Costco 2012 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2012 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Repair and maintenance costs are expensed when incurred. Expenditures for remodels,

refurbishments and improvements that add to or change the way an asset functions or that extend the

useful life of an asset are capitalized. Assets that were removed during the remodel, refurbishment or

improvement are retired. Assets classified as held for sale were not material at the end of 2012 or

2011.

The Company evaluates long-lived assets for impairment on an annual basis, when relocating or

closing a facility, or when events or changes in circumstances occur that may indicate the carrying

amount of the asset group, generally an individual warehouse, may not be fully recoverable. For asset

groups held and used, including warehouses to be relocated, the carrying value of the asset group is

considered recoverable when the estimated future undiscounted cash flows generated from the use

and eventual disposition of the asset group exceed the group’s net carrying value. In the event that the

carrying value is not considered recoverable, an impairment loss would be recognized for the asset

group to be held and used equal to the excess of the carrying value above the estimated fair value of

the asset group. For asset groups classified as held for sale (disposal group), the carrying value is

compared to the disposal group’s fair value less costs to sell. The Company estimates fair value by

obtaining market appraisals from third party brokers or other valuation techniques. Impairment

charges, included in selling, general and administrative expenses on the consolidated statements of

income, in 2012, 2011, and 2010 were immaterial.

Software Costs

The Company capitalizes certain computer software and software development costs incurred in

connection with developing or obtaining computer software for internal use. These costs are included

in property, plant, and equipment and amortized on a straight-line basis over the estimated useful lives

of the software, generally three to seven years.

Other Assets

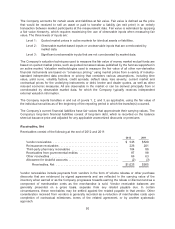

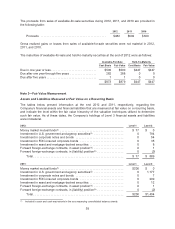

Other assets consist of the following at the end of 2012 and 2011:

2012 2011

Prepaid rents, lease costs, and long-term deposits .................. $230 $211

Receivables from governmental entities ........................... 225 216

Cash surrender value of life insurance ............................ 76 71

Goodwill, net ................................................. 66 74

Other ....................................................... 56 51

Other Assets ............................................. $653 $623

Receivables from governmental entities largely consists of