Frontier Communications 2008 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2008 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

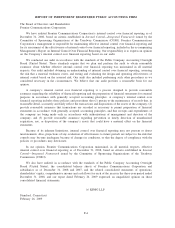

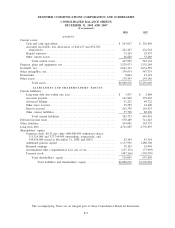

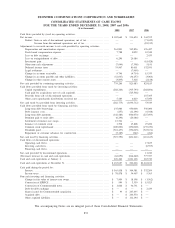

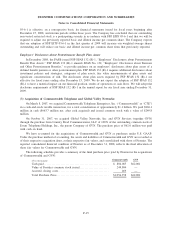

FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

DECEMBER 31, 2008 AND 2007

($ in thousands)

2008 2007

ASSETS

Current assets:

Cash and cash equivalents ............................................. $ 163,627 $ 226,466

Accounts receivable, less allowances of $40,125 and $32,748,

respectively ......................................................... 222,247 234,762

Prepaid expenses . . . ................................................... 33,265 29,437

Other current assets. ................................................... 48,820 33,489

Total current assets ............................................... 467,959 524,154

Property, plant and equipment, net . ......................................... 3,239,973 3,335,244

Goodwill, net . . ............................................................ 2,642,323 2,634,559

Other intangibles, net....................................................... 359,674 547,735

Investments ................................................................ 8,044 21,191

Other assets. . . . ............................................................ 170,703 193,186

Total assets....................................................... $6,888,676 $7,256,069

LIABILITIES AND SHAREHOLDERS’ EQUITY

Current liabilities:

Long-term debt due within one year .................................... $ 3,857 $ 2,448

Accounts payable . . . ................................................... 141,940 179,402

Advanced billings . . ................................................... 51,225 44,722

Other taxes accrued. ................................................... 25,585 21,400

Interest accrued ....................................................... 102,370 116,923

Other current liabilities ................................................ 57,798 80,996

Total current liabilities . . . ......................................... 382,775 445,891

Deferred income taxes. . . ................................................... 670,489 711,645

Other liabilities ............................................................ 594,682 363,737

Long-term debt ............................................................ 4,721,685 4,736,897

Shareholders’ equity:

Common stock, $0.25 par value (600,000,000 authorized shares;

311,314,000 and 327,749,000 outstanding, respectively, and

349,456,000 issued at December 31, 2008 and 2007).................. 87,364 87,364

Additional paid-in capital .............................................. 1,117,936 1,280,508

Retained earnings. . . ................................................... 38,163 14,001

Accumulated other comprehensive loss, net of tax....................... (237,152) (77,995)

Treasury stock......................................................... (487,266) (305,979)

Total shareholders’ equity ......................................... 519,045 997,899

Total liabilities and shareholders’ equity ....................... $6,888,676 $7,256,069

The accompanying Notes are an integral part of these Consolidated Financial Statements.

F-5