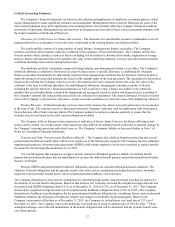

materially different than the Company’s current reserve. At this time, the Company cannot reasonably estimate the impact of

any remedies the EPA might seek beyond the Company's current reserve for this matter, if any.

York Environmental Matters:

The Company is involved with government agencies and groups of potentially responsible parties in various

environmental matters, including a matter involving the cleanup of soil and groundwater contamination at its York,

Pennsylvania facility. The York facility was formerly used by the U.S. Navy and AMF prior to the purchase of the York facility

by the Company from AMF in 1981. Although the Company is not certain as to the full extent of the environmental

contamination at the York facility, it has been working with the Pennsylvania Department of Environmental Protection

(PADEP) since 1986 in undertaking environmental investigation and remediation activities, including an ongoing site-wide

remedial investigation/feasibility study (RI/FS). In January 1995, the Company entered into a settlement agreement (the

Agreement) with the Navy, and the parties amended the Agreement in 2013 to address ordnance and explosive waste. The

Agreement calls for the Navy and the Company to contribute amounts into a trust equal to 53% and 47%, respectively, of future

costs associated with environmental investigation and remediation activities at the York facility (Response Costs). The trust

administers the payment of the Response Costs incurred at the York facility as covered by the Agreement.

The Company has a reserve for its estimate of its share of the future Response Costs at the York facility which is included

in accrued liabilities in the Condensed Consolidated Balance Sheets.(1) As noted above, the RI/FS is still underway and given

the uncertainty that exists concerning the nature and scope of additional environmental investigation and remediation that may

ultimately be required under the RI/FS or otherwise at the York facility, the Company is unable to make a reasonable estimate

of those additional costs, if any, that may result.

The estimate of the Company’s future Response Costs that will be incurred at the York facility is based on reports of

independent environmental consultants retained by the Company, the actual costs incurred to date and the estimated costs to

complete the necessary investigation and remediation activities. Response Costs are expected to be paid primarily through 2017

although certain Response Costs may continue for some time beyond 2017.

Product Liability Matters:

The Company is involved in product liability suits related to the operation of its business. The Company accrues for claim

exposures that are probable of occurrence and can be reasonably estimated. The Company also maintains insurance coverage

for product liability exposures. The Company believes that its accruals and insurance coverage are adequate and that product

liability suits will not have a material adverse effect on the Company’s consolidated financial statements.(1)

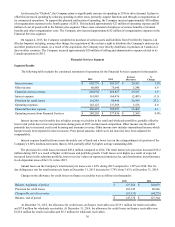

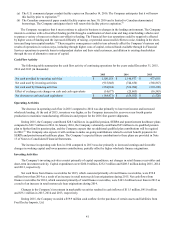

Liquidity and Capital Resources as of December 31, 2015

Over the long-term, the Company expects that its business model will continue to generate cash that will allow it to invest

in the business, fund future growth opportunities and return value to shareholders.(1) The Company believes the Motorcycles

operations will continue to be primarily funded through cash flows generated by operations.(1) The Company’s Financial

Services operations have been funded with unsecured debt, unsecured commercial paper, asset-backed commercial paper

conduit facilities, committed unsecured bank facilities, term asset-backed securitizations and intercompany borrowings.

The Company’s strategy is to maintain a minimum of twelve months of its projected liquidity needs through a

combination of cash and marketable securities and availability under credit facilities. The following table summarizes the

Company’s cash and marketable securities and availability under credit facilities (in thousands):

December 31,

2015

Cash and cash equivalents $ 722,209

Current marketable securities 45,192

Total cash and cash equivalents and marketable securities 767,401

Global credit facilities 148,620

Asset-backed U.S. commercial paper conduit facility (a) 600,000

Asset-backed Canadian commercial paper conduit facility (b) 19,191

Total availability under credit facilities 767,811

Total $ 1,535,212