Frontier Communications 2008 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2008 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

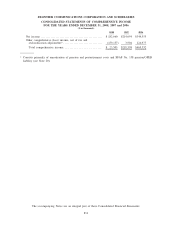

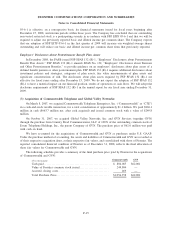

03-6-1 is effective, on a retrospective basis, for financial statements issued for fiscal years beginning after

December 15, 2008, and interim periods within those years. The Company has concluded that our outstanding

non-vested restricted stock is a participating security in accordance with FSP EITF 03-6-1 and that we will be

required to adjust our previously reported basic and diluted income per common share. The Company expects

that our adoption of FSP EITF 03-6-1 in the first quarter of 2009 will increase our weighted average shares

outstanding and will reduce our basic and diluted income per common share from that previously reported.

Employers’ Disclosures about Postretirement Benefit Plan Assets

In December 2008, the FASB issued FSP SFAS 132 (R)-1, “Employers’ Disclosures about Postretirement

Benefit Plan Assets.” FSP SFAS 132 (R)-1 amends SFAS No. 132, “Employers’ Disclosures about Pensions

and Other Postretirement Benefits,” to provide guidance on an employers’ disclosures about plan assets of a

defined benefit pension or other postretirement plan. FSP SFAS 132 (R)-1 requires additional disclosures about

investment policies and strategies, categories of plan assets, fair value measurements of plan assets and

significant concentrations of risk. The disclosures about plan assets required by FSP SFAS 132 (R)-1 are

effective for fiscal years ending after December 15, 2009. We do not expect the adoption of FSP SFAS 132

(R)-1 to have a material impact on our financial position, results of operations or cash flows. We will adopt the

disclosure requirements of FSP SFAS 132 (R)-1 in the annual report for our fiscal year ending December 31,

2009.

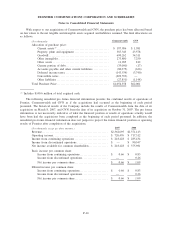

(3) Acquisition of Commonwealth Telephone and Global Valley Networks:

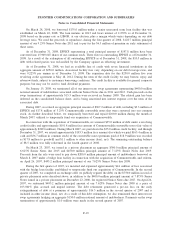

On March 8, 2007, we acquired Commonwealth Telephone Enterprises, Inc. (“Commonwealth” or “CTE”)

in a cash-and-stock taxable transaction, for a total consideration of approximately $1.1 billion. We paid $804.1

million in cash ($663.7 million net, after cash acquired) and issued common stock with a value of $249.8

million.

On October 31, 2007, we acquired Global Valley Networks, Inc. and GVN Services (together GVN)

through the purchase from Country Road Communications, LLC of 100% of the outstanding common stock of

Evans Telephone Holdings, Inc., the parent Company of GVN. The purchase price of $62.0 million was paid

with cash on hand.

We have accounted for the acquisitions of Commonwealth and GVN as purchases under U.S. GAAP.

Under the purchase method of accounting, the assets and liabilities of Commonwealth and GVN are recorded as

of their respective acquisition dates, at their respective fair values, and consolidated with those of Frontier. The

reported consolidated financial condition of Frontier as of December 31, 2008, reflects the final allocation of

these fair values for Commonwealth and GVN.

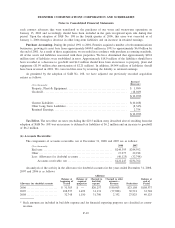

The following schedule provides a summary of the final purchase price paid by Frontier in the acquisitions

of Commonwealth and GVN:

($ in thousands) Commonwealth GVN

Cash paid ................................................... $ 804,085 $62,001

Value of Frontier common stock issued....................... 249,804 —

Accrued closing costs........................................ 469 —

Total Purchase Price ......................................... $1,054,358 $62,001

F-15

FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES

Notes to Consolidated Financial Statements