Harley Davidson 2015 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2015 Harley Davidson annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

41

(a) The U.S. commercial paper conduit facility expires on December 14, 2016. The Company anticipates that it will renew

this facility prior to expiration.(1)

(b) The Canadian commercial paper conduit facility expires on June 30, 2016 and is limited to Canadian denominated

borrowings. The Company anticipates that it will renew this facility prior to expiration.(1)

The Company recognizes that it must continue to adjust its business to changes in the lending environment. The Company

intends to continue with a diversified funding profile through a combination of short-term and long-term funding vehicles and

to pursue a variety of sources to obtain cost-effective funding. The Financial Services operations could be negatively affected

by higher costs of funding and the increased difficulty of raising, or potential unsuccessful efforts to raise, funding in the short-

term and long-term capital markets.(1) These negative consequences could in turn adversely affect the Company’s business and

results of operations in various ways, including through higher costs of capital, reduced funds available through its Financial

Services operations to provide loans to independent dealers and their retail customers, and dilution to existing shareholders

through the use of alternative sources of capital.

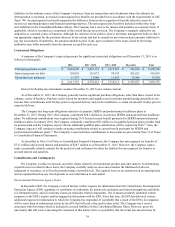

Cash Flow Activity

The following table summarizes the cash flow activity of continuing operations for the years ended December 31, 2015,

2014 and 2013 (in thousands):

2015 2014 2013

Net cash provided by operating activities $ 1,100,118 $ 1,146,677 $ 977,093

Net cash used by investing activities (915,848)(744,650)(568,867)

Net cash used by financing activities (354,064)(536,096)(393,209)

Effect of exchange rate changes on cash and cash equivalents (14,677)(25,863)(16,543)

Net decrease in cash and cash equivalents $ (184,471) $ (159,932) $ (1,526)

Operating Activities

The decrease in operating cash flow in 2015 compared to 2014 was due primarily to lower net income and increased

wholesale lending. At the end of 2015, inventory was higher, as the Company increased its year-over-year fourth quarter

production to maximize manufacturing efficiencies and prepare for the 2016 first quarter shipments.

During 2015, the Company contributed $28.5 million to its qualified pension, SERPA and postretirement healthcare plans

compared to $29.7 million in 2014. In January 2016, the Company voluntarily contributed $25 million to its qualified pension

plan to further fund its pension plan, and the Company expects that no additional qualified plan contributions will be required

in 2016.(1) The Company also expects it will continue to make on-going contributions related to current benefit payments for

SERPA and postretirement healthcare plans. The Company’s expected future contributions to these plans are provided in Note

13 of Notes to Consolidated Financial Statements.

The increase in operating cash flow in 2014 compared to 2013 was due primarily to increased earnings and favorable

changes in working capital and lower pension contributions, partially offset by higher wholesale finance originations.

Investing Activities

The Company’s investing activities consist primarily of capital expenditures, net changes in retail finance receivables and

short-term investment activity. Capital expenditures were $260.0 million, $232.3 million and $208.3 million during 2015, 2014

and 2013, respectively.

Net cash flows from finance receivables for 2015, which consisted primarily of retail finance receivables, were $59.8

million lower than 2014 as a result of an increase in retail motorcycle loan originations during 2015. Net cash flows from

finance receivables for 2014, which consisted primarily of retail finance receivables, were $143.2 million lower than in 2013 as

a result of an increase in retail motorcycle loan originations during 2014.

Changes in the Company’s investment in marketable securities resulted in cash inflows of $11.5 million, $41.0 million

and $35.1 million in 2015, 2014 and 2013, respectively.

During 2015, the Company recorded a $59.9 million cash outflow for the purchase of certain assets and liabilities from

Fred Deeley Imports, Ltd.