Frontier Communications 2008 Annual Report Download - page 77

Download and view the complete annual report

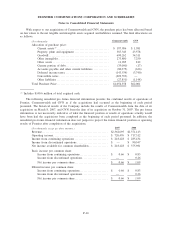

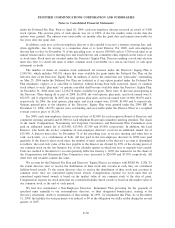

Please find page 77 of the 2008 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.(15) Company Obligated Mandatorily Redeemable Convertible Preferred Securities:

As of December 31, 2008, we fully redeemed the EPPICS related debt outstanding to third parties. The

following disclosure provides the history regarding this issue.

In 1996, our consolidated wholly-owned subsidiary, Citizens Utilities Trust (the Trust), issued, in an

underwritten public offering, 4,025,000 shares of EPPICS, representing preferred undivided interests in the

assets of the Trust, with a liquidation preference of $50 per security (for a total liquidation amount of $201.3

million). These securities had an adjusted conversion price of $11.46 per share of our common stock. The

conversion price was reduced from $13.30 to $11.46 during the third quarter of 2004 as a result of the $2.00

per share of common stock special, non-recurring dividend. The proceeds from the issuance of the Trust

Convertible Preferred Securities and a Company capital contribution were used to purchase $207.5 million

aggregate liquidation amount of 5% Partnership Convertible Preferred Securities due 2036 from another

wholly-owned subsidiary, Citizens Utilities Capital L.P. (the Partnership). The proceeds from the issuance of

the Partnership Convertible Preferred Securities and a Company capital contribution were used to purchase

from us $211.8 million aggregate principal amount of 5% Convertible Subordinated Debentures due 2036. The

sole assets of the Trust were the Partnership Convertible Preferred Securities, and our Convertible Subordinated

Debentures were substantially all the assets of the Partnership. Our obligations under the agreements related to

the issuances of such securities, taken together, constituted a full and unconditional guarantee by us of the

Trust’s obligations relating to the Trust Convertible Preferred Securities and the Partnership’s obligations

relating to the Partnership Convertible Preferred Securities.

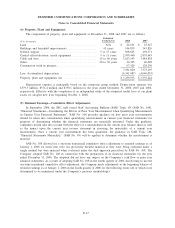

In accordance with the terms of the issuances, we paid the annual 5% interest in quarterly installments on

the Convertible Subordinated Debentures in 2008, 2007 and 2006. Cash was paid (net of investment returns) to

the Partnership in payment of the interest on the Convertible Subordinated Debentures. The cash was then

distributed by the Partnership to the Trust and then by the Trust to the holders of the EPPICS.

As of December 31, 2008, EPPICS representing a total principal amount of $197.8 million have been

converted into 15,969,645 shares of our common stock. There were no outstanding EPPICS as of December 31,

2008. As a result of the redemption of all outstanding EPPICS as of December 31, 2008, the $10.5 million in

debt with related parties was reclassified by the Company against an offsetting investment.

We adopted the provisions of FIN No. 46R (revised December 2003) (FIN No. 46R), “Consolidation of

Variable Interest Entities,” effective January 1, 2004. Accordingly, the Trust holding the EPPICS and the

related Citizens Utilities Capital L.P. were deconsolidated.

(16) Capital Stock:

We are authorized to issue up to 600,000,000 shares of common stock. The amount and timing of

dividends payable on common stock are, subject to applicable law, within the sole discretion of our Board of

Directors.

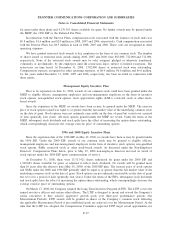

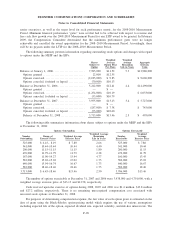

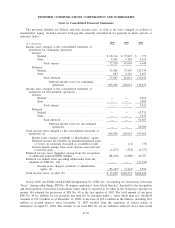

(17) Stock Plans:

At December 31, 2008, we had five stock-based compensation plans under which grants have been made

and awards remained outstanding. These plans, which are described below, are the Management Equity

Incentive Plan (MEIP), the 1996 Equity Incentive Plan (1996 EIP), the Amended and Restated 2000 Equity

Incentive Plan (2000 EIP), the Non-Employee Directors’ Deferred Fee Plan (Deferred Fee Plan) and the Non-

Employee Directors’ Equity Incentive Plan (Directors’ Equity Plan, and together with the Deferred Fee Plan,

the Director Plans).

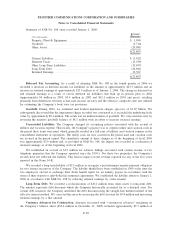

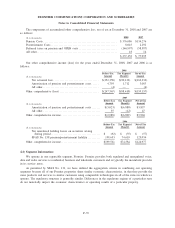

In accordance with the adoption of SFAS No. 123R as of January 1, 2006, we recorded stock-based

compensation expense for the cost of our stock options. Compensation expense, recognized in other operating

expenses, of $0.0 million, $0.8 million and $2.2 million in 2008, 2007 and 2006, respectively, has been

recorded for the cost of our stock options. Our general policy is to issue shares upon the grant of restricted

shares and exercise of options from treasury. At December 31, 2008, there were 16,058,182 shares authorized

F-26

FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES

Notes to Consolidated Financial Statements