HSBC 2012 Annual Report Download

Download and view the complete annual report

Please find the complete 2012 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Connecting customers

to opportunities

HSBC Holdings plc

Annual Report and Accounts 2012

Table of contents

-

Page 1

Connecting customers to opportunities HSBC Holdings plc Annual Report and Accounts 2012 -

Page 2

...means HSBC Holdings plc and 'HSBC', the 'Group', 'we', 'us' and 'our' refers to HSBC Holdings together with its subsidiaries. Within this document the Hong Kong Special Administrative Region of the People's Republic of China is referred to as 'Hong Kong'. When used in the terms 'shareholders' equity... -

Page 3

... four global businesses: Retail Banking and Wealth Management, Commercial Banking, Global Banking and Markets, and Global Private Banking. Our network covers 81 countries and territories in six geographical regions: Europe, Hong Kong, Rest of Asia-Pacific, Middle East and North Africa, North America... -

Page 4

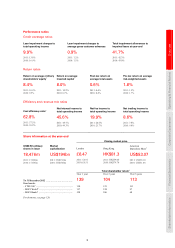

...shareholders of the parent company US$68,330m - down 5% 2011: US$72,280m 2010: US$68,247m US$13,454m - down 17% 2011: US$16,224m 2010: US$12,746m At the year-end Loans and advances to customers Customer accounts Ratio of customer advances to customer accounts US$998bn - up 6% 2011: US$940bn 2010... -

Page 5

... operating income Net trading income to total operating income 2011: 57.5% 2010: 55.2% 2011: 48.7% 2010: 49.3% 2011: 20.6% 2010: 21.7% 2011: 7.8% 2010: 9.0% Share information at the year-end Closing market price US$0.50 ordinary shares in issue Market capitalisation London Hong Kong American... -

Page 6

... their company is worth more than its contributed capital. We remained among the highest dividend payers in the FTSE 100, a performance which we know is of great importance to our shareholders. The cover to this year's Annual Report again illustrates our strategy of connecting customers and markets... -

Page 7

... being sought by UK regulators. During 2012, the UK government increased the rate of levy applied on the global balance sheets of UK domiciled banks. The cost to HSBC of the revised levy for the current year was US$571m of which US$295m related to non-UK banking activity. The 2012 levy, which is... -

Page 8

... Audit and Remuneration Committees. Renato brings to the Board considerable international business and financial expertise from a distinguished career in industrial, service and financial companies. He is currently Vice Chairman of the Supervisory Board and a member of the audit and the compensation... -

Page 9

...programme, which helps street children, children in care and orphans to access education. Initiatives under this programme are developed and supported by HSBC colleagues around the world and, in 2012, 2,717 members of staff volunteered to support the programme. Importantly in all our community work... -

Page 10

... Group structure in 2012, bringing the total number of announced disposals and closures of non-strategic businesses or non-core investments to 47 since the beginning of 2011, including 4 in 2013. During 2012, we completed the disposal of the Card and Retail Services business and the upstate New York... -

Page 11

... globally. Commercial Banking also recorded revenue growth as customer loans and advances increased in all regions, with over half of this growth coming from our faster-growing regions of Hong Kong, Rest of Asia-Pacific and Latin America, driven by higher trade-related lending. Customer deposits... -

Page 12

HSBC HOLDINGS PLC Report of the Directors: Overview (continued) Group Chief Executive's Business Review and Cash Management products. In addition, Retail Banking and Wealth Management experienced revenue growth across all fastergrowing regions, in particular Hong Kong and Latin America. These ... -

Page 13

... forward contract included within our 2012 results. On 19 February 2013 we announced the sale of our operations in Panama for US$2.1bn. S T Gulliver, Group Chief Executive 4 March 2013 11 Shareholder Information Financial Statements Corporate Governance Operating & Financial Review Overview -

Page 14

... Group Risk Committee. management strategies/ • Diagram of risk exposures by global business. business models Capital adequacy and risk- • Reconciliation of the accounting balance sheet to the regulatory balance sheet. weighted assets • Regulatory capital flow statement. • Analysis of credit... -

Page 15

... of non-strategic and non core investments were announced in 2012 and a further four in 2013, taking the total to 47 since 2011. The most significant of these transactions which were completed in 2012 were the sale of the US Card and Retail Services business and the upstate New York branches for... -

Page 16

... of markets, as tabulated below. Business model We take deposits from our customers and use these funds to make loans, either directly or through the capital markets. Our direct lending includes residential and commercial mortgages and overdrafts, and term loan facilities. We finance importers and... -

Page 17

.... Global functions, including HSBC Technology and Services, support and facilitate the execution of the strategy. Holding company HSBC Holdings plc, the holding company of the Group, is listed in London, Hong Kong, New York, Paris and Bermuda. HSBC Holdings is the primary provider of equity capital... -

Page 18

... Balance sheet management Asset driven • Credit and lending • Credit and lending • Trade and receivables finance • Credit and lending • Asset and trade finance • Credit and lending • Asset management • Wealth solutions and Fee driven and other financial planning • Commercial... -

Page 19

...2010 2011 2012 Vehicle finance 18 Non-real estate (unsecured) For footnote, see page 120. We have identified segments of the real estate portfolio in the US that represent a high risk and/or a high operational burden or may be sold on a capital 17 Shareholder Information Financial Statements... -

Page 20

... 2011 we have announced and completed a significant number of disposals: Announced transactions19 Completed 25 Still to complete 14 Number 8 2011 2012/2013 • Afore Key • HSBC Insurance (UK) Ltd • US Card and Retail Services • US branches • Ping An • Bao Viet Holdings • HSBC Bank... -

Page 21

... our four global businesses to 19 Shareholder Information Financial Statements Our aim in executing our strategy is to be regarded as the world's leading international bank. We have defined financial targets to achieve a return on equity of between 12% and 15% with a core tier 1 ratio of between... -

Page 22

... Other HSBC (including Holding Company) Global business RBWM CMB GB&M GPB Deposits Accounts services Credit and lending Asset management Wealth solutions and financial planning • Deposits • Payments and cash management • Deposits • Payments and cash management • Balance sheet... -

Page 23

... its debt securities, and to provide profits for payment of future dividends to shareholders. We may be required to make substantial contributions to our pension plans. Operating & Financial Review Shareholder Information 21 • • • • Risks related to our business operations, governance and... -

Page 24

...Surveys were not designed to report employee engagement information comparable with that derived from the Global People Surveys, we have not disclosed this KPI in 2012. During 2012, our senior management paid particular attention to a number of top and emerging risks. The current list is summarised... -

Page 25

... and Retail Services business and derecognition of Ping An as an associate. Measure: loans and advances to customers as a percentage of the total of core customer deposits and term funding with a remaining term to maturity in excess of one year. Target: to maintain an advances to core funding ratio... -

Page 26

HSBC HOLDINGS PLC Report of the Directors: Overview (continued) KPIs // Financial summary > Use of non-GAAP financial measures Growing HSBC - continuing to position ourselves for growth Risk-adjusted revenue growth (2012: underlying growth 13%) 37 Strategy Dividends per ordinary share growth 14... -

Page 27

... Shareholder Information Financial Statements The management commentary included in the Report of the Directors: 'Overview' and 'Operating and Financial Review', together with the 'Employees' and 'Corporate sustainability' sections of 'Corporate Governance' and the 'Directors' Remuneration Report... -

Page 28

...global business28 Retail Banking and Wealth Management ...Commercial Banking ...Global Banking and Markets ...Global Private Banking ...Other ...Profit before tax ...By geographical region28 Europe ...Hong Kong ...Rest of Asia-Pacific ...Middle East and North Africa ...North America ...Latin America... -

Page 29

... and commercial banking business of Lloyds Banking Group in the UAE by HSBC Bank Middle East Limited ...Fair value gain on acquisition US$m Jul 2011 Jun 2012 Oct 2012 (48) 3 18 27 Shareholder Information Financial Statements Corporate Governance Operating & Financial Review Overview We use... -

Page 30

... global business Retail Banking and Wealth Management ...Commercial Banking ...Global Banking and Markets ...Global Private Banking ...Other ...Underlying profit before tax ...By geographical region Europe ...Hong Kong ...Rest of Asia-Pacific ...Middle East and North Africa ...North America ...Latin... -

