Frontier Communications 2008 Annual Report Download - page 36

Download and view the complete annual report

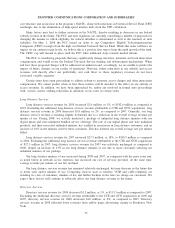

Please find page 36 of the 2008 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.cost structure and an increase in the program’s NACPL, along with reductions in Universal Service Fund (USF)

surcharges due to the elimination of high-speed internet units from the USF calculation.

Many factors may lead to further increases in the NACPL, thereby resulting in decreases in our federal

subsidy revenue in the future. The FCC and state regulators are currently considering a number of proposals for

changing the manner in which eligibility for federal subsidies is determined as well as the amounts of such

subsidies. On May 1, 2008 the FCC issued an order to cap Competitive Eligible Telecommunications

Companies (CETC) receipts from the high cost Federal Universal Service Fund. While this order will have no

impact on our current receipt levels, we believe this is a positive first step to limit the rapid growth of the fund.

The CETC cap will remain in place until the FCC takes additional steps towards needed reform.

The FCC is considering proposals that may significantly change interstate, intrastate and local intercarrier

compensation and would revise the Federal Universal Service funding and disbursement mechanisms. When

and how these proposed changes will be addressed are unknown and, accordingly, we are unable to predict the

impact of future changes on our results of operations. However, future reductions in our subsidy and access

revenues will directly affect our profitability and cash flows as those regulatory revenues do not have

associated variable expenses.

Certain states have open proceedings to address reform to intrastate access charges and other intercarrier

compensation. We cannot predict when or how these matters will be decided or the effect on our subsidy or

access revenues. In addition, we have been approached by, and/or are involved in formal state proceedings

with, various carriers seeking reductions in intrastate access rates in certain states.

Long Distance Services

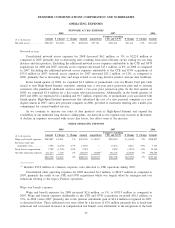

Long distance services revenue for 2008 increased $2.0 million, or 1%, to $182.6 million as compared to

2007. Excluding the additional long distance services revenue attributable to CTE and GVN acquisitions, long

distance services revenue in 2008 decreased $3.8 million, or 2%, as compared to 2007. Generally, our long

distance services revenue is trending slightly downward due to a reduction in the overall average revenue per

minute of use. During 2008, we actively marketed a package of unlimited long distance minutes with our

digital phone and state unlimited bundled service offerings. The sale of our digital phone and state unlimited

products, and their associated unlimited minutes, has resulted in an increase in long distance customers, and an

increase of 10% in the minutes used by these customers. This has lowered our overall average rate per minute

billed.

Long distance services revenue for 2007 increased $27.3 million, or 18%, to $180.5 million as compared

to 2006. Excluding the additional long distance services revenue attributable to the CTE and GVN acquisitions

of $27.1 million in 2007, long distance services revenue for 2007 was relatively unchanged as compared to

2006, despite an increase of 13% in our long distance minutes of use due to more customers selecting our

unlimited minutes of use package.

Our long distance minutes of use increased during 2008 and 2007, as compared with the prior years and,

as noted below in network access expenses, has increased our cost of services provided. At the same time,

average revenue per minute of use has declined.

Our long distance services revenue has remained relatively unchanged, but may decrease in the future due

to lower rates and/or minutes of use. Competing services such as wireless, VOIP and cable telephony are

resulting in a loss of customers, minutes of use and further declines in the rates we charge our customers. We

expect these factors will continue to adversely affect our long distance revenue in the future.

Directory Services

Directory services revenue for 2008 decreased $1.2 million, or 1%, to $113.3 million as compared to 2007.

Excluding the additional directory services revenue attributable to the CTE and GVN acquisitions in 2008 and

2007, directory services revenue for 2008 decreased $4.0 million, or 4%, as compared to 2007. Directory

services revenue in 2008 reflected lower revenues from yellow pages advertising, mainly in Rochester, New

York.

35

FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES