Frontier Communications 2008 Annual Report Download - page 65

Download and view the complete annual report

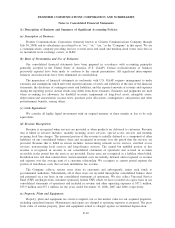

Please find page 65 of the 2008 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.asset in collateral assignment split-dollar life insurance arrangements. EITF No. 06-10 was effective for fiscal

years beginning after December 15, 2007. Our adoption of the accounting requirements of EITF No. 06-10 in

the first quarter of 2008 had no impact on our financial position, results of operations or cash flows.

Accounting for the Income Tax Benefits of Dividends on Share-Based Payment Awards

In June 2007, the FASB ratified EITF No. 06-11, “Accounting for the Income Tax Benefits of Dividends

on Share-Based Payment Awards.” EITF No. 06-11 provides that tax benefits associated with dividends on

share-based payment awards be recorded as a component of additional paid-in capital. EITF No. 06-11 was

effective, on a prospective basis, for fiscal years beginning after December 15, 2007. The implementation of

this standard in the first quarter of 2008 had no material impact on our financial position, results of operations

or cash flows.

Business Combinations

In December 2007, the FASB revised SFAS No. 141, “Business Combinations.” The revised statement,

SFAS No. 141R, requires an acquiring entity to recognize all the assets acquired and liabilities assumed in a

transaction at the acquisition date at fair value, to remeasure liabilities related to contingent consideration at fair

value in each subsequent reporting period and to expense all acquisition related costs. The effective date of

SFAS No. 141R is for business combinations for which the acquisition date is on or after the beginning of the

first annual reporting period beginning on or after December 15, 2008. This standard does not impact our

currently reported results and we do not expect the adoption of SFAS No. 141R in the first quarter of 2009 to

have a material impact on our financial position, results of operations or cash flows.

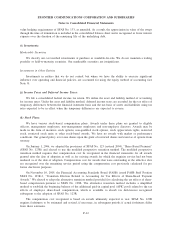

Noncontrolling Interests in Consolidated Financial Statements

In December 2007, the FASB issued SFAS No. 160, “Noncontrolling Interests in Consolidated Financial

Statements.” SFAS No. 160 establishes requirements for ownership interest in subsidiaries held by parties other

than the Company (sometimes called “minority interest”) be clearly identified, presented and disclosed in the

consolidated statement of financial position within shareholder equity, but separate from the parent’s equity. All

changes in the parent’s ownership interest are required to be accounted for consistently as equity transactions

and any noncontrolling equity investments in unconsolidated subsidiaries must be measured initially at fair

value. SFAS No. 160 is effective, on a prospective basis, for fiscal years beginning after December 15, 2008.

However, presentation and disclosure requirements must be retrospectively applied to comparative financial

statements. We do not expect the adoption of SFAS No. 160 in the first quarter of 2009 to have a material

impact on our financial position, results of operations or cash flows.

The Hierarchy of Generally Accepted Accounting Principles

In May 2008, the FASB issued SFAS No. 162, “The Hierarchy of Generally Accepted Accounting

Principles.” This standard identifies the sources of accounting principles and the framework for selecting the

principles to be used in the preparation of financial statements of nongovernmental entities that are presented in

conformity with U.S. GAAP. The effective date of SFAS No. 162 was November 15, 2008. Our adoption of

SFAS No. 162 during the fourth quarter of 2008 did not result in any changes to our current accounting

practices or policies and thereby has not impacted the preparation of the consolidated financial statements.

Determining Whether Instruments Granted in Share-Based Payment Transactions are Participating

Securities

In June 2008, the FASB ratified FSP EITF 03-6-1, “Determining Whether Instruments Granted in Share-

Based Payment Transactions are Participating Securities.” FSP EITF 03-6-1 addresses whether instruments

granted in share-based payment transactions are participating securities prior to vesting and, therefore, should

be included in the earnings allocation in computing earnings per share under the two-class method. FSP EITF

F-14

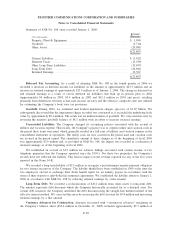

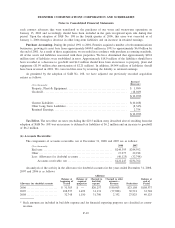

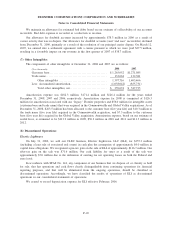

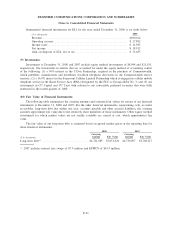

FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES

Notes to Consolidated Financial Statements