Frontier Communications 2008 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2008 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

such contract advances that were transferred to the purchaser of our water and wastewater operations on

January 15, 2002 and accordingly should have been included in the gain recognized upon sale during that

period. Upon the adoption of SAB No. 108 in the fourth quarter of 2006, this error was corrected as of

January 1, 2006 through a decrease in other long-term liabilities and an increase in retained earnings.

Purchase Accounting. During the period 1991 to 2001, Frontier acquired a number of telecommunications

businesses, growing its asset base from approximately $400.0 million in 1991 to approximately $6.0 billion by

the end of 2001. As a result of these acquisitions, we recorded in accordance with purchase accounting standards,

all of the assets and liabilities associated with these properties. We have determined that approximately $18.8

million (net) of liabilities were established in error. Approximately $18.0 million of the liabilities should have

been recorded as a decrease to goodwill and $4.2 million should have been an increase to property, plant and

equipment ($1.99 million after amortization of $2.21 million). In addition, $4.964 million of liabilities should

have been reversed in 2001. We corrected this error by reversing the liability to retained earnings.

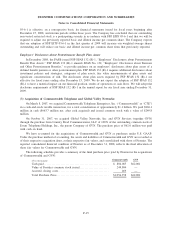

As permitted by the adoption of SAB No. 108, we have adjusted our previously recorded acquisition

entries as follows:

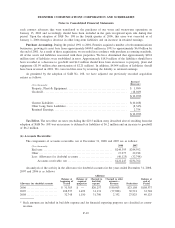

($ in thousands)

Increase/

(Decrease)

Property, Plant & Equipment ............................................... $ 1,990

Goodwill .................................................................. (18,049)

$(16,059)

Current Liabilities ......................................................... $(10,468)

Other Long-Term Liabilities ................................................ (8,345)

Retained Earnings. ......................................................... 2,754

$(16,059)

Tax Effect. The net effect on taxes (excluding the $23.5 million entry described above) resulting from the

adoption of SAB No. 108 was an increase to deferred tax liabilities of $6.2 million and an increase to goodwill

of $6.2 million.

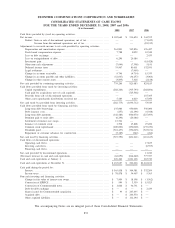

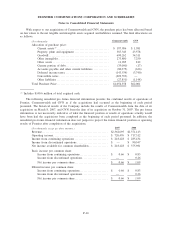

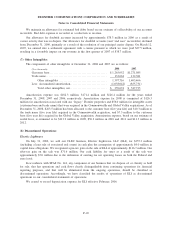

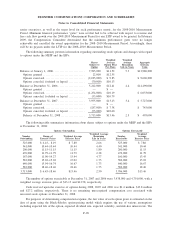

(6) Accounts Receivable:

The components of accounts receivable, net at December 31, 2008 and 2007 are as follows:

($ in thousands) 2008 2007

End user. . . .................................................... $244,395 $244,592

Other .......................................................... 17,977 22,918

Less: Allowance for doubtful accounts . . ........................ (40,125) (32,748)

Accounts receivable, net . .................................. $222,247 $234,762

An analysis of the activity in the allowance for doubtful accounts for the years ended December 31, 2008,

2007 and 2006 is as follows:

Allowance for doubtful accounts

Balance at

beginning of

Period

Balance of

acquired

properties

Charged to

bad debt

expense*

Charged to other

accounts—

Revenue Deductions

Balance at

end of

Period

Additions

2006 ........................ $ 31,385 $ — $20,257 $ 80,003 $23,108 $108,537

2007 ........................ 108,537 1,499 31,131 (77,898) 30,521 32,748

2008 ........................ 32,748 1,150 31,700 2,352 27,825 40,125

* Such amounts are included in bad debt expense and for financial reporting purposes are classified as contra-

revenue.

F-19

FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES

Notes to Consolidated Financial Statements