Frontier Communications 2008 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2008 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

commenced on March 19, 2007 and was completed on October 15, 2007. During 2007, we repurchased

17,279,600 shares of our common stock at an aggregate cost of $250.0 million.

In February 2006, our Board of Directors authorized us to repurchase up to $300.0 million of our common

stock in public or private transactions over the following twelve-month period. This share repurchase program

commenced on March 6, 2006. During 2006, we repurchased 10,199,900 shares of our common stock at an

aggregate cost of approximately $135.2 million. No further purchases were made prior to expiration of this

authorization.

Dividends

We expect to pay regular quarterly dividends. Our ability to fund a regular quarterly dividend will be

impacted by our ability to generate cash from operations. The declarations and payment of future dividends will

be at the discretion of our Board of Directors, and will depend upon many factors, including our financial

condition, results of operations, growth prospects, funding requirements, applicable law, restrictions in our

credit facilities and other factors our Board of Directors deems relevant.

Off-Balance Sheet Arrangements

We do not maintain any off-balance sheet arrangements, transactions, obligations or other relationships

with unconsolidated entities that would be expected to have a material current or future effect upon our

financial statements.

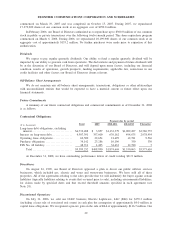

Future Commitments

A summary of our future contractual obligations and commercial commitments as of December 31, 2008

is as follows:

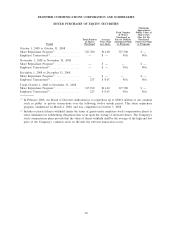

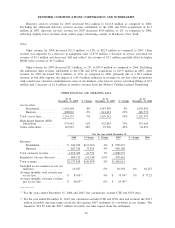

Contractual Obligations:

($ in thousands) Total 2009 2010-2011 2012-2013 Thereafter

Payment due by period

Long-term debt obligations, excluding

interest................................ $4,732,488 $ 3,857 $1,132,379 $1,009,497 $2,586,755

Interest on long-term debt ................ 4,507,391 357,600 676,162 494,675 2,978,954

Operating lease obligations ............... 66,500 22,654 21,499 12,781 9,566

Purchase obligations ..................... 34,142 23,286 10,196 330 330

FIN No. 48 liability...................... 48,711 1,493 34,433 12,780 5

Total ............................... $9,389,232 $408,890 $1,874,669 $1,530,063 $5,575,610

At December 31, 2008, we have outstanding performance letters of credit totaling $21.9 million.

Divestitures

On August 24, 1999, our Board of Directors approved a plan to divest our public utilities services

businesses, which included gas, electric and water and wastewater businesses. We have sold all of these

properties. All of the agreements relating to the sales provide that we will indemnify the buyer against certain

liabilities (typically liabilities relating to events that occurred prior to sale), including environmental liabilities,

for claims made by specified dates and that exceed threshold amounts specified in each agreement (see

Note 24).

Discontinued Operations

On July 31, 2006, we sold our CLEC business, Electric Lightwave, LLC (ELI) for $255.3 million

(including a later sale of associated real estate) in cash plus the assumption of approximately $4.0 million in

capital lease obligations. We recognized a pre-tax gain on the sale of ELI of approximately $116.7 million. Our

29

FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES