Frontier Communications 2008 Annual Report Download - page 64

Download and view the complete annual report

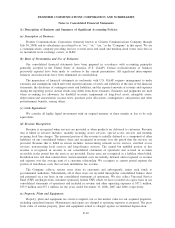

Please find page 64 of the 2008 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.(l) Net Income Per Common Share Available for Common Shareholders:

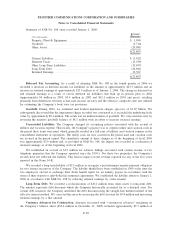

Basic net income per common share is computed using the weighted average number of common shares

outstanding during the period being reported on. Except when the effect would be antidilutive, diluted net

income per common share reflects the dilutive effect of the assumed exercise of stock options using the

treasury stock method at the beginning of the period being reported on as well as common shares that would

result from the conversion of convertible preferred stock (EPPICS) and convertible notes. In addition, the

related interest on debt (net of tax) is added back to income since it would not be paid if the debt was

converted to common stock.

(2) Recent Accounting Literature and Changes in Accounting Principles:

Accounting for Endorsement Split-Dollar Life Insurance Arrangements

In September 2006, the FASB reached consensus on the guidance provided by Emerging Issues Task

Force (EITF) No. 06-4, “Accounting for Deferred Compensation and Postretirement Benefit Aspects of

Endorsement Split-Dollar Life Insurance Arrangements.” The guidance is applicable to endorsement split-dollar

life insurance arrangements, whereby the employer owns and controls the insurance policies, that are associated

with a postretirement benefit. EITF No. 06-4 requires that for a split-dollar life insurance arrangement within

the scope of the issue, an employer should recognize a liability for future benefits in accordance with SFAS No.

106 (if, in substance, a postretirement benefit plan exists) or Accounting Principles Board Opinion (APB) No.

12 (if the arrangement is, in substance, an individual deferred compensation contract) based on the substantive

agreement with the employee. EITF No. 06-4 was effective for fiscal years beginning after December 15, 2007.

Our adoption of the accounting requirements of EITF No. 06-4 in the first quarter of 2008 had no impact on

our financial position, results of operations or cash flows.

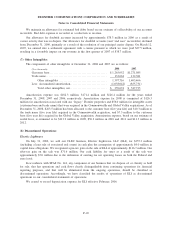

Fair Value Measurements

In September 2006, the FASB issued SFAS No. 157, “Fair Value Measurements,” which defines fair

value, establishes a framework for measuring fair value, and expands disclosures about fair value

measurements. In February 2008, the FASB amended SFAS No. 157 to defer the application of this standard

to nonfinancial assets and liabilities until 2009. The provisions of SFAS No. 157 related to financial assets and

liabilities were effective as of the beginning of our 2008 fiscal year. Our adoption of SFAS No. 157 in the first

quarter of 2008 had no impact on our financial position, results of operations or cash flows. We do not expect

the adoption of SFAS No. 157, as amended, in the first quarter of 2009 with respect to its effect on

nonfinancial assets and liabilities to have a material impact on our financial position, results of operations or

cash flows. Nonfinancial assets and liabilities for which we have not applied the provisions of SFAS No. 157

include those measured at fair value in impairment testing and those initially measured at fair value in a

business combination.

The Fair Value Option for Financial Assets and Financial Liabilities

In February 2007, the FASB issued SFAS No. 159, “The Fair Value Option for Financial Assets and

Financial Liabilities—Including an Amendment of FASB Statement No. 115,” which permits entities to choose

to measure many financial instruments and certain other items at fair value. The provisions of SFAS No. 159

were effective as of the beginning of our 2008 fiscal year. Our adoption of SFAS No. 159 in the first quarter of

2008 had no impact on our financial position, results of operations or cash flows.

Accounting for Collateral Assignment Split-Dollar Life Insurance Arrangements

In March 2007, the FASB ratified the consensus reached by the EITF on Issue No. 06-10, “Accounting for

Collateral Assignment Split-Dollar Life Insurance Arrangements.” EITF No. 06-10 provides guidance on an

employers’ recognition of a liability and related compensation costs for collateral assignment split-dollar life

insurance arrangements that provide a benefit to an employee that extends into postretirement periods, and the

F-13

FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES

Notes to Consolidated Financial Statements