Frontier Communications 2008 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2008 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

taxable income. Our effective tax rate for 2007 was 37.4% as compared with an effective tax rate of 34.9% for

2006. The Company’s effective tax rate increased in 2007 mainly due to changes in permanent difference items

and tax contingencies.

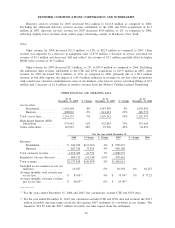

DISCONTINUED OPERATIONS

($ in thousands) Amount

2006

Revenue.................................................... $100,612

Operating income ........................................... $ 27,882

Income taxes ............................................... $ 11,583

Net income . ................................................ $ 18,912

Gain on disposal of ELI, net of tax .......................... $ 71,635

On July 31, 2006, we sold our CLEC business, Electric Lightwave, LLC (ELI) for $255.3 million

(including a later sale of associated real estate) in cash plus the assumption of approximately $4.0 million in

capital lease obligations. We recognized a pre-tax gain on the sale of ELI of approximately $116.7 million. Our

after-tax gain on the sale was $71.6 million. Our cash liability for taxes as a result of the sale was

approximately $5.0 million due to the utilization of existing tax net operating losses on both the Federal and

state level.

Item 7A. Quantitative and Qualitative Disclosures about Market Risk

Disclosure of primary market risks and how they are managed

We are exposed to market risk in the normal course of our business operations due to ongoing investing

and funding activities, including those associated with our pension assets. Market risk refers to the potential

change in fair value of a financial instrument as a result of fluctuations in interest rates and equity prices. We

do not hold or issue derivative instruments, derivative commodity instruments or other financial instruments for

trading purposes. As a result, we do not undertake any specific actions to cover our exposure to market risks,

and we are not party to any market risk management agreements other than in the normal course of business.

Our primary market risk exposures are interest rate risk and equity price risk as follows:

Interest Rate Exposure

Our exposure to market risk for changes in interest rates relates primarily to the interest-bearing portion of

our investment portfolio. Our long-term debt as of December 31, 2008 was approximately 94% fixed rate debt

with minimal exposure to interest rate changes after the termination of our remaining interest rate swap

agreements on January 15, 2008.

Our objectives in managing our interest rate risk are to limit the impact of interest rate changes on

earnings and cash flows and to lower our overall borrowing costs. To achieve these objectives, all but $281.0

million of our borrowings at December 31, 2008 have fixed interest rates. Consequently, we have limited

material future earnings or cash flow exposures from changes in interest rates on our long-term debt. An

adverse change in interest rates would increase the amount that we pay on our variable obligations and could

result in fluctuations in the fair value of our fixed rate obligations. Based upon our overall interest rate

exposure at December 31, 2008, a near-term change in interest rates would not materially affect our

consolidated financial position, results of operations or cash flows.

On January 15, 2008, we terminated all of our interest rate swap agreements representing $400.0 million

notional amount of indebtedness associated with our Senior Notes due in 2011 and 2013. Cash proceeds on the

swap terminations of approximately $15.5 million were received in January 2008. The related gain has been

deferred on the consolidated balance sheet, and is being amortized into interest expense over the term of the

associated debt.

41

FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES