Frontier Communications 2008 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2008 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

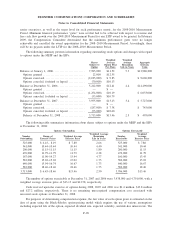

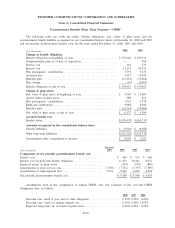

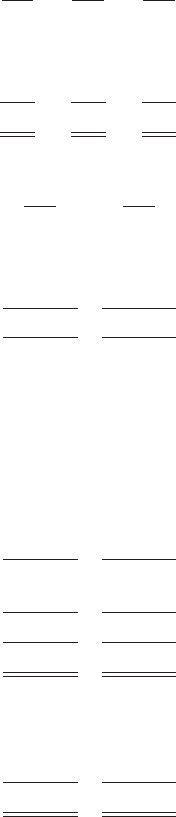

(18) Income Taxes:

The following is a reconciliation of the provision for income taxes for continuing operations computed at

Federal statutory rates to the effective rates for the years ended December 31, 2008, 2007 and 2006:

2008 2007 2006

Consolidated tax provision at federal statutory rate . ..................... 35.0% 35.0% 35.0%

State income tax provisions, net of federal income tax benefit ........... 2.8% 1.8% 2.1%

Tax reserve adjustment ................................................ (1.4)% 1.0% 0.2%

All other, net.......................................................... 0.4% (0.4)% (2.4)%

36.8% 37.4% 34.9%

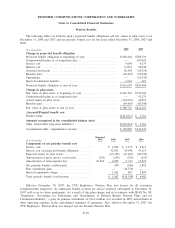

The components of the net deferred income tax liability (asset) at December 31 are as follows:

($ in thousands) 2008 2007

Deferred income tax liabilities:

Property, plant and equipment basis differences ......................... $642,598 $624,426

Intangibles............................................................ 248,520 275,102

Other, net ............................................................ 15,946 10,431

907,064 909,959

Deferred income tax assets:

SFAS No. 158 pension/OPEB liability ................................. 146,997 58,587

Tax operating loss carryforward. . ...................................... 72,434 83,203

Alternative minimum tax credit carryforward ........................... — 26,658

Employee benefits .................................................... 62,482 68,791

State tax liability...................................................... 7,483 10,361

Accrued expenses ..................................................... 19,726 14,818

Bad debts. ............................................................ 12,026 4,971

Other, net ............................................................ 14,550 12,700

335,698 280,089

Less: Valuation allowance........................................... (67,331) (59,566)

Net deferred income tax asset . . . ...................................... 268,367 220,523

Net deferred income tax liability .................................... $638,697 $689,436

Deferred tax assets and liabilities are reflected in the following

captions on the consolidated balance sheet:

Deferred income taxes .............................................. $670,489 $711,645

Other current assets . . ............................................... (31,792) (22,209)

Net deferred income tax liability . . . ............................. $638,697 $689,436

Our state tax operating loss carryforward as of December 31, 2008 is estimated at $952.3 million. A

portion of our state loss carryforward begins to expire in 2009.

F-31

FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES

Notes to Consolidated Financial Statements