Costco 2012 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2012 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.discounted issue price plus accrued interest to date of redemption) any time after August 2002. As of

September 2, 2012, $864 in principal amount of Zero Coupon Notes had been converted by note

holders into shares of Costco Common Stock.

Off-Balance Sheet Arrangements

We have no off-balance sheet arrangements that have had, or are reasonably likely to have, a material

current or future effect on our financial condition or consolidated financial statements.

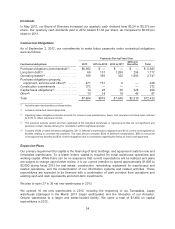

Stock Repurchase Programs

In April 2011, our Board of Directors authorized a stock repurchase program in the amount of $4,000,

expiring in April 2015, bringing total authorizations by our Board of Directors since inception of the

program in 2001 to $10,800. The authorization in April 2011 revoked previously authorized but unused

amounts totaling $792.

During 2012 and 2011, we repurchased 7,272,000 and 8,939,000 shares of common stock, at an

average price of $84.75 and $71.74, totaling approximately $617 and $641, respectively. The

remaining amount available to be purchased under our approved plan was $3,089 at the end of 2012.

Purchases are made from time-to-time, as conditions warrant, in the open market or in block

purchases and pursuant to plans under SEC Rule 10b5-1. Repurchased shares are retired, in

accordance with the Washington Business Corporation Act.

Critical Accounting Estimates

The preparation of our consolidated financial statements in accordance with U.S. generally accepted

accounting principles requires that we make estimates and judgments. We continue to review our

accounting policies and evaluate our estimates, including those related to revenue recognition,

investments, merchandise inventory valuation, impairment of long-lived assets, insurance/self-

insurance liabilities, and income taxes. We base our estimates on historical experience and on

assumptions that we believe to be reasonable. For further information on key accounting policies, see

discussion in Note 1 to the consolidated financial statements included in this Report.

Revenue Recognition

We generally recognize sales, which include shipping fees where applicable, net of estimated returns,

at the time the member takes possession of merchandise or receives services. When we collect

payment from customers prior to the transfer of ownership of merchandise or the performance of

services, the amount received is generally recorded as deferred revenue on the consolidated balance

sheets until the sale or service is completed. We provide for estimated sales returns based on

historical trends in merchandise returns, net of the estimated net realizable value of merchandise

inventories to be returned and any estimated disposition costs. Amounts collected from members that

under common trade practices are referred to as sales taxes are recorded on a net basis.

We evaluate whether it is appropriate to record the gross amount of merchandise sales and related

costs or the net amount earned as commissions. Generally, when we are the primary obligor, subject

to inventory risk, have latitude in establishing prices and selecting suppliers, influence product or

service specifications, or have several but not all of these indicators, revenue and related shipping fees

are recorded on a gross basis. If we are not the primary obligor and do not possess other indicators of

gross reporting as noted above, we record the net amounts as commissions earned, which is reflected

in net sales.

36