Page 31

...Shareholder Information Financial Statements Corporate Governance Operating & Financial Review 2012 US$m Net interest income ...Net fee income ...Net trading income ...Net income/(expense) from financial instruments designated at fair value ...Gains less losses from financial investments ...Dividend... -

Page 32

...An. Our remaining shareholding in Ping An has been reclassified as a financial investment (see Note 26 on the Financial Statements), the sale of which was completed on 6 February 2013. We expect disposal of the Card and Retail Services business in North America and of our associate shares in Ping An... -

Page 33

...) (553) 314 (96) (1,392) 243 (1,057) Notable revenue items by global business Retail Banking and Wealth Commercial Management Banking US$m US$m 2012 Non-qualifying hedges ...Ping An contingent forward sale contract37 ...Gain on sale of non-core investments in India ...Loss recognised following the... -

Page 34

...pension credit ...Payroll tax ...US mortgage foreclosure and servicing costs ...2010 Restructuring and other related costs ...UK customer redress programmes ...US accounting gain on change in staff benefits ...Payroll tax ...For footnote, see page 120. 266 1,751 - 62 258 - Global Banking and Markets... -

Page 35

... item Net interest income Overview Shareholder Information Financial Statements Corporate Governance Operating & Financial Review 2012 US$m Interest income ...Interest expense ...Net interest income39 ...Average interest-earning assets ...Gross interest yield ...Less: cost of funds ...Net interest... -

Page 36

... 2012, principally in the US. These disposals also led to a change in the composition of our lending book as the decline in higher yielding card balances was replaced by volume growth in relatively lower yielding products, mainly residential mortgages and term lending, in Hong Kong, Rest of Asia... -

Page 37

... also lower in North America, due to the sale of the full service retail brokerage business in Canada. In Europe, the decline was mainly due to challenging market conditions in the latter half of 2011 which led to a fall in average client assets in 2012 as well as net new money outflows and a fall... -

Page 38

HSBC HOLDINGS PLC Report of the Directors: Operating and Financial Review (continued) Financial summary > Group performance by income and expense item Net trading income 2012 US$m Trading activities ...Ping An contingent forward sale contract37 ...Net interest income on trading activities ...Other... -

Page 39

... to global businesses, but are reported in 'Other'. Credit spread movements on own debt designated at fair value are excluded from underlying results, and related fair value movements are not included in the calculation of regulatory capital. Financial Statements Corporate Governance Assets and... -

Page 40

...fair value movements arose in 2012 as credit spreads tightened in Europe and North America, having widened during 2011. Net income arising from financial assets held to meet liabilities under insurance and investment contracts reflected net investment gains in 2012 as global equity market conditions... -

Page 41

... Governance Operating & Financial Review The rise in net earned premium income was driven by Hong Kong and Latin America. In Hong Kong, sales of insurance contracts increased, in particular deferred annuity products, as we widened our product offerings to fulfil customers' long-term savings... -

Page 42

...HOLDINGS PLC Report of the Directors: Operating and Financial Review (continued) Financial summary > Group performance by income and expense item Change in present value of in-force long-term insurance business 2012 US$m Value of new business ...Expected return ...Assumption changes and experience... -

Page 43

... of positive equity market movements in 2012 compared with losses experienced during 2011 notably in Hong Kong, France and the UK. The gains or losses on the financial assets designated at fair value held to support these insurance and investment contract liabilities are reported in 'Net income from... -

Page 44

HSBC HOLDINGS PLC Report of the Directors: Operating and Financial Review (continued) Financial summary > Group performance by income and expense item following a review completed in the fourth quarter of 2012 which concluded that the estimated average period of time from current status to write-... -

Page 45

... in 2011 (US$1.1bn as reported). 2012 % HSBC ...Geographical regions Europe ...Hong Kong ...Rest of Asia-Pacific ...Middle East and North Africa ...North America ...Latin America ...Global businesses Retail Banking and Wealth Management ...Commercial Banking ...Global Banking and Markets ...Global... -

Page 46

... growth in lending balances and a rise in associated fee income, partly offset by higher operating expenses in line with business expansion, as well as increased loan impairment charges. On 7 January 2013, our holding in Industrial Bank was diluted following its issue of additional share capital to... -

Page 47

...Loans and advances to customers54 ...Financial investments ...Assets held for sale ...Other assets ...Total assets ...LIABILITIES AND EQUITY Liabilities Deposits by banks ...Customer accounts ...Trading liabilities ...Financial liabilities designated at fair value ...Derivatives ...Debt securities... -

Page 48

... the capital markets. Reverse repo balances also declined, mainly in Europe. During 2012 we reclassified to 'Assets held for sale' loans and advances to customers relating to the planned disposals of non-strategic RBWM banking operations in Rest of Asia-Pacific and businesses in Latin America and... -

Page 49

... 2012, reflecting an improvement in the fair value of these assets. 47 Shareholder Information Financial Statements Corporate Governance Operating & Financial Review Overview Financial liabilities designated at fair value remained broadly in line with December 2011 levels. A net increase... -

Page 50

...and advances to banks ...Loans and advances to customers ...Financial investments ...Assets held for sale ...Other assets ...Total assets ...Deposits by banks ...Customer accounts ...Trading liabilities ...Financial liabilities designated at fair value ...Derivative liabilities ...Debt securities in... -

Page 51

... our strategy, we have agreed to sell a number of businesses across the Group. Assets and liabilities of businesses which, it is highly probable, will be sold are reported as held for sale on the balance sheet until the sale is closed. We include loans and advances to customers and customer account... -

Page 52

HSBC HOLDINGS PLC Report of the Directors: Operating and Financial Review (continued) Financial summary > Consolidated balance sheet / Economic profit/loss Customer accounts by country At 31 December 2012 US$m Europe ...UK ...France61 ...Germany ...Malta ...Switzerland62 ...Turkey ...Other ...Hong... -

Page 53

... to ordinary shareholders represents the amount of economic profit/(loss) generated. Our long-term cost of capital is reviewed annually and is 11% for 2012; this remains unchanged from 2011. However, it has been revised to 10% for 2013, primarily due to a reduction in the risk-free rate, reflecting... -

Page 54

...as contributing to the longer-term performance of the Group. These include the run-off portfolios and the Card and Retail Services business which was sold in 2012. The Card and Retail Services average RWAs in the table below represent the average of the associated operational risk RWAs that were not... -

Page 55

...By global business Retail Banking and Wealth Management ...Commercial Banking ...Global Banking and Markets ...Global Private Banking ...Other ...Profit/(loss) before tax ...By geographical region Europe ...Hong Kong ...Rest of Asia-Pacific ...Middle East and North Africa ...North America ...Latin... -

Page 56

... mortgage lending portfolios. The adjustment was made following a review completed in the fourth quarter of 2012 which concluded that the estimated average period of time from current status to write-off was ten months for real estate loans (previously a period of seven months was used). During 2013... -

Page 57

... Our accounting policy for goodwill is described in Note 2p on the Financial Statements. Note 23 on the Financial Statements lists our cash generating units ('CGU's) by geographical region and global business. HSBC's total goodwill amounted to US$21bn at 31 December 2012 (2011: US$21bn). The review... -

Page 58

... PLC Report of the Directors: Operating and Financial Review (continued) Financial summary > Critical accounting policies for this CGU and concluded that there was no impairment. Note 23 on the Financial Statements includes details of the CGUs with significant balances of goodwill, states the key... -

Page 59

... to reduce deductible funding expenses or otherwise deploy such capital or increase levels of taxable income. Management expects that, with this strategy, the US operations will generate sufficient future profits to support the recognition of the deferred tax assets. If HSBC Holdings were to decide... -

Page 60

HSBC HOLDINGS PLC Report of the Directors: Operating and Financial Review (continued) Global businesses > Summary Global businesses Summary ...Products and services ...Retail Banking and Wealth Management ...Commercial Banking ...Global Banking and Markets ...Global Private Banking ...Other ...... -

Page 61

... US$m Retail Banking and Wealth Management ...Commercial Banking ...Global Banking and Markets ...Global Private Banking ...Other73 ...5,574 594 149 55 3,107 9,479 For footnotes, see page 120. 2011 US$m 3,328 76 114 (9) 141 3,650 2010 US$m 3 119 262 - 250 634 59 Shareholder Information Financial... -

Page 62

... wealth management and a variety of other commercial risk insurance products in selected countries. • GB&M: our CMB franchise represents a key client base for GB&M products and services, including foreign exchange and interest rate products, together with capital raising on debt and equity markets... -

Page 63

... Solutions comprise trusts and estate planning, designed to protect wealth and preserve it for future generations through structures tailored to meet the individual needs of each client. 61 Shareholder Information Financial Statements Corporate Governance Operating & Financial Review - capital... -

Page 64

... as reported) relating to defined benefit pension obligations. Revenue grew by 13% in Hong Kong reflecting wider deposit spreads, higher lending and deposit balances and the gains on sale of the general insurance businesses and our shares in Global Payments Asia-Pacific Ltd. Insurance income also... -

Page 65

... system across key markets in Europe and Asia towards the end of 2011. Foreign exchange services are a core component of our wealth strategy, and we continue to invest in order to further enhance our customer offering. By 31 December 2012, over 220,000 of our customers were using our Global View and... -

Page 66

... PLC Report of the Directors: Operating and Financial Review (continued) Global businesses > RBWM / CMB • Sales of our long-term fund products, including our managed solutions, continued to grow. We launched the HSBC Asia Focused Income Fund in May which grew to US$1bn by the end of 2012. World... -

Page 67

... deposits also benefited from higher liability spreads in Hong Kong, reflecting an increase in short-term interest rates. Net fee income benefited from higher transaction volumes of Payments and Cash Management products, mainly in Europe, Latin America and Hong Kong. Net fee income from Global Trade... -

Page 68

... countries in Rest of Asia-Pacific by the end of 2013. International payments volumes in Payments and Cash Management have grown at twice the rate of the market globally since 2010 with yearon-year revenue increasing by 15% in 2012. This growth reflected new mandates and investments in new products... -

Page 69

... 2012, we launched our trade credit insurance offering in Hong Kong, Brazil and the UK. It will be rolled out to further markets in the first half of 2013, including Turkey, France, Singapore and Malaysia. Simplify processes and enhance risk management controls by adopting a global operating model... -

Page 70

...HOLDINGS PLC Report of the Directors: Operating and Financial Review (continued) Global businesses > GB&M Global Banking and Markets GB&M provides tailored financial solutions to major government, corporate and institutional clients worldwide. 2012 US$m Net interest income ...Net fee income ...Net... -

Page 71

... of total operating income 2012 US$m Global Markets79 ...Credit ...Rates ...Foreign Exchange .. Equities ...Securities Services . Asset and Structured Finance ...Global Banking ...Financing and Equity Capital Markets .. Payments and Cash Management80 ...Other transaction services81 ...Balance Sheet... -

Page 72

... in key strategic markets. In Rest of Asia-Pacific, we enhanced our advisory, debt capital markets and credit and lending businesses through a number of senior appointments in the Resources and Energy and the Financial Institutions groups. We also appointed a Co-Head of Global Banking in Brazil to... -

Page 73

... to higher revenues and increased Premier account openings respectively, compared with 2011. We also appointed a Head of Coverage in Hong Kong to strengthen our Global Banking franchise and deliver on IPC initiatives in the region. Operating & Financial Review We have worked closely with CMB... -

Page 74

... US$70m of sustainable cost savings Outstanding Private Bank in Asia-Pacific and in the Middle East (Private Banker International Awards, 2012) • Strategic direction GPB works with high net worth clients to manage and preserve their wealth while connecting them to global opportunities. We focus... -

Page 75

... US and Global Private Wealth Solutions in the Channel Islands, which provide integrated databases to support effective client management. We will continue to roll these systems out to other locations during 2013. Overview Shareholder Information Financial Statements Corporate Governance Operating... -

Page 76

... four new real estate 'club deals' and two private equity launches in the year raising more than US$1.3bn. Further launches are expected in 2013. 2012 US$m Net interest expense ...Net fee income ...Net trading expense ...Change in credit spread on long-term debt ...Other changes in fair value ...Net... -

Page 77

... to global businesses through a recharge mechanism, with income reported in 'Other operating income'. • • • • • • 75 Shareholder Information Financial Statements Corporate Governance • Operating & Financial Review Overview economically hedge fixed rate long-term debt, on... -

Page 78

HSBC HOLDINGS PLC Report of the Directors: Operating and Financial Review (continued) Global businesses > Analysis Analysis by global business HSBC profit/(loss) before tax and balance sheet data 2012 Retail Banking and Wealth Commercial Management Banking US$m US$m Global Banking and Markets US$m... -

Page 79

2011 Retail Banking and Wealth Management US$m Global Banking and Markets US$m Global Private Banking US$m Inter- segment elimination85 US$m Commercial Banking US$m Other73 US$m Total US$m Profit before tax Net interest income/(expense) ...Net fee income ...Trading income/(expense) excluding net... -

Page 80

...Hong Kong ...Rest of Asia-Pacific ...Middle East and North Africa ...North America ...Latin America ...Profit/(loss) before tax ...Gain on sale ...For footnotes, see page 120. 21 78 Commercial Banking US$m 133 - 4 2 1 - 203 20 363 (129) 234 (4) 230 (164) 66 89 155 2012 Global Banking and Markets... -

Page 81

... that follows, operating income and operating expenses include intra-HSBC items of US$3,358m (2011: US$3,421m; 2010: US$3,125m). Overview Shareholder Information 79 2012 US$m Europe ...Hong Kong ...Rest of Asia-Pacific ...Middle East and North Africa ...North America ...Latin America ...(3,414... -

Page 82

HSBC HOLDINGS PLC Report of the Directors: Operating and Financial Review (continued) Geographical regions > Europe Selected items included in profit before tax by geographical region Fair value movements arising from changes in own credit spreads26 2012 US$m Europe ...Hong Kong ...Rest of Asia-... -

Page 83

... Strong Rates and Credit performance as investor sentiment improved 40% reduction in RBWM loan impairment charges US$2.3bn of customer redress provisions in the UK For footnotes, see page 120. 81 Shareholder Information Financial Statements Corporate Governance Operating & Financial Review... -

Page 84

HSBC HOLDINGS PLC Report of the Directors: Operating and Financial Review (continued) Geographical regions > Europe Profit/(loss) before tax by country within global businesses Retail Banking and Wealth Management US$m 2012 UK ...France60 ...Germany ...Malta ...Switzerland ...Turkey ...Other ...... -

Page 85

... transactional Foreign Exchange business. To enhance coverage efforts in Global Banking, the Corporate Finance Group was established to strengthen the financial advisory and event financing business. Payments and Cash Management won a number of mandates and implemented the Global Liquidity Solutions... -

Page 86

... in 2011 on the disposal of available-for-sale debt securities in our Insurance business in RBWM. These factors were partly offset by higher gains on the disposal of available-for-sale debt securities in Balance Sheet Management, mainly in the UK, as part of structural interest rate risk management... -

Page 87

... in, and reallocate capital, to our designated growth businesses such as our mortgage offering, our international CMB business and our home and priority growth markets (UK, France, Germany and Turkey), as well as launching the M&S Bank in the UK. Operating & Financial Review US$268m related to the... -

Page 88

HSBC HOLDINGS PLC Report of the Directors: Operating and Financial Review (continued) Geographical regions > Europe Profit/(loss) before tax and balance sheet data - Europe 2012 Retail Banking and Wealth Commercial Management Banking US$m US$m Global Banking and Markets US$m Global Private Banking... -

Page 89

... US$m 434,336 1,281,945 493,404 (214,281) 87 Shareholder Information Balance sheet data74 Financial Statements Corporate Governance Operating & Financial Review Overview Retail Banking and Wealth Global Banking and Markets US$m Global Private Banking US$m Intersegment elimination85 US$m -

Page 90

... operating expenses. In RBWM, we continue to develop our Wealth Management services for our retail customers and launched new investment funds, including the Global High Yield Bond Fund which attracted over US$1bn of subscriptions by the end of the year. The sale of the general insurance businesses... -

Page 91

... Information Net income from financial instruments designated at fair value was US$447m compared with an expense of US$540m in 2011, due to net investment gains on assets held by the Insurance business (compared with net losses in 2011) as a result of more favourable equity market conditions... -

Page 92

... sale of our shares in Global Payments Asia-Pacific Ltd and the HSBC and Hang Seng Bank general insurance businesses, realising gains of US$212m, US$117m and US$46m, respectively. While the value of the PVIF asset rose, this was not to the same extent as in 2011 as increased insurance sales in 2012... -

Page 93

... tax and balance sheet data - Hong Kong 2012 Retail Banking and Wealth Commercial Management Banking US$m US$m Global Banking and Markets US$m Other US$m Total US$m Profit/(loss) before tax Net interest income/(expense) ...Net fee income ...Trading income/(expense) excluding net interest income... -

Page 94

... HOLDINGS PLC Report of the Directors: Operating and Financial Review (continued) Geographical regions > Hong Kong / Rest of Asia-Pacific Profit/(loss) before tax and balance sheet data - Hong Kong (continued) 2011 Retail Banking and Wealth Management US$m Commercial Banking US$m Global Banking... -

Page 95

... in 2012 9% growth in lending balances (on a constant currency basis) 'Best Domestic Cash Management Bank' (Euromoney) across 14 countries in the region For footnotes, see page 120. 93 Shareholder Information Financial Statements Corporate Governance Operating & Financial Review Overview -

Page 96

HSBC HOLDINGS PLC Report of the Directors: Operating and Financial Review (continued) Geographical regions > Rest of Asia-Pacific Profit/(loss) before tax by country within global businesses Retail Banking and Wealth Management US$m 2012 Australia ...India ...Indonesia ...Mainland China ...Ping An... -

Page 97

...China from Balance Sheet Management, arising from growth in the debt securities portfolio and improved yields, as well as from increased trade-related and term lending in CMB and GB&M. We grew average deposit balances, notably in GB&M and CMB reflecting new Payments and Cash Management mandates, and... -

Page 98

... into lower yielding products reflecting investor's lower risk appetite. Net trading income decreased by 34% compared with 2011, mainly from adverse fair value movements on the contingent forward sale contract of US$553m relating to Ping An (see Note 26 on the Financial Statements). Trading income... -

Page 99

... ...Total operating expenses ...Operating profit ...Share of profit in associates and joint ventures ...Profit before tax ... Share of HSBC's profit before tax ...Cost efficiency ratio ... 7.3 72.3 Balance sheet data74 Loans and advances to customers (net) ...Total assets ...Customer accounts ...46... -

Page 100

HSBC HOLDINGS PLC Report of the Directors: Operating and Financial Review (continued) Geographical regions > Rest of Asia-Pacific / Middle East and North Africa Profit before tax and balance sheet data - Rest of Asia-Pacific (continued) 2011 Retail Banking and Wealth Management US$m Commercial ... -

Page 101

... programmes 4th consecutive year: 5th consecutive year: Best Regional Cash Best Trade Finance Management Provider Bank in the Middle in the Middle East East and North Africa (Euromoney) (Global Trade Review 2012) For footnotes, see page 120. 99 Shareholder Information Our reported... -

Page 102

HSBC HOLDINGS PLC Report of the Directors: Operating and Financial Review (continued) Geographical regions > Middle East and North Africa Profit/(loss) before tax by country within global businesses Retail Banking and Wealth Management US$m 2012 Egypt ...Qatar ...United Arab Emirates ...Other ...... -

Page 103

... Bank. This was driven by higher revenue resulting from strong balance sheet growth, together with lower costs derived from effective control and monitoring. 101 Shareholder Information Financial Statements Corporate Governance Operating & Financial Review In CMB, we continued to support... -

Page 104

... HOLDINGS PLC Report of the Directors: Operating and Financial Review (continued) Geographical regions > Middle East and North Africa Profit/(loss) before tax and balance sheet data - Middle East and North Africa 2012 Retail Banking and Wealth Commercial Management Banking US$m US$m Global Banking... -

Page 105

...,875 57,464 36,422 (3,181) 103 Shareholder Information Financial Statements Share of HSBC's profit before tax ...Cost efficiency ratio ... Corporate Governance Operating & Financial Review Overview Global Banking and Markets US$m Global Private Banking US$m Intersegment elimination85 US$m -

Page 106

HSBC HOLDINGS PLC Report of the Directors: Operating and Financial Review (continued) Geographical regions > North America North America Our North American businesses are located in the US, Canada and Bermuda. Operations in the US are primarily conducted through HSBC Bank USA, N.A., and HSBC ... -

Page 107

... trading volumes, and higher revenues in Balance Sheet Management reflecting an increase in gains on sales of available-for-sale assets. These results were partly offset by lower net interest income due to the closure of the Canadian consumer finance company to new business, spread compression... -

Page 108

HSBC HOLDINGS PLC Report of the Directors: Operating and Financial Review (continued) Geographical regions > North America existing infrastructure. We also completed the sale of the retail branches, principally in upstate New York, recognising gains of US$586m in RBWM and US$278m in CMB. In Canada... -

Page 109

... of our long-term debt during the year. Operating & Financial Review Net trading income increased in GB&M during 2012 as a result of the improved performance of economic hedges used to manage interest rate risk, which benefited from a more stable interest rate environment. Rates revenue was higher... -

Page 110

HSBC HOLDINGS PLC Report of the Directors: Operating and Financial Review (continued) Geographical regions > North America Profit/(loss) before tax and balance sheet data - North America 2012 Retail Banking and Wealth Commercial Management Banking89 US$m US$m Global Banking and Markets US$m 948 ... -

Page 111

... Share of HSBC's profit before tax ...Cost efficiency ratio ... (12.2) 56.9 Balance sheet data74 US$m Loans and advances to customers (net) reported in: - loans and advances to customers (net) ...- assets held for sale (disposal groups) ...Total assets ...Customer accounts reported in: - customer... -

Page 112

HSBC HOLDINGS PLC Report of the Directors: Operating and Financial Review (continued) Geographical regions > North America / Latin America North America RBWM - profit/(loss) before tax and balance sheet data 2012 Card and Retail Services US$m Run-off portfolios US$m Rest of RBWM US$m North America... -

Page 113

...Balance Sheet Management revenues in Brazil following a downward movement in interest rates which lowered the cost of funding. In Brazil, loan 111 Shareholder Information Financial Statements Our operations in Latin America reported a profit before tax of US$2.4bn in 2012, 3% higher than in 2011... -

Page 114

... PLC Report of the Directors: Operating and Financial Review (continued) Geographical regions > Latin America Profit/(loss) before tax by country within global businesses Retail Banking and Wealth Management US$m 2012 Argentina ...Brazil ...Mexico ...Panama ...Other ...209 94 338 29 (62) 608 2011... -

Page 115

... benefited from a change in the composition of the lending book in Brazil as we increased our balances of higher yielding assets. Net interest income from deposits also increased due to higher balances in current accounts in Mexico and savings accounts in Argentina supported by marketing campaigns... -

Page 116

... general insurance business in Argentina in 2012. Loan impairment charges and other credit risk provisions increased by 29%. This was mainly in Brazil, driven by increased delinquency rates in RBWM and CMB, particularly in Business Banking, reflecting lower economic growth in 2012. We took a number... -

Page 117

... expenses ...Operating profit/(loss) ...Share of profit in associates and joint ventures ...Profit/(loss) before tax ... Share of HSBC's profit before tax ...Cost efficiency ratio ... 2.9 64.8 Balance sheet data74 US$m Loans and advances to customers (net) ...Total assets ...Customer accounts ...17... -

Page 118

HSBC HOLDINGS PLC Report of the Directors: Operating and Financial Review (continued) Geographical regions > Latin America / Disposals, held for sale and run-off portfolios Profit/(loss) before tax and balance sheet data - Latin America (continued) 2011 Retail Banking and Wealth Management US$m ... -

Page 119

... Shareholder Information Financial Statements Corporate Governance Operating & Financial Review Summary income statements for disposals, held for sale and run-off portfolios69,70 2012 Rest of Asia-Pacific US$m 40 (3) 5 North America US$m 4,051 401 (186) Latin America US$m 372 30 27 Europe US$m Net... -

Page 120

... and multi-asset products, in Rest of Asia-Pacific, Hong Kong and Latin America. GPB funds increased by 11% on 31 December 2011 to US$288bn, mainly due to the inclusion of custody assets in client assets and favourable equity market and foreign exchange movements. Negative net new money was driven... -

Page 121

... above are made in the report 'Enhancing the Risk Disclosures of Banks' issued by the Enhanced Disclosure Task Force of the Financial Stability Board on 29 October 2012. 119 Shareholder Information Financial Statements Corporate Governance Operating & Financial Review Overview 126 to 128 -

Page 122

...financial assets). Including hedge funds, real estate and private equity. Vehicle Finance was sold in 2010. 'Transactions' refers to the sale or closure of non-strategic businesses or non-core investment. Hong Kong, Rest of Asia-Pacific, Middle East and North Africa, and Latin America. Net operating... -

Page 123

...-related policies. Consequently, claims rise in line with increases in sales of savings-related business and with investment market growth. Consolidated balance sheet 54 Net of impairment allowances. 55 The calculation of capital resources, capital ratios and risk-weighted assets for 2012 and 2011... -

Page 124

... a Global Markets limit structure. Balance Sheet Management revenues include notional tax credits on income earned from tax-exempt investments of US$116m in 2012, US$85m in 2011 and US$50m in 2010, which are offset within 'Other'. 83 'Other' in GB&M includes net interest earned on free capital held... -

Page 125

... to globally consistent standards and risk management policies across the Group. • Our top and emerging risks • • Macro-prudential, regulatory and legal risk to our business model. Risks related to our business operations, governance and internal control systems. Financial Statements... -

Page 126

HSBC HOLDINGS PLC Report of the Directors: Operating and Financial Review (continued) Risk > Managing risk Managing risk (Unaudited) on our attitude towards risk and the behaviours expected by our policies. Our risk culture is reinforced by our approach to remuneration, which is discussed in the ... -

Page 127

... rate management of • is managed using risk limits approved by the GMB for HSBC our retail and commercial Holdings and our various global businesses. These units are allocated banking assets and across business lines and to the Group's legal entities. liabilities, financial investments designated... -

Page 128

... monthly by Group Sustainability Risk management; and • is managed using sustainability risk policies covering project finance lending and sector-based sustainability polices for sectors with high environmental or social impacts. Pension risk arises from investments delivering an inadequate return... -

Page 129

... of risk, intra-group lending, strategic investments, risk categories and risk diversification and concentration. Measurement against the metrics guides underlying business activity, ensuring it is aligned to risk appetite statements; informs risk-adjusted remuneration; enables the key underlying... -

Page 130

... spread of our businesses, we believe that the level of inherent compliance risk that we face as a Group will continue to remain high for the foreseeable future. Commercial real estate Our exposure to commercial real estate lending continued to be concentrated in Hong Kong, the UK, Rest of Asia... -

Page 131

...The relevance of current market conditions to impairment assessment is particularly relevant over a 12-month period. Over a 12 to 24-month horizon, US$3.3bn of UK commercial real estate and other property-related lending loans are due to be refinanced. Reviews of more sensitive assets due between 12... -

Page 132

HSBC HOLDINGS PLC Report of the Directors: Operating and Financial Review (continued) Risk > Areas of special interest / Top and emerging risks placement of funds directly with central banks in the most highly-rated countries. Our businesses in peripheral eurozone countries are funded from a mix ... -

Page 133

... and public debt. This is expected to help resolve the sovereign and banking crisis in the medium term but, in the short term, it is limiting growth, leaving labour markets weak and thereby making fiscal consolidation a bigger challenge. This is affecting the rest of the world through lower trade... -

Page 134

... capital for lending to sectors perceived as higher risk, (iii) the designation of the Group by the Financial Stability Board as a global systemically important bank; (iv) proposed legislation in the UK to give effect to the recommendations of the ICB in relation to 'ring-fencing' of the UK retail... -

Page 135

...institution or more generally in relation to a particular product. We have seen recent examples of this approach in the context of the mis-selling of payment protection insurance and of interest rate derivative products to SMEs. Corporate Governance Operating & Financial Review Bank USA is not in... -

Page 136

... in Note 43 on the Financial Statements. Potential impact on HSBC Dispute risk gives rise to potential financial loss and significant reputational damage which could adversely affect customer and investor confidence. Risks related to our business operations, governance and internal control systems... -

Page 137

.... Overview Shareholder Information Financial Statements Corporate Governance Operating & Financial Review Level of change creating operational complexity and heightened operational risk There are many drivers of change affecting HSBC and the banking industry, including new banking regulations, the... -

Page 138

HSBC HOLDINGS PLC Report of the Directors: Operating and Financial Review (continued) Risk > Top and emerging risks // Credit risk • We pro-actively review relevant external events and assess the impact they may have on our systems. Within HSBC, we have a strong focus on industry best practices... -

Page 139

... balances ...Number of renegotiated real estate secured accounts remaining in HSBC Finance's portfolio ...Movement in impaired loans by geographical region ...Residential mortgage loans ...Commercial real estate loans and advances by collateral ...Other corporate, commercial and financial (non-bank... -

Page 140

HSBC HOLDINGS PLC Report of the Directors: Operating and Financial Review (continued) Risk > Credit risk > Summary in 2012 Page Impairment of loans and advances Further analysis of impairment (continued) App1 Tables Individually and collectively assessed impairment charge to the income statement... -

Page 141

... as the related balances had been transferred to 'Assets held for sale' during 2011. Corporate Governance Operating & Financial Review Overview Rest of Asia-Pacific. First lien residential mortgages represented 30% of total gross loans and advances, mainly in the UK, the US and Hong Kong. Other... -

Page 142

HSBC HOLDINGS PLC Report of the Directors: Operating and Financial Review (continued) Risk > Credit risk > Summary in 2012 the redeployment of liquidity in Europe to central banks, together with maturities and repayments in Hong Kong. Loan and other credit-related commitments declined from US$... -

Page 143

...Shareholder Information Financial Statements At 31 December 2012, our corporate and commercial lending balances were US$517bn. The increase of 8% compared with the end of 2011 was mainly in the international trade and services sector, largely in Europe despite muted demand for credit, and in Hong... -

Page 144

HSBC HOLDINGS PLC Report of the Directors: Operating and Financial Review (continued) Risk > Credit risk > Summary in 2012 Credit quality of gross loans and advances (Unaudited) Hong Kong US$m 200,110 275 1,311 8 477 109 191,691 309 1,107 4 608 134 Rest of AsiaPacific US$m 179,337 199 2,974 35 1,... -

Page 145

... commercial Commercial real estate Financial 2012 2011 During 2012, the growth in gross loans and advances was affected by a reclassification of certain lending balances to 'Assets held for sale'. Disclosures relating to assets held for sale are provided in the following credit risk management... -

Page 146

HSBC HOLDINGS PLC Report of the Directors: Operating and Financial Review (continued) Risk > Credit risk > Summary in 2012 / Credit exposure The lending balances in 'Assets held for sale' at the end of 2012 included non-real estate personal loan balances from our CML portfolio in North America and... -

Page 147

... into available-for-sale investments, notably treasury bills in Hong Kong and highly-rated debt securities in North America. Trading assets In 2012, our exposure to trading assets rose by 19% reflecting increased client activity compared with the subdued levels seen in 2011. This resulted in... -

Page 148

... banks ...Hong Kong Government certificates of indebtedness ...Trading assets ...Treasury and other eligible bills ...Debt securities ...Loans and advances to banks ...Loans and advances to customers ...Financial assets designated at fair value ...Treasury and other eligible bills ...Debt securities... -

Page 149

... products such as overdrafts, credit cards and payroll loans; and debt consolidation loans which may be secured or unsecured. Total personal lending (Unaudited) Rest of Europe US$m 8,148 27,656 24 3,060 - 24,572 35,804 Hong Kong US$m 52,296 18,045 - 5,930 - 12,115 70,341 Rest of North America... -

Page 150

HSBC HOLDINGS PLC Report of the Directors: Operating and Financial Review (continued) Risk > Credit risk > Personal lending In 2012, the credit quality of the majority of our personal lending portfolios improved, reflecting the continued low levels of interest rates and strong customer repayments ... -

Page 151

... the purpose of 149 Shareholder Information Financial Statements Corporate Governance Operating & Financial Review 301,862 6,961 Overview mortgages, was US$309bn, 5% higher than at the end of 2011. Our most significant concentrations of mortgage lending were in the UK, the US and Hong Kong. -

Page 152

... our own sales force, and the self-certification of income was not permitted. The majority of our mortgage lending in the UK was to existing customers who held current or savings accounts with HSBC. The average LTV ratio for new business was 59% during December 2012, while loan impairment charges... -

Page 153

... allowance is close to 100% in the CML portfolios, and more than 80% in HSBC Bank USA. Overview Shareholder Information Financial Statements Corporate Governance Operating & Financial Review For further information on renegotiated loans in North America, see page 158. Mortgage lending In our... -

Page 154

... 2012 were related to HSBC Bank USA's credit card programme. Personal non-credit card lending Personal non-credit card lending balances and two months and over delinquent balances in the US fell, largely due to the reclassification of non-real estate personal loan balances to 'Assets held for sale... -

Page 155

... trade and services ...- Commercial real estate ...- Other property-related ...- Government ...- Other commercial9 ...Financial (non-bank financial institutions)...Asset-backed securities reclassified ...Loans and advances to banks ...Total wholesale lending (A) ...Impairment allowances on wholesale... -

Page 156

...not meet netting criteria under accounting rules. The aggregate of our commercial real estate and other property-related lending was US$117bn at 31 December 2012, 3% higher than at 31 December 2011, representing 12% of total loans and advances to customers. This growth was mainly in Hong Kong, where... -

Page 157

... 2012 Cash and balances at central banks ...Items in the course of collection from other banks.. Hong Kong Government certificates of indebtedness .. Trading assets ...- treasury and other eligible bills ...- debt securities ...- loans and advances: to banks ...to customers ...Financial assets... -

Page 158

... course of collection from other banks.. Hong Kong Government certificates of indebtedness .. Trading assets ...- treasury and other eligible bills ...- debt securities ...- loans and advances: to banks ...to customers ...Financial assets designated at fair value11 ...- treasury and other eligible... -

Page 159

... in 2012 was primarily in North America in the CML portfolio, due to the reclassification of non-real estate personal loan balances to 'Assets held for sale' as well as the continued run-off of the lending balances. This was partly offset by increases in Rest of Asia-Pacific relating to a number of... -

Page 160

HSBC HOLDINGS PLC Report of the Directors: Operating and Financial Review (continued) Risk > Credit risk > Credit quality of financial instruments Renegotiated loans and forbearance (Audited) Current policies and procedures regarding renegotiated loans and forbearance are described in the Appendix... -

Page 161

... due to releases and write-offs of a number of non-performing loans as well as the sale of a number of exposures. The renegotiated loans in Europe largely consisted of commercial real estate and other property-related sector lending of 37% (2011: 43%) mainly in the UK, and manufacturing Since 2006... -

Page 162

...December 2012, renegotiated real estate secured accounts in HSBC Finance represented 86% (2011: 86%) of North America's total renegotiated loans; US$14bn (2011: US$16bn) of these renegotiated real estate secured loans were classified as impaired. This decline was mainly due to lower lending balances... -

Page 163

...UK commercial real estate and other property-related lending. Excluding the change in basis of reporting renegotiated loans, total renegotiated loans in the commercial real estate and other property-related sector remained broadly unchanged. Corporate Governance Total Operating & Financial Review... -

Page 164

... that the customer will be able to meet the revised terms. Renegotiated loan balances in the manufacturing and international trade services sector increased in 2012, mainly in Latin America from the restructuring of a small number of loans in Mexico. In the Middle East and North Africa, renegotiated... -

Page 165

... in Global Banking that their size requires the use of portfolio level credit mitigants. Across Global Banking risk limits and utilisations, maturity profiles and risk quality are monitored and managed pro-actively. This process is key to the setting of risk appetite Financial Statements Loans and... -

Page 166

... Global Banking portfolio management team. Hedging activity is carried out within agreed credit parameters, and is subject to market risk limits and a robust governance structure. CDS mitigants are held at portfolio level and are not reported in the presentation below. Residential mortgage loans... -

Page 167

...sheet loan commitments, primarily undrawn credit lines. Overview Shareholder Information Financial Statements Corporate Governance Operating & Financial Review Commercial real estate loans and advances including loan commitments by level of collateral (Audited) Europe US$m At 31 December 2012 Rated... -

Page 168

HSBC HOLDINGS PLC Report of the Directors: Operating and Financial Review (continued) Risk > Credit risk > Collateral / Impairment of loans and advances purposes of this disclosure. In Hong Kong, market practice is for lending to major property companies to be typically secured by guarantees or ... -

Page 169

... with counterparties and netting agreements. We do not currently undertake active management of our 167 Shareholder Information The collateral used in the assessment of the above lending relates primarily to cash and marketable securities. Loans and advances to banks are typically unsecured... -

Page 170

HSBC HOLDINGS PLC Report of the Directors: Operating and Financial Review (continued) Risk > Credit risk > Collateral / Impairment of loans and advances general OTC derivative counterparty exposure in the credit markets, although we may manage individual exposures in certain circumstances. A ... -

Page 171

... footnotes, see page 249. 15 35.8 0.3 1.2 169 Shareholder Information Financial Statements Corporate Governance At 31 December 2011 Gross loans and advances to customers Individually assessed impaired loans14 (E) ... Operating & Financial Review 55,771 1,013,735 Overview Europe US$m MENA... -

Page 172

HSBC HOLDINGS PLC Report of the Directors: Operating and Financial Review (continued) Risk > Credit risk > Impairment of loans and advances Net loan impairment charge to the income statement by geographical region (Unaudited) Hong Kong US$m (8) 32 (34) (6) 92 117 (25) 84 84 Rest of AsiaPacific US... -

Page 173

... America decreased by 2% from the end of 2011 to US$401m, mainly in Brazil. For an analysis of loan impairment charges and other credit risk provisions by global business, see page 76. 171 Shareholder Information Financial Statements Corporate Governance Operating & Financial Review Overview -

Page 174

HSBC HOLDINGS PLC Report of the Directors: Operating and Financial Review (continued) Risk > Credit risk > Impairment of loans and advances Further analysis of impairment Movement in impairment allowances by industry sector and by geographical region (Unaudited) Hong Kong US$m 581 (219) (128) - (... -

Page 175

... against banks: - individually assessed ...Impairment allowances against customers: - individually assessed ...- collectively assessed17 ...At 31 December 2011 ...For footnotes, see page 249. 173 Shareholder Information Financial Statements Corporate Governance 9 Operating & Financial Review... -

Page 176

HSBC HOLDINGS PLC Report of the Directors: Operating and Financial Review (continued) Risk > Credit risk > Impairment of loans and advances Movement in impairment allowances by industry sector (Unaudited) 2012 US$m Impairment allowances at 1 January ...Amounts written off ...Personal ...- first ... -

Page 177

... US$m Banks ...Personal ...First lien residential mortgages ...Other personal1 ...Corporate and commercial ...Manufacturing and international trade and services ...Commercial real estate and other property-related ...Other commercial9 ...Financial ...Total charge to income statement ...For footnotes... -

Page 178

HSBC HOLDINGS PLC Report of the Directors: Operating and Financial Review (continued) Risk > Credit risk > Impairment of loans and advances Net loan impairment charge to the income statement (Unaudited) 2012 US$m Individually assessed impairment allowances ...New allowances ...Release of ... -

Page 179

.... 177 Shareholder Information Financial Statements Corporate Governance Operating & Financial Review Loans and advances to customers are excluded from average balances when reclassified to 'Assets held for sale'. Including these loans and advances to customers, the total new allowances net of... -

Page 180

HSBC HOLDINGS PLC Report of the Directors: Operating and Financial Review (continued) Risk > Credit risk > Concentration of exposure Reconciliation of reported and constant currency impairment charge to the income statement (Unaudited) 31 Dec 11 at 31 Dec 12 exchange rates US$m 1,855 2,951 (531) (... -

Page 181

...trade and services ...Commercial real estate ...Other property-related ...Government ...Other commercial9 ...Financial ...Non-bank financial institutions ...Settlement accounts ...Asset-backed securities reclassified ...Total gross loans and advances to customers ...Gross loans and advances to banks... -

Page 182

...lending represented 8% of total gross lending to customers. Lending increased marginally, as the demand for funds in property investment and development remained strong in Hong Kong. The main concentrations of commercial real estate lending were in the UK and Hong Kong. Lending to non-bank financial... -

Page 183

... ...International trade and services ...Commercial real estate ...Other property-related ...Government ...Other commercial9 ...Financial ...Non-bank financial institutions ...Settlement accounts ...Asset-backed securities reclassified .. Total gross loans and advances to customers (A) ...Percentage... -

Page 184

HSBC HOLDINGS PLC Report of the Directors: Operating and Financial Review (continued) Risk > Credit risk > Concentration of exposure Loans and advances to banks by geographical region (Unaudited) Hong Kong US$m 23,500 35,159 33,585 36,197 29,646 Rest of AsiaPacific US$m 44,592 47,309 40,437 35,648... -

Page 185

...residential mortgages US$m At 31 December 2011 Europe ...UK ...France ...Germany ...Malta ...Switzerland ...Turkey ...Other ...Hong Kong ...Rest of Asia-Pacific ...Australia ...India ...Indonesia ...Mainland China ...Malaysia ...Singapore ...Taiwan ...Vietnam ...Other ...Middle East and North Africa... -

Page 186

... represent claims on Group subsidiaries in Europe and North America. All of the derivative transactions are with HSBC undertakings which are banking counterparties (2011: 100%) and for which HSBC Holdings has in place master netting arrangements. From 2012, the credit risk exposure has been managed... -

Page 187

... are assets held in the GB&M legacy credit portfolio with a carrying value of US$31.6bn (2011: US$35.4bn). Operating & Financial Review Shareholder Information Financial Statements Corporate Governance A summary of the nature of HSBC's exposures is provided in the Appendix to Risk on page 259. 2012... -

Page 188

HSBC HOLDINGS PLC Report of the Directors: Operating and Financial Review (continued) Risk > Credit risk > Securitisation exposures and other structured products Movement in the available-for-sale reserve (Audited) 2012 Directly held/ Solitaire28 US$m Available-for-sale reserve at 1 January ...... -

Page 189

...) Designated at fair value Held to through maturity profit or loss US$m US$m Of which held through consolidated Total SPEs US$m US$m Gross principal exposure30 US$m Credit default swap protection31 US$m Net principal exposure32 US$m Trading US$m At 31 December 2012 Mortgage-related assets: Sub... -

Page 190

...the Directors: Operating and Financial Review (continued) Risk > Credit risk > Securitisation exposures and other structured products HSBC HOLDINGS PLC Carrying amount of HSBC's consolidated holdings of ABSs, and direct lending held at fair value through profit or loss26 (continued) Designated at... -

Page 191

... in 2012 (2011: US$36m). Transactions with monoline insurers (Audited) Our principal exposure to monolines is through a number of OTC derivative transactions, mainly CDSs. We entered into these CDSs primarily to purchase credit protection against securities held at the time within the trading... -

Page 192

... assets described in Note 17 on the Financial Statements. Leveraged finance transactions (Audited) HSBC's exposure to debt securities which benefit from guarantees provided by monolines Within both the trading and available-for-sale portfolios, we hold bonds that are 'wrapped' with a credit... -

Page 193

... for loan files and estimated future demands in respect of mortgages sold to date which are either two or more payments delinquent or expected to become delinquent at an estimated conversion rate. Repurchase demands of US$89m were outstanding at 2012 (2011: US$113m). Operating & Financial Review... -

Page 194

... transacted with counterparties incorporated or domiciled outside the country whose exposure they reference. • Short positions managed together with trading assets mitigate risk to which HSBC is exposed at the balance sheet date when, in the event of default, the trading asset and related short... -

Page 195

... 26.1 Corporate Governance Operating & Financial Review between the counterparties. Such credit events normally include bankruptcy, payment default on a reference asset or assets, restructuring and repudiation or moratoria. Off-balance sheet exposures mainly relate to commitments to lend and the... -

Page 196

... 6.6 HSBC HOLDINGS PLC Sovereign and agencies US$bn Cash and balances at central banks ...Loans and advances ...- gross ...- impairment allowances ...Financial investments available for sale37 ...- amortised cost ...Trading assets ...Derivative assets ...Gross balance sheet exposure before risk... -

Page 197

...-balance sheet exposures ...- commitments ...- guarantees and others ...Total net exposure ...Of which: - net trading assets representing cash collateral posted ...- on-balance sheet exposures held to meet DPF insurance liabilities ...Total credit default swaps - CDS bought positions ...- CDS sold... -

Page 198

...-balance sheet exposures ...- commitments ...- guarantees and others ...Total net exposure ...Of which: - net trading assets representing cash collateral posted ...- on-balance sheet exposures held to meet DPF insurance liabilities ...Total credit default swaps - CDS bought positions ...- CDS sold... -

Page 199

... ...Risk mitigation ...- short trading positions ...- collateral and derivative liabilities ...Net on-balance sheet exposure ...Off-balance sheet exposures ...- commitments ...- guarantees and others ...Total net exposure ...Total credit default swaps - CDS bought positions ...- CDS sold positions... -

Page 200

... HSBC HOLDINGS PLC Sovereign and agencies US$bn Loans and advances ...- gross ...Financial investments available for sale ...- cumulative impairment ...- amortised cost ...- available-for-sale reserve ...Trading assets ...Derivative assets ...Gross balance sheet exposure before risk mitigation... -

Page 201

... off-balance sheet commitments and guarantees to other financial institutions and corporates of US$0.1bn (2011: US$0.1bn). 199 Shareholder Information Financial Statements Corporate Governance Operating & Financial Review Overview Italian other financial institutions and corporates mainly... -

Page 202

... PLC Report of the Directors: Operating and Financial Review (continued) Risk > Eurozone exposures > Redenomination risk Exposures to other eurozone countries Summary of exposures to other eurozone countries (Unaudited) Other financial institutions and corporates US$bn Sovereign and agencies... -

Page 203

... comprise loans and deposits arising from our commercial banking operations in these countries. The net assets represent our net funding exposure to those countries which we consider most likely to be affected by a redenomination event. The table also identifies incountry off-balance sheet exposures... -

Page 204

HSBC HOLDINGS PLC Report of the Directors: Operating and Financial Review (continued) Risk > Eurozone exposures > Redenomination risk // Liquidity and funding rise to a balance sheet exposure. It is to be noted that this analysis can only be an indication as it does not include euro-denominated ... -

Page 205

...-bank loans and intra-group deposits and reverse repo, repo and short positions ... 207 208 264 264 265 261 Group's contractual undrawn exposures monitored under the contingent liquidity risk limit structure ...Funding sources and uses ...Wholesale funding cash flows payable by HSBC under financial... -

Page 206

... recording a decrease in its advances to core funding ratio to 78% as at 31 December 2012 (2011: 86%). Customer deposit markets Customer accounts increased by 7% year on year. After excluding repo balances, the year-on-year increase was 7%. Retail Banking and Wealth Management We continued to grow... -

Page 207

...% (2011: 96%). Financial Statements Our liquidity and funding risk management framework ('LFRF') employs two key measures to define, monitor and control the liquidity and funding risk of each of our operating entities. The advances to core funding ratio is used to monitor the structural long-term... -

Page 208

HSBC HOLDINGS PLC Report of the Directors: Operating and Financial Review (continued) Risk > Liquidity and funding > Management of liquidity and funding risk Stressed one-month and three-month coverage ratios39 (Audited) Stressed one-month coverage ratios at 31 December 2012 2011 % % 114 116 117 ... -

Page 209

...Level 2 under the new policy and are shown as such in the comparatives. Liquid assets held by HSBC USA decreased as a result of the sale of the US Card and Retail Services business and non-strategic branches during 2012. Net contractual cash flows Corporate Governance Operating & Financial Review... -

Page 210

HSBC HOLDINGS PLC Report of the Directors: Operating and Financial Review (continued) Risk > Liquidity and funding > Management of liquidity and funding risk / Contingent liquidity risk Net cash inflows/(outflows) for interbank and intra-group loans and deposits and reverse repo, repo and short ... -

Page 211

.... The Group remained a net unsecured lender to the banking sector. 209 Shareholder Information Financial Statements Corporate Governance Operating & Financial Review Overview UK. Since HSBC controls the size of the portfolio of securities held by these conduits, no contingent liquidity risk... -

Page 212

... HOLDINGS PLC Report of the Directors: Operating and Financial Review (continued) Risk > Liquidity and funding > Contingent liquidity risk / Encumbered and unencumbered assets Funding sources and uses (Audited) 2012 US$m Sources Customer accounts ...- repos ...- cash deposits ...Deposits by banks... -

Page 213

... consolidated balance sheet as the table incorporates, on an undiscounted basis, all cash flows relating to principal and future coupon payments. Funding of HSBC Finance We do not expect the professional markets to be a source of funding for HSBC Finance in the future in view of the sale of the Card... -

Page 214

HSBC HOLDINGS PLC Report of the Directors: Operating and Financial Review (continued) Risk > Liquidity and funding > Encumbered and unencumbered assets At 31 December 2012, the Group held US$1,749bn of unencumbered assets that could be used to support potential future funding and collateral needs,... -

Page 215

... from other banks ...Hong Kong Government certificates of indebtedness ...Trading assets ...- Treasury and other eligible bills ...- debt securities ...- equity securities ...- loans and advances to banks ...- loans and advances to customers ...Financial assets designated at fair value ...- Treasury... -

Page 216

... of repos and debt securities in issue included in trading liabilities is presented on page 485. In addition, loan and other credit-related commitments and financial guarantees and similar contracts are generally not recognised on our balance sheet. The undiscounted cash flows potentially payable... -

Page 217

... ...Other financial liabilities ...Loan and other credit-related commitments ...Financial guarantees and similar contracts ...At 31 December 2011 Deposits by banks ...Customer accounts ...Trading liabilities ...Financial liabilities designated at fair value ...Derivatives ...Debt securities in issue... -

Page 218

HSBC HOLDINGS PLC Report of the Directors: Operating and Financial Review (continued) Risk > Liquidity and funding > Liquidity regulation // Market risk Cash flows payable by HSBC Holdings under financial liabilities by remaining contractual maturities (Audited) On demand US$m At 31 December 2012 ... -

Page 219

... ...Credit spread risk for available-for-sale debt securities ...Equity securities classified as available for sale ...Structural foreign exchange exposures ...Non-trading interest rate risk ...Balance Sheet Management ...Sensitivity of net interest income ...Defined benefit pension schemes... -

Page 220

... from the interest rate management of our retail and commercial banking assets and liabilities, financial investments designated as available for sale and held to maturity, and exposures arising from our insurance operations (see page 239). Monitoring and limiting market risk exposures Our objective... -

Page 221

... securities are mainly held within Balance Sheet Management in GB&M. The positions which are originated in order to manage structural interest rate and liquidity risk are treated as non-trading risk for the purposes of market risk management. Available-for-sale security holdings within insurance... -

Page 222

HSBC HOLDINGS PLC Report of the Directors: Operating and Financial Review (continued) Risk > Market risk > Trading portfolios / Non-trading portfolios For a description of the parameters used in calculating VAR, see the 'Appendix to Risk' on page 266. Trading portfolios (Audited) Value at risk ... -

Page 223

... (2011: US$389m). This sensitivity was 221 Shareholder Information Credit spread VAR for available-for-sale debt securities, excluding those held in insurance operations, is included in the Group non-trading VAR. Financial Statements Corporate Governance Operating & Financial Review Overview... -

Page 224

... invested for short-term cash management ...Investment to facilitate ongoing business54 ...Other strategic investments ...2.9 0.2 1.1 1.6 5.8 For footnotes, see page 249. 2011 US$bn 3.0 0.2 1.1 2.9 7.2 • to define the rules governing the transfer of interest rate risk from the global businesses... -

Page 225

...571 (1,909) 223 Shareholder Information Financial Statements Corporate Governance Operating & Financial Review Cash and balances at central banks ...Trading assets ...Financial assets designated at fair value ...Loans and advances: - to banks ...- to customers ...Financial investments ...Other... -

Page 226

...assets with determinable cash flows. The principal tools used in the management of market risk are VAR for foreign exchange rate risk, and the projected sensitivity of HSBC Holdings' net interest income to future changes in yield curves and interest rate gap re-pricing tables for interest rate risk... -

Page 227

... Financial Statements Corporate Governance (Audited) Operating & Financial Review HSBC Holdings monitors net interest income sensitivity over a 5-year time horizon reflecting the longer-term perspective on interest rate risk management appropriate to a financial services holding company... -

Page 228

... structure of interest rate mismatches within HSBC Holdings' balance sheet. Total US$m At 31 December 2012 Cash at bank and in hand: - balances with HSBC undertakings ...Derivatives ...Loans and advances to HSBC undertakings ...Financial investments ...Investments in subsidiaries ...Other assets... -

Page 229

...with HSBC's management and staff. Each regional, global business, country, business unit and functional head is required to maintain oversight over operational risk and internal control covering all business and operational activities for which they are responsible. A summary of our current policies... -

Page 230

HSBC HOLDINGS PLC Report of the Directors: Operating and Financial Review (continued) Risk > Market risk > Operational risk > In 2012 Operational risk management framework Operational risks Operations Accounting Compliance Fiduciary Internal fraud External fraud Physical Business continuity ... -

Page 231

... in Note 43 on the Financial Statements. Frequency of operational risk incidents by risk category Compliance 4% 5% 54% 55% 8% 8% 28% 25% 3% 6% 3% 1% • Fraud Legal Operations and Systems People 2011 2012 Other 229 Shareholder Information Financial Statements Corporate Governance The... -

Page 232

...laws, codes, rules, regulations and standards of good market practice. In 2012, we experienced increasing levels of compliance risk as regulators and other agencies pursued investigations into historical activities and as we continued to work with them in relation to already identified issues. These... -

Page 233

Fiduciary risk (Unaudited) 231 Shareholder Information Financial Statements Corporate Governance Operating & Financial Review A fiduciary duty is one where HSBC holds, manages, oversees or has responsibility for assets for a third party that involves a legal and/or regulatory duty to act with ... -

Page 234

HSBC HOLDINGS PLC Report of the Directors: Operating and Financial Review (continued) Risk > Risk management of insurance operations > Bancassurance / In 2012 Risk management of insurance operations (Audited) Page HSBC's bancassurance model ...Overview of insurance products ...Nature and extent of... -

Page 235

... (HSBC). Financial risks include market risk, credit risk and liquidity risk. There were no material changes to our policies and practices for the management of risks arising in the insurance operations, including the risks relating to different life and non-life products, during 2012. A summary... -

Page 236

HSBC HOLDINGS PLC Report of the Directors: Operating and Financial Review (continued) Risk > Risk management of insurance operations > In 2012 / Balance sheet of manufacturing subsidiaries a contract, claims and benefits may exceed the aggregate amount of premiums received and investment income. ... -

Page 237

... case at the end of 2012. A principal tool used to manage exposures to both financial and insurance risk, in particular for life insurance contracts, is asset and liability matching. 235 Shareholder Information Financial Statements Corporate Governance Operating & Financial Review Overview -

Page 238

HSBC HOLDINGS PLC Report of the Directors: Operating and Financial Review (continued) Risk > Risk management of insurance operations > Balance sheet of insurance manufacturing subsidiaries Balance sheet of insurance manufacturing subsidiaries by type of contract (Audited) Insurance contracts Term ... -

Page 239

... 581 3,136 North America57 US$m 1,573 1,573 - - - - 1,037 1,037 536 1,573 Latin America US$m 9,254 4 6,702 - 1,998 550 35 557 201 10,047 - 455 7,639 177 327 8,598 1,449 10,047 At 31 December 2012 Financial assets ...- trading assets ...- financial assets designated at fair value ...- derivatives... -

Page 240

HSBC HOLDINGS PLC Report of the Directors: Operating and Financial Review (continued) Risk > Risk management of insurance operations > Financial risks Financial risks (Audited) as there are insufficient assets that can be realised as cash. Further details on the nature of these financial risks ... -

Page 241

... of financial assets were invested in debt securities at 31 December 2012 (2011: 65.2%) with 24.5% (2011: 22.9%) invested in equity securities. Long-term insurance or investment products may incorporate benefits that are guaranteed. Where mismatches exist as a result of current yields falling below... -

Page 242

... bills and debt securities within our Insurance business by measures of credit quality. The five credit quality classifications are defined in the Appendix to Risk on page 253. Only assets supporting liabilities under non-linked insurance and investment contracts and shareholders' funds are included... -

Page 243

... 50 3,820 Supporting shareholders' funds Financial assets designated at fair value ...- debt securities ...Financial investments ...- other eligible bills ...- debt securities ... 71 341 341 3,198 50 3,148 3,539 Total Trading assets - debt securities ...Financial assets designated at fair value... -

Page 244

HSBC HOLDINGS PLC Report of the Directors: Operating and Financial Review (continued) Risk > Risk management of insurance operations > Financial risks / PVIF Reinsurers' share of liabilities under insurance contracts (Audited) Neither past due nor impaired Strong US$m At 31 December 2012 Linked ... -

Page 245

... basis with reference to market risk free yields. Financial Statements • Corporate Governance Present value of in-force long-term insurance business • unwind of the discount rate less the reversal of expected cash flows for the period ('Expected return'); Operating & Financial Review 195... -

Page 246