Harley Davidson 2015 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2015 Harley Davidson annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

56

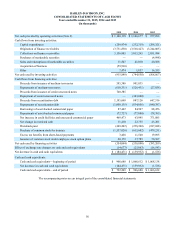

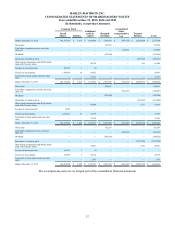

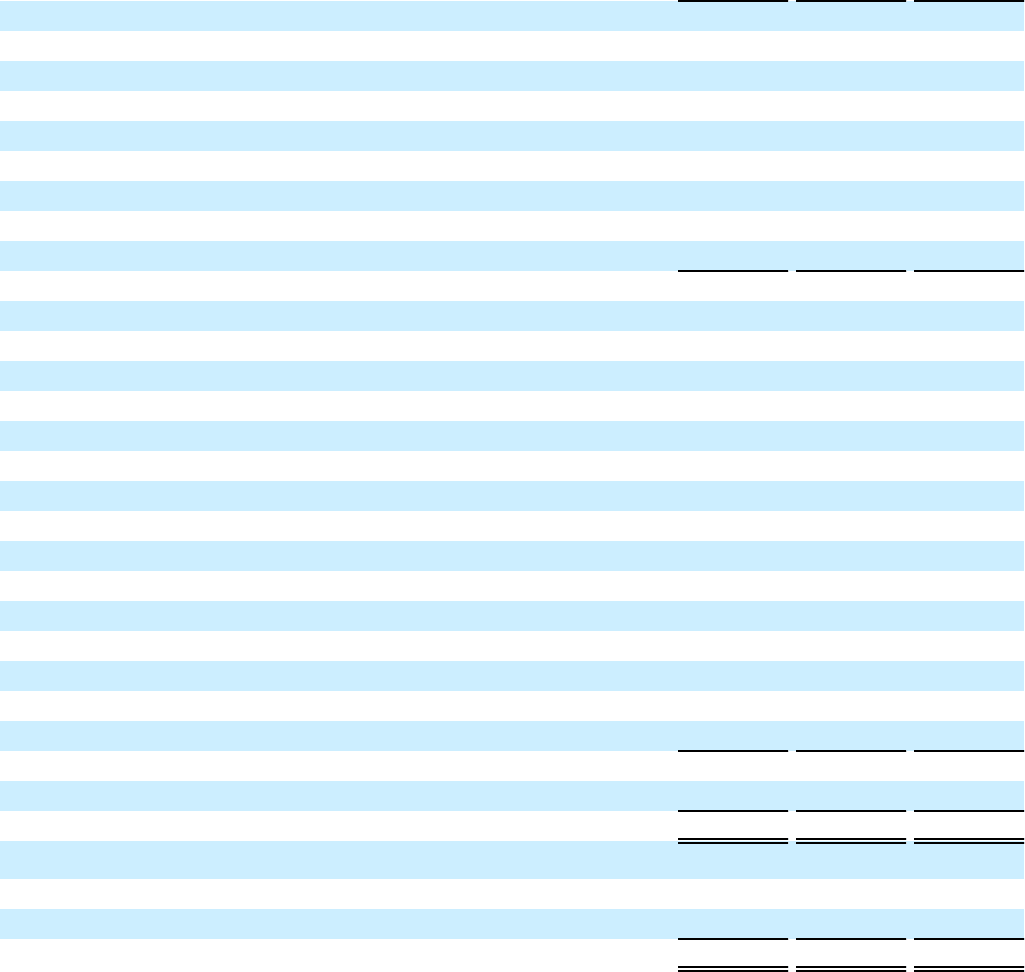

HARLEY-DAVIDSON, INC.

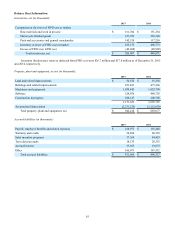

CONSOLIDATED STATEMENTS OF CASH FLOWS

Years ended December 31, 2015, 2014 and 2013

(In thousands)

2015 2014 2013

Net cash provided by operating activities (Note 2) $ 1,100,118 $ 1,146,677 $ 977,093

Cash flows from investing activities:

Capital expenditures (259,974)(232,319)(208,321)

Origination of finance receivables (3,751,830)(3,568,423)(3,244,005)

Collections on finance receivables 3,136,885 3,013,245 2,831,994

Purchases of marketable securities — — (4,998)

Sales and redemptions of marketable securities 11,507 41,010 40,108

Acquisition of business (59,910) — —

Other 7,474 1,837 16,355

Net cash used by investing activities (915,848)(744,650)(568,867)

Cash flows from financing activities:

Proceeds from issuance of medium-term notes 595,386 991,835 —

Repayments of medium-term notes (610,331)(526,431)(27,858)

Proceeds from issuance of senior unsecured notes 740,385 — —

Repayment of senior unsecured notes — (303,000) —

Proceeds from securitization debt 1,195,668 847,126 647,516

Repayments of securitization debt (1,008,135)(834,856)(840,387)

Borrowings of asset-backed commercial paper 87,442 84,907 88,456

Repayments of asset-backed commercial paper (72,727)(77,800)(78,765)

Net increase in credit facilities and unsecured commercial paper 469,473 63,945 371,085

Net change in restricted cash 11,410 22,755 43,201

Dividends paid (249,262)(238,300)(187,688)

Purchase of common stock for treasury (1,537,020)(615,602)(479,231)

Excess tax benefits from share-based payments 3,468 11,540 19,895

Issuance of common stock under employee stock option plans 20,179 37,785 50,567

Net cash used by financing activities (354,064)(536,096)(393,209)

Effect of exchange rate changes on cash and cash equivalents (14,677)(25,863)(16,543)

Net decrease in cash and cash equivalents $ (184,471) $ (159,932) $ (1,526)

Cash and cash equivalents:

Cash and cash equivalents—beginning of period $ 906,680 $ 1,066,612 $ 1,068,138

Net decrease in cash and cash equivalents (184,471)(159,932)(1,526)

Cash and cash equivalents—end of period $ 722,209 $ 906,680 $ 1,066,612

The accompanying notes are an integral part of the consolidated financial statements.