Frontier Communications 2008 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2008 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Exhibit

No. Description

4.7 — Seventh Supplemental Indenture to the August 1991 Indenture, dated as of June 1, 1996, between

the Company and JPMorgan Chase Bank, N.A. (as successor to Chemical Bank), as Trustee (filed as

Exhibit 4.100.11 to the Company’s Annual Report on Form 10-K for the year ended December 31,

1996 (the “1996 10-K”)).*

4.8 — Eighth Supplemental Indenture to the August 1991 Indenture, dated as of December 1, 1996,

between the Company and JPMorgan Chase Bank, N.A. (as successor to Chemical Bank), as

Trustee (filed as Exhibit 4.100.12 to the 1996 10-K).*

4.9 — Senior Indenture, dated as of May 23, 2001, between the Company and JPMorgan Chase Bank,

N.A. (as successor to The Chase Manhattan Bank), as Trustee (the “May 2001 Indenture”) (filed as

Exhibit 4.1 to the Company’s Current Report on Form 8-K filed on May 24, 2001 8-K (the “May

24, 2001 8-K”)).*

4.10 — First Supplemental Indenture to the May 2001 Indenture, dated as of May 23, 2001, between the

Company and JPMorgan Chase Bank, N.A. (filed as Exhibit 4.2 to the May 24, 2001 8-K).*

4.11 — Form of Senior Note due 2011 (filed as Exhibit 4.4 to the May 24, 2001 8-K).*

4.12 — Third Supplemental Indenture to the May 2001 Indenture, dated as of November 12, 2004, between

the Company and JPMorgan Chase Bank, N.A. (filed as Exhibit 4.1 to the Company’s Current

Report on Form 8-K filed on November 12, 2004 (the “November 12, 2004 8-K”)).*

4.13 — Form of Senior Note due 2013 (filed as Exhibit A to Exhibit 4.1 to the November 12, 2004 8-K).*

4.14 — Indenture, dated as of August 16, 2001, between the Company and JPMorgan Chase Bank, N.A. (as

successor to The Chase Manhattan Bank), as Trustee (including the form of note attached thereto)

(filed as Exhibit 4.1 of the Company’s Current Report on Form 8-K filed on August 22, 2001).*

4.15 — Indenture, dated as of December 22, 2006, between the Company and The Bank of New York, as

Trustee (filed as Exhibit 4.1 to the Company’s Current Report on Form 8-K filed on December 29,

2006).*

4.16 — Indenture dated as of March 23, 2007 by and between the Company and The Bank of New York

with respect to the 6.625% Senior Notes due 2015 (including the form of such note attached thereto)

(filed as Exhibit 4.1 to the Company’s Current Report on Form 8-K filed on March 27, 2007 (the

“March 27, 2007 8-K”)).*

4.17 — Indenture dated as of March 23, 2007 by and between the Company and The Bank of New York

with respect to the 7.125% Senior Notes due 2019 (including the form of such note attached thereto)

(filed as Exhibit 4.2 to the March 27, 2007 8-K).*

10.1 — Loan Agreement between the Company and Rural Telephone Finance Cooperative for $200,000,000

dated October 24, 2001 (filed as Exhibit 10.39 to the Company’s Quarterly Report on Form 10-Q

for the fiscal quarter ended September 30, 2001).*

10.2 — Amendment No. 1, dated as of March 31, 2003, to Loan Agreement between the Company and

Rural Telephone Finance Cooperative (filed as Exhibit 10.1 to the Company’s Quarterly Report on

Form 10-Q for the fiscal quarter ended March 31, 2003).*

10.3 — Credit Agreement, dated as of December 6, 2006, among the Company, as the Borrower, and

CoBank, ACB, as the Administrative Agent, the Lead Arranger and a Lender, and the other Lenders

referred to therein (filed as Exhibit 10.1 to the Company’s Current Report on Form 8-K filed on

December 7, 2006).*

10.4 — Loan Agreement, dated as of March 8, 2007, among the Company, as borrower, the Lenders listed

therein, Citicorp North America, Inc., as Administrative Agent, and Citigroup Global Markets Inc.,

Credit Suisse Securities (USA) LLC and J.P. Morgan Securities Inc. as Joint-Lead Arrangers and

Joint Book-Running Managers (filed as Exhibit 10.3 to the March 9, 2007 8-K).*

46

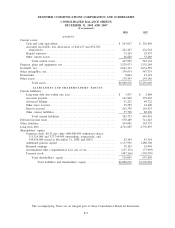

FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES