Frontier Communications 2008 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2008 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

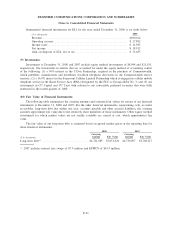

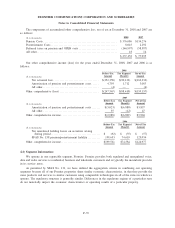

As of January 16, 2008, we no longer have any derivative instruments. The following disclosure is

necessary to understand our historical financial statements.

The interest rate swap contracts are reflected at fair value in our consolidated balance sheets and the

related portion of fixed-rate debt being hedged is reflected at an amount equal to the sum of its book value and

an amount representing the change in fair value of the debt obligations attributable to the interest rate risk being

hedged. Changes in the fair value of interest rate swap contracts, and the offsetting changes in the adjusted

carrying value of the related portion of the fixed-rate debt being hedged, are recognized in the consolidated

statements of operations in interest expense. The notional amounts of interest rate swap contracts hedging

fixed-rate indebtedness as of December 31, 2007 was $400.0 million. Such contracts required us to pay variable

rates of interest (average pay rates of approximately 8.54% as of December 31, 2007) and receive fixed rates of

interest (average receive rates of 8.50% as of December 31, 2007). The fair value of these derivatives is

reflected in other assets as of December 31, 2007 in the amount of $7.9 million. The related underlying debt

was increased in 2007 by a like amount. For the years ended December 31, 2007 and 2006, the interest expense

resulting from these interest rate swaps totaled approximately $2.4 million and $4.2 million, respectively.

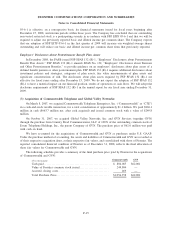

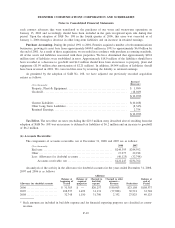

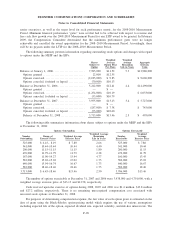

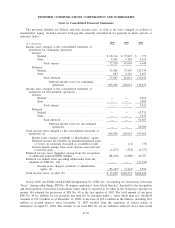

(13) Investment Income:

The components of investment income for the years ended December 31, 2008, 2007 and 2006 are as

follows:

($ in thousands) 2008 2007 2006

Interest and dividend income . . ................................... $10,928 $32,986 $22,172

Gain from Rural Telephone Bank dissolution ..................... — — 61,428

Equity earnings/minority interest in joint ventures, net ............. 3,576 2,795 (4,164)

Total investment income ......................................... $14,504 $35,781 $79,436

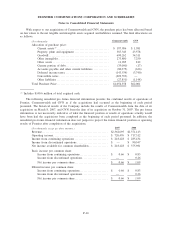

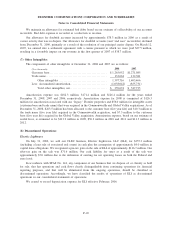

(14) Other Income (Loss), net:

The components of other income (loss), net for the years ended December 31, 2008, 2007 and 2006 are as

follows:

($ in thousands) 2008 2007 2006

Bridge loan fee.................................................. $ — $ (4,069) $ —

Premium on debt repurchases . ................................... (6,290) (18,217) —

Legal fees and settlement costs................................... (1,037) — (1,000)

Gain on expiration/settlement of customer advances, net . . . ........ 4,520 2,031 3,539

Loss on exchange of debt........................................ — — (2,433)

Gain on forward rate agreements ................................. — — 430

Other, net . . ..................................................... (2,363) 2,422 2,471

Total other income (loss), net . ................................... $(5,170) $(17,833) $ 3,007

During the first quarter of 2008, we retired certain debt and recognized a pre-tax loss of $6.3 million on

the early extinguishment of debt at a premium, mainly for the 9.25% Senior Notes due 2011. During the first

quarter of 2007, we incurred $4.1 million of fees associated with a bridge loan facility. In 2007, we retired

certain debt and recognized a pre-tax loss of $18.2 million on the early extinguishment of debt at a premium,

mainly for the 7.625% Senior Notes due 2008. During 2008, 2007 and 2006, we recognized income of $4.5

million, $2.0 million and $3.5 million, respectively, in connection with certain retained liabilities, that have

terminated, associated with customer advances for construction from our disposed water properties. During

2008 and 2006, we recorded legal fees and settlement costs in connection with the Bangor, Maine legal matter

of $1.0 million in each year. In connection with our exchange of debt during the first quarter of 2006, we

recognized a non-cash, pre-tax loss of $2.4 million. 2006 also includes a gain for the changes in fair value of

our forward rate agreements of $0.4 million.

F-25

FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES

Notes to Consolidated Financial Statements