Frontier Communications 2008 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2008 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

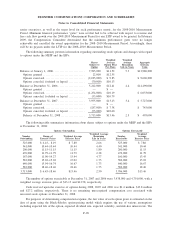

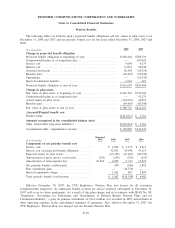

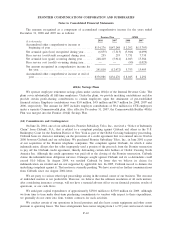

Pension Benefits

The following tables set forth the plan’s projected benefit obligations and fair values of plan assets as of

December 31, 2008 and 2007 and net periodic benefit cost for the years ended December 31, 2008, 2007 and

2006:

($ in thousands) 2008 2007

Change in projected benefit obligation

Projected benefit obligation at beginning of year . . ....................... $ 820,404 $780,719

Commonwealth plan as of acquisition date ............................... — 107,047

Service cost ............................................................ 6,005 9,175

Interest cost ............................................................ 52,851 50,948

Actuarial loss/(gain) . ................................................... 20,230 (26,524)

Benefits paid ........................................................... (69,465) (87,049)

Curtailment ............................................................ — (14,379)

Special termination benefits . . . .......................................... 1,662 467

Projected benefit obligation at end of year ............................... $ 831,687 $820,404

Change in plan assets

Fair value of plan assets at beginning of year ............................ $ 822,165 $770,182

Commonwealth plan as of acquisition date ............................... — 92,175

Actual return on plan assets. . . .......................................... (162,924) 46,857

Benefits paid ........................................................... (69,465) (87,049)

Fair value of plan assets at end of year. . ................................ $ 589,776 $822,165

(Accrued)/Prepaid benefit cost

Funded status .......................................................... $(241,911) $ 1,761

Amounts recognized in the consolidated balance sheet

Other assets/(other long-term liabilities) . . ................................ $(241,911) $ 1,761

Accumulated other comprehensive income ............................... $ 376,086 $134,276

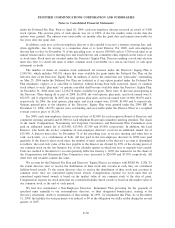

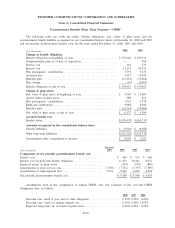

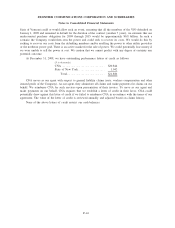

($ in thousands)

Expected

2009 2008 2007 2006

Components of net periodic benefit cost

Service cost. . . ...................................... $ 6,005 $ 9,175 $ 6,811

Interest cost on projected benefit obligation........... 52,851 50,948 45,215

Expected return on plan assets . . . .................... (65,256) (67,467) (60,759)

Amortization of prior service cost/(credit) . ........... (255) (255) (255) (255)

Amortization of unrecognized loss ................... 26,824 6,855 7,313 11,871

Net periodic benefit cost/(income).................... 200 (286) 2,883

Plan curtailment gain . . . ............................. — (14,379) —

Special termination charge ........................... 1,662 467 1,809

Total periodic benefit cost/(income) .................. $ 1,862 $(14,198) $ 4,692

Effective December 30, 2007, the CTE Employees’ Pension Plan was frozen for all non-union

Commonwealth employees. No additional benefit accruals for service rendered subsequent to December 30,

2007 will occur for those participants. As a result of this plan change and in accordance with SFAS No. 88,

“Employers’ Accounting for Settlements and Curtailments of Defined Benefit Pension Plans and for

Termination Benefits,” a gain on pension curtailment of $14.4 million was recorded in 2007 and included in

other operating expenses in the consolidated statement of operations. Also, effective December 31, 2007, the

CTE Employees’ Pension Plan was merged into the Frontier Pension Plan.

F-38

FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES

Notes to Consolidated Financial Statements