Harley Davidson 2015 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2015 Harley Davidson annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

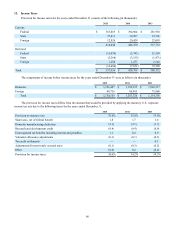

73

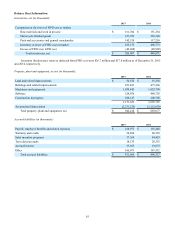

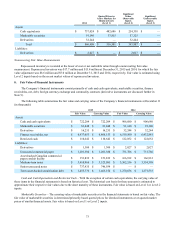

2014

Quoted Prices in

Active Markets for

Identical Assets

(Level 1)

Significant

Other

Observable

Inputs

(Level 2)

Significant

Unobservable

Inputs

(Level 3)

Assets:

Cash equivalents $ 737,024 $ 482,686 $ 254,338 $ —

Marketable securities 91,140 33,815 57,325 —

Derivatives 32,244 — 32,244 —

Total $ 860,408 $ 516,501 $ 343,907 $ —

Liabilities:

Derivatives $ 2,027 $ — $ 2,027 $ —

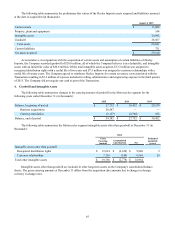

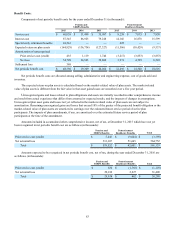

Nonrecurring Fair Value Measurements

Repossessed inventory is recorded at the lower of cost or net realizable value through a nonrecurring fair value

measurement. Repossessed inventory was $17.7 million and $13.4 million at December 31, 2015 and 2014, for which the fair

value adjustment was $8.6 million and $5.0 million at December 31, 2015 and 2014, respectively. Fair value is estimated using

Level 2 inputs based on the recent market values of repossessed inventory.

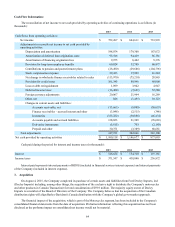

8. Fair Value of Financial Instruments

The Company’s financial instruments consist primarily of cash and cash equivalents, marketable securities, finance

receivables, net, debt, foreign currency exchange and commodity contracts (derivative instruments are discussed further in

Note 9).

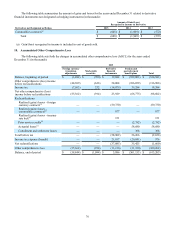

The following table summarizes the fair value and carrying value of the Company’s financial instruments at December 31

(in thousands):

2015 2014

Fair Value Carrying Value Fair Value Carrying Value

Assets:

Cash and cash equivalents $ 722,209 $ 722,209 $ 906,680 $ 906,680

Marketable securities $ 81,448 $ 81,448 $ 91,140 $ 91,140

Derivatives $ 16,235 $ 16,235 $ 32,244 $ 32,244

Finance receivables, net $ 6,937,053 $ 6,868,153 $ 6,519,500 $ 6,432,881

Restricted cash $ 110,642 $ 110,642 $ 122,052 $ 122,052

Liabilities:

Derivatives $ 1,300 $ 1,300 $ 2,027 $ 2,027

Unsecured commercial paper $ 1,201,380 $ 1,201,380 $ 731,786 $ 731,786

Asset-backed Canadian commercial

paper conduit facility $ 153,839 $ 153,839 $ 166,912 $ 166,912

Medium-term notes $ 3,410,966 $ 3,325,081 $ 3,502,536 $ 3,334,398

Senior unsecured notes $ 737,435 $ 746,934 $ — $ —

Term asset-backed securitization debt $ 1,455,776 $ 1,463,154 $ 1,270,656 $ 1,271,533

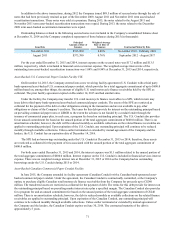

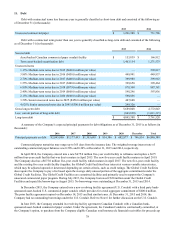

Cash and Cash Equivalents and Restricted Cash – With the exception of certain cash equivalents, the carrying value of

these items in the financial statements is based on historical cost. The historical cost basis for these amounts is estimated to

approximate their respective fair values due to the short maturity of these instruments. Fair value is based on Level 1 or Level 2

inputs.

Marketable Securities – The carrying value of marketable securities in the financial statements is based on fair value. The

fair value of marketable securities is determined primarily based quoted prices for identical instruments or on quoted market

prices of similar financial assets. Fair value is based on Level 1 or Level 2 inputs.