Costco 2012 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2012 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

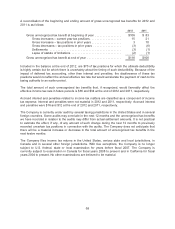

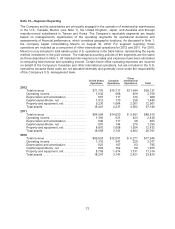

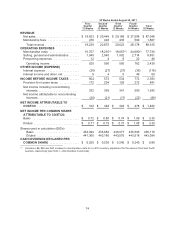

Note 12—Segment Reporting

The Company and its subsidiaries are principally engaged in the operation of membership warehouses

in the U.S., Canada, Mexico (see Note 1), the United Kingdom, Japan, and Australia and through

majority-owned subsidiaries in Taiwan and Korea. The Company’s reportable segments are largely

based on management’s organization of the operating segments for operational decisions and

assessments of financial performance, which considers geographic locations. As discussed in Note 1,

the Company began consolidating Mexico on August 30, 2010. For segment reporting, these

operations are included as a component of other international operations for 2012 and 2011. For 2010,

Mexico is only included in total assets under U.S. operations in the table below, representing the equity

method investment in the joint venture. The material accounting policies of the segments are the same

as those described in Note 1. All material inter-segment net sales and expenses have been eliminated

in computing total revenue and operating income. Certain home office operating expenses are incurred

on behalf of the Company’s Canadian and other international operations, but are included in the U.S.

operations because those costs are not allocated internally and generally come under the responsibility

of the Company’s U.S. management team.

United States

Operations

Canadian

Operations

Other

International

Operations Total

2012

Total revenue .......................... $71,776 $15,717 $11,644 $99,137

Operating income ....................... 1,632 668 459 2,759

Depreciation and amortization ............. 667 117 124 908

Capital expenditures, net ................. 1,012 170 298 1,480

Property and equipment, net .............. 9,236 1,664 2,061 12,961

Total assets ............................ 18,401 4,237 4,502 27,140

2011

Total revenue .......................... $64,904 $14,020 $ 9,991 $88,915

Operating income ....................... 1,395 621 423 2,439

Depreciation and amortization ............. 640 117 98 855

Capital expenditures, net ................. 876 144 270 1,290

Property and equipment, net .............. 8,870 1,608 1,954 12,432

Total assets ............................ 18,558 3,741 4,462 26,761

2010

Total revenue .......................... $59,624 $12,051 $ 6,271 $77,946

Operating income ....................... 1,310 547 220 2,077

Depreciation and amortization ............. 625 107 63 795

Capital expenditures, net ................. 804 162 89 1,055

Property and equipment, net .............. 8,709 1,474 1,131 11,314

Total assets ............................ 18,247 3,147 2,421 23,815

72