Costco 2012 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2012 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

valuation model. While options and RSUs granted to employees generally vest over five years, all

grants allow for either daily or quarterly vesting of the pro-rata number of stock-based awards that

would vest on the next anniversary of the grant date in the event of retirement or voluntary termination.

The historical experience rate of actual forfeitures has been minimal. As such, the Company does not

reduce stock-based compensation for an estimate of forfeitures because the estimate is

inconsequential in light of historical experience and considering the awards vest on either a daily or

quarterly basis. The impact of actual forfeitures arising in the event of involuntary termination is

recognized as actual forfeitures occur, which generally has been infrequent. Stock options have a

ten-year term. Stock-based compensation expense is predominantly included in selling, general and

administrative expenses on the consolidated statements of income. See Note 7 for additional

information on the Company’s stock-based compensation plans.

Leases

The Company leases land and/or buildings at warehouses and certain other office and distribution

facilities, primarily under operating leases. Operating leases expire at various dates through 2052, with

the exception of one lease in the Company’s United Kingdom subsidiary, which expires in 2151. These

leases generally contain one or more of the following options which the Company can exercise at the

end of the initial lease term: (a) renewal of the lease for a defined number of years at the then-fair

market rental rate or rate stipulated in the lease agreement; (b) purchase of the property at the then-

fair market value; or (c) right of first refusal in the event of a third-party purchase offer.

The Company accounts for its lease expense with free rent periods and step-rent provisions on a

straight-line basis over the original term of the lease and any exercised extension options, from the

date the Company has control of the property. Certain leases provide for periodic rental increases

based on the price indices, and some of the leases provide for rents based on the greater of minimum

guaranteed amounts or sales volume.

The Company has entered into capital leases for warehouse locations, expiring at various dates

through 2040. Capital lease assets are included in buildings and improvements in the accompanying

consolidated balance sheets. Amortization expense on capital lease assets is recorded as depreciation

expense and is predominately included in selling, general and administrative expenses. Capital lease

liabilities are recorded at the lesser of the estimated fair market value of the leased property or the net

present value of the aggregate future minimum lease payments and are included in other current

liabilities and deferred income taxes and other liabilities. Interest on these obligations is included in

interest expense.

Preopening Expenses

Preopening expenses related to new warehouses, new regional offices and other startup operations

are expensed as incurred.

Interest Income and Other, Net

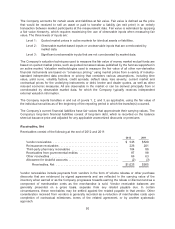

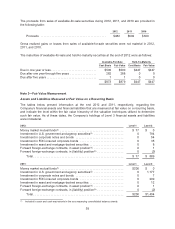

Interest income and other, net includes:

2012 2011 2010

Interest income, net .................................. $ 49 $41 $23

Foreign-currency transactions gains (losses), net .......... 40 9 14

Earnings from affiliates and other, net ................... 14 10 51

Interest Income and Other, Net ..................... $103 $60 $88

For 2010, the equity in earnings of Costco Mexico, $41, is included in interest income and other, net in

the accompanying consolidated statements of income.

56