HSBC 2007 Annual Report Download - page 285

Download and view the complete annual report

Please find page 285 of the 2007 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284 -

285

285 -

286

286 -

287

287 -

288

288 -

289

289 -

290

290 -

291

291 -

292

292 -

293

293 -

294

294 -

295

295 -

296

296 -

297

297 -

298

298 -

299

299 -

300

300 -

301

301 -

302

302 -

303

303 -

304

304 -

305

305 -

306

306 -

307

307 -

308

308 -

309

309 -

310

310 -

311

311 -

312

312 -

313

313 -

314

314 -

315

315 -

316

316 -

317

317 -

318

318 -

319

319 -

320

320 -

321

321 -

322

322 -

323

323 -

324

324 -

325

325 -

326

326 -

327

327 -

328

328 -

329

329 -

330

330 -

331

331 -

332

332 -

333

333 -

334

334 -

335

335 -

336

336 -

337

337 -

338

338 -

339

339 -

340

340 -

341

341 -

342

342 -

343

343 -

344

344 -

345

345 -

346

346 -

347

347 -

348

348 -

349

349 -

350

350 -

351

351 -

352

352 -

353

353 -

354

354 -

355

355 -

356

356 -

357

357 -

358

358 -

359

359 -

360

360 -

361

361 -

362

362 -

363

363 -

364

364 -

365

365 -

366

366 -

367

367 -

368

368 -

369

369 -

370

370 -

371

371 -

372

372 -

373

373 -

374

374 -

375

375 -

376

376 -

377

377 -

378

378 -

379

379 -

380

380 -

381

381 -

382

382 -

383

383 -

384

384 -

385

385 -

386

386 -

387

387 -

388

388 -

389

389 -

390

390 -

391

391 -

392

392 -

393

393 -

394

394 -

395

395 -

396

396 -

397

397 -

398

398 -

399

399 -

400

400 -

401

401 -

402

402 -

403

403 -

404

404 -

405

405 -

406

406 -

407

407 -

408

408 -

409

409 -

410

410 -

411

411 -

412

412 -

413

413 -

414

414 -

415

415 -

416

416 -

417

417 -

418

418 -

419

419 -

420

420 -

421

421 -

422

422 -

423

423 -

424

424 -

425

425 -

426

426 -

427

427 -

428

428 -

429

429 -

430

430 -

431

431 -

432

432 -

433

433 -

434

434 -

435

435 -

436

436 -

437

437 -

438

438 -

439

439 -

440

440 -

441

441 -

442

442 -

443

443 -

444

444 -

445

445 -

446

446 -

447

447 -

448

448 -

449

449 -

450

450 -

451

451 -

452

452 -

453

453 -

454

454 -

455

455 -

456

456 -

457

457 -

458

458 -

459

459 -

460

460 -

461

461 -

462

462 -

463

463 -

464

464 -

465

465 -

466

466 -

467

467 -

468

468 -

469

469 -

470

470 -

471

471 -

472

472 -

473

473 -

474

474 -

475

475 -

476

476

|

|

283

HSBC as a whole. Individual banking subsidiaries

are directly regulated by their local banking

supervisors, who set and monitor their capital

adequacy requirements. In most jurisdictions, non-

banking financial subsidiaries are also subject to the

supervision and capital requirements of local

regulatory authorities. Since 1988, when the

governors of the Group of Ten central banks agreed

to guidelines for the international convergence of

capital measurement and standards, known as

Basel I, the banking supervisors of HSBC’s major

banking subsidiaries have exercised capital adequacy

supervision within a broadly similar framework.

The FSA implements the capital adequacy

requirements issued by the Basel Committee on

Banking Supervision (‘the Basel Committee’) as

implemented by the relevant EU Directives. In June

2006, the EU Capital Requirements Directive

(‘CRD’) was formally adopted by the Council and

European Parliament and it required EU Member

States to bring implementing provisions into force

on 1 January 2007. The CRD recast the Banking

Consolidation Directive and the Capital Adequacy

Directive, which had previously applied.

In October 2006, the FSA published the General

Prudential Sourcebook (‘GENPRU’) and the

Prudential Sourcebook for Banks, Building Societies

and Investment Firms (‘BIPRU’), which took effect

from 1 January 2007 and implemented the CRD in

the UK. GENPRU introduced changes to the

definition of capital and the methodology for

calculating a firm’s capital resources requirements.

BIPRU sets out the FSA’s rules implementing the

other CRD requirements for banks, building

societies and investment firms and groups containing

such firms. Transitional provisions regarding the

implementation of capital requirements calculations

meant that, in general, unless firms notified the FSA

to the contrary, they continued to apply the existing

capital requirements calculations until 1 January

2008; changes that took effect on that date are

described below in the section ‘Basel II’.

In implementing these EU Directives, the FSA

requires each bank and banking group to maintain an

individually prescribed ratio of total capital to risk-

weighted assets, taking into account both balance

sheet assets and off-balance sheet transactions.

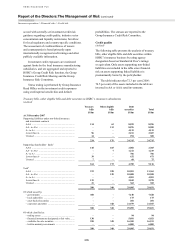

HSBC’s capital is divided into two tiers:

• Tier 1 capital comprises core tier 1 capital and

innovative tier 1 securities. Core tier 1 capital

comprises shareholders’ funds, and minority

interests in tier 1 capital, after adjusting for

items reflected in shareholders’ funds which are

treated differently for the purposes of capital

adequacy. The book values of goodwill and

intangible assets are deducted in arriving at core

tier 1 capital.

• Tier 2 capital comprises qualifying subordinated

loan capital, collective impairment allowances,

minority and other interests in tier 2 capital and

unrealised gains arising on the fair valuation of

equity instruments held as available-for-sale.

Tier 2 capital also includes reserves arising from

the revaluation of properties.

Various limits are applied to elements of the

capital base. The amount of innovative tier 1

securities cannot exceed 15 per cent of overall tier

1 capital, qualifying tier 2 capital cannot exceed

tier 1 capital, and qualifying term subordinated loan

capital may not exceed 50 per cent of tier 1 capital.

There are also limitations on the amount of

collective impairment allowances which may be

included as part of tier 2 capital. From the total of

tier 1 and tier 2 capital are deducted the carrying

amounts of unconsolidated investments, investments

in the capital of banks, and certain regulatory items.

Changes to the definition of capital came into

force on 1 January 2007. They include the

introduction of proportional consolidation of

banking associates, which previously were either

fully consolidated or deducted from capital, the

relaxation of rules covering the deduction of

investments in other banks’ capital, and a change for

disclosure purposes only to make certain deductions,

previously from total capital, now 50 per cent from

each of tier 1 and tier 2 capital in the published

disclosures. This applies to deductions of

investments in insurance subsidiaries and associates,

but the FSA has granted a transitional provision,

until 31 December 2012, under which any of these

insurance investments that were acquired before

20 July 2006 may be deducted from the total of tier 1

and tier 2 capital instead. HSBC has elected to apply

this transitional provision.

Banking operations are categorised as either

trading book or banking book and risk-weighted

assets are determined accordingly. Banking book

risk-weighted assets are measured by means of a

hierarchy of risk weightings classified according to

the nature of each asset and counterparty, taking into

account any eligible collateral or guarantees.

Banking book off-balance sheet items giving rise to

credit, foreign exchange or interest rate risk are

assigned weights appropriate to the category of the

counterparty, taking into account any eligible

collateral or guarantees. Trading book risk-weighted

assets are determined by taking into account market-