Frontier Communications 2008 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2008 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

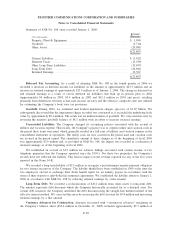

We maintain an allowance for estimated bad debts based on our estimate of collectability of our accounts

receivable. Bad debt expense is recorded as a reduction to revenue.

Our allowance for doubtful accounts increased by approximately $78.3 million in 2006 as a result of

carrier activity that was in dispute. Our allowance for doubtful accounts (and “end user” receivables) declined

from December 31, 2006, primarily as a result of the resolution of our principal carrier dispute. On March 12,

2007, we entered into a settlement agreement with a carrier pursuant to which we were paid $37.5 million,

resulting in a favorable impact on our revenue in the first quarter of 2007 of $38.7 million.

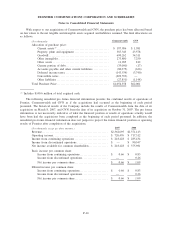

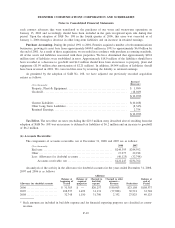

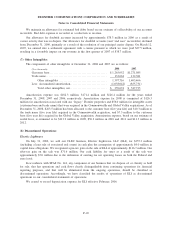

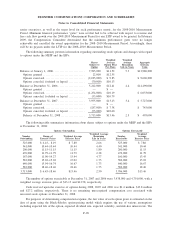

(7) Other Intangibles:

The components of other intangibles at December 31, 2008 and 2007 are as follows:

($ in thousands) 2008 2007

Customer base ............................................. $ 1,265,052 $1,271,085

Trade name................................................ 132,664 132,381

Other intangibles ...................................... 1,397,716 1,403,466

Less: Accumulated amortization. ............................ (1,038,042) (855,731)

Total other intangibles, net............................. $ 359,674 $ 547,735

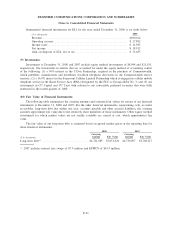

Amortization expense was $182.3 million, $171.4 million and $126.4 million for the years ended

December 31, 2008, 2007 and 2006, respectively. Amortization expense for 2008 is comprised of $126.3

million for amortization associated with our “legacy” Frontier properties and $56.0 million for intangible assets

(customer base and trade name) that were acquired in the Commonwealth and Global Valley acquisitions. As of

December 31, 2008, $263.5 million has been allocated to the customer base (five year life) and $10.3 million to

the trade name (five year life) acquired in the Commonwealth acquisition, and $7.3 million to the customer

base (five year life) acquired in the Global Valley acquisition. Amortization expense, based on our estimate of

useful lives, is estimated to be $113.9 million in 2009, $56.2 million in 2010 and 2011 and $11.3 million in

2012.

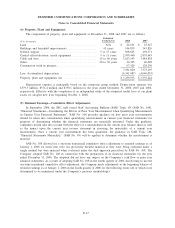

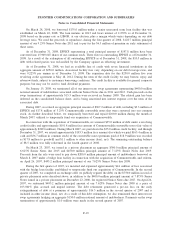

(8) Discontinued Operations:

Electric Lightwave

On July 31, 2006, we sold our CLEC business, Electric Lightwave, LLC (ELI), for $255.3 million

(including a later sale of associated real estate) in cash plus the assumption of approximately $4.0 million in

capital lease obligations. We recognized a pre-tax gain on the sale of ELI of approximately $116.7 million. Our

after-tax gain on the sale was $71.6 million. Our cash liability for taxes as a result of the sale was

approximately $5.0 million due to the utilization of existing tax net operating losses on both the Federal and

state level.

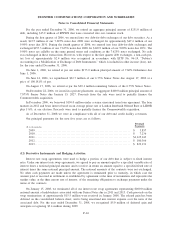

In accordance with SFAS No. 144, any component of our business that we dispose of, or classify as held

for sale, that has operations and cash flows clearly distinguishable from continuing operations for financial

reporting purposes, and that will be eliminated from the ongoing operations, should be classified as

discontinued operations. Accordingly, we have classified the results of operations of ELI as discontinued

operations in our consolidated statements of operations.

We ceased to record depreciation expense for ELI effective February 2006.

F-20

FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES

Notes to Consolidated Financial Statements