Frontier Communications 2008 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2008 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

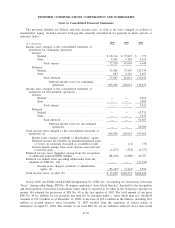

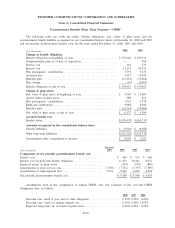

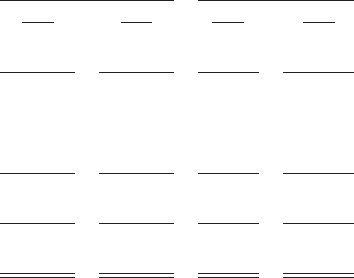

The amounts recognized as a component of accumulated comprehensive income for the years ended

December 31, 2008 and 2007 are as follows:

($ in thousands) 2008 2007 2008 2007

Pension Plan OPEB

Accumulated other comprehensive income at

beginning of year ................................ $134,276 $147,248 $ 2,292 $(13,703)

Net actuarial gain (loss) recognized during year ...... (6,855) (7,313) (5,946) (6,099)

Prior service (cost)/credit recognized during year ..... 255 255 7,751 7,735

Net actuarial loss (gain) occurring during year ....... 248,410 (5,914) 4,043 15,384

Prior service cost (credit) occurring during year ...... — — (95) (1,025)

Net amount recognized in comprehensive income for

the year.......................................... 241,810 (12,972) 5,753 15,995

Accumulated other comprehensive income at end of

year . ............................................ $376,086 $134,276 $ 8,045 $ 2,292

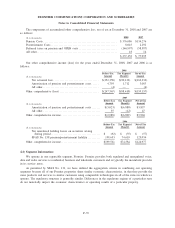

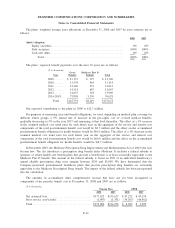

401(k) Savings Plans

We sponsor employee retirement savings plans under section 401(k) of the Internal Revenue Code. The

plans cover substantially all full-time employees. Under the plans, we provide matching contributions and also

provide certain profit-sharing contributions to certain employees upon the attainment of pre-established

financial criteria. Employer contributions were $5.0 million, $4.9 million and $4.7 million for 2008, 2007 and

2006, respectively. The amount for 2007 includes employer contributions of $0.4 million for CTE employees

under a separate Commonwealth plan. Also, effective December 31, 2007, the Commonwealth Builder 401(k)

Plan was merged into the Frontier 401(k) Savings Plan.

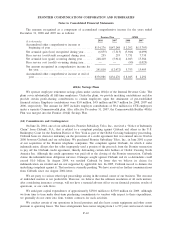

(24) Commitments and Contingencies:

On June 24, 2004, one of our subsidiaries, Frontier Subsidiary Telco, Inc., received a “Notice of Indemnity

Claim” from Citibank, N.A., that is related to a complaint pending against Citibank and others in the U.S.

Bankruptcy Court for the Southern District of New York as part of the Global Crossing bankruptcy proceeding.

Citibank bases its claim for indemnity on the provisions of a credit agreement that was entered into in October

2000 between Citibank and our subsidiary. We purchased Frontier Subsidiary Telco, Inc., in June 2001 as part

of our acquisition of the Frontier telephone companies. The complaint against Citibank, for which it seeks

indemnification, alleges that the seller improperly used a portion of the proceeds from the Frontier transaction

to pay off the Citibank credit agreement, thereby defrauding certain debt holders of Global Crossing North

America Inc. Although the credit agreement was paid off at the closing of the Frontier transaction, Citibank

claims the indemnification obligation survives. Damages sought against Citibank and its co-defendants could

exceed $1.0 billion. In August 2004, we notified Citibank by letter that we believe its claims for

indemnification are invalid and are not supported by applicable law. In 2005, Citibank moved to dismiss the

underlying complaint against it. That motion is currently pending. We have received no further communications

from Citibank since our August 2004 letter.

We are party to various other legal proceedings arising in the normal course of our business. The outcome

of individual matters is not predictable. However, we believe that the ultimate resolution of all such matters,

after considering insurance coverage, will not have a material adverse effect on our financial position, results of

operations, or our cash flows.

We anticipate capital expenditures of approximately $250.0 million to $270.0 million for 2009. Although

we from time to time make short-term purchasing commitments to vendors with respect to these expenditures,

we generally do not enter into firm, written contracts for such activities.

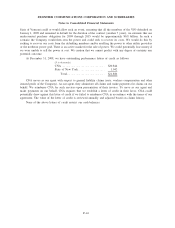

We conduct certain of our operations in leased premises and also lease certain equipment and other assets

pursuant to operating leases. The lease arrangements have terms ranging from 1 to 99 years and several contain

F-42

FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES

Notes to Consolidated Financial Statements