Frontier Communications 2008 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2008 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Credit Facility

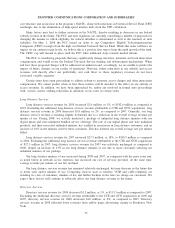

As of December 31, 2008, we had available lines of credit with seven financial institutions in the

aggregate amount of $250.0 million and there were no outstanding standby letters of credit issued under the

facility. Associated facility fees vary, depending on our debt leverage ratio, and were 0.225% per annum as of

December 31, 2008. The expiration date for this $250.0 million five year revolving credit agreement is May 18,

2012. During the term of the credit facility we may borrow, repay and reborrow funds subject to customary

conditions. The credit facility is available for general corporate purposes but may not be used to fund dividend

payments. Although we believe, based on information available to us, that the financial institutions syndicated

under our credit facility would be able to fulfill their commitments, given the current economic environment

and the recent severe contraction in the global financial markets, this could change in the future.

Covenants

The terms and conditions contained in our indentures and credit facility agreements include the timely

payment of principal and interest when due, the maintenance of our corporate existence, keeping proper books

and records in accordance with U.S. GAAP, restrictions on the allowance of liens on our assets, and restrictions

on asset sales and transfers, mergers and other changes in corporate control. We currently have no restrictions

on the payment of dividends either by contract, rule or regulation, other than those imposed by the Delaware

General Corporation Law. However, we would be restricted under our credit facilities from declaring dividends

if an event of default has occurred and is continuing at the time or will result from the dividend declaration.

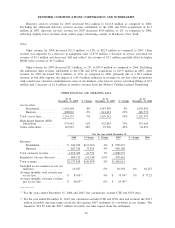

Our $200.0 million term loan facility with the Rural Telephone Finance Cooperative (RTFC), which

matures in 2011, contains a maximum leverage ratio covenant. Under the leverage ratio covenant, we are

required to maintain a ratio of (i) total indebtedness minus cash and cash equivalents in excess of $50.0 million

to (ii) consolidated adjusted EBITDA (as defined in the agreement) over the last four quarters no greater than

4.00 to 1.

Our $250.0 million credit facility, and our $150.0 million and $135.0 million senior unsecured term loans,

each contain a maximum leverage ratio covenant. Under the leverage ratio covenant, we are required to

maintain a ratio of (i) total indebtedness minus cash and cash equivalents in excess of $50.0 million to (ii)

consolidated adjusted EBITDA (as defined in the agreements) over the last four quarters no greater than 4.50 to

1. Although all of these facilities are unsecured, they will be equally and ratably secured by certain liens and

equally and ratably guaranteed by certain of our subsidiaries if we issue debt that is secured or guaranteed.

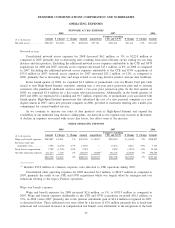

Our credit facilities and certain indentures for our senior unsecured debt obligations limit our ability to

create liens or merge or consolidate with other companies and our subsidiaries’ ability to borrow funds, subject

to important exceptions and qualifications.

As of December 31, 2008, we were in compliance with all of our debt and credit facility covenants.

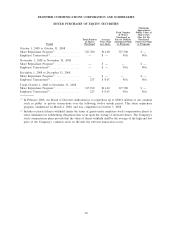

Proceeds from the Sale of Equity Securities

We receive proceeds from the issuance of common stock upon the exercise of options pursuant to our

stock-based compensation plans. For the years ended December 31, 2008, 2007 and 2006, we received

approximately $1.4 million, $13.8 million and $27.2 million, respectively, upon the exercise of outstanding

stock options.

Share Repurchase Programs

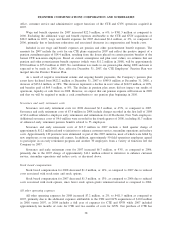

In February 2008, our Board of Directors authorized us to repurchase up to $200.0 million of our common

stock in public or private transactions over the following twelve month period. This share repurchase program

commenced on March 4, 2008 and was completed on October 3, 2008. During 2008, we repurchased

17,778,300 shares of our common stock at an aggregate cost of $200.0 million.

In February 2007, our Board of Directors authorized us to repurchase up to $250.0 million of our common

stock in public or private transactions over the following twelve month period. This share repurchase program

28

FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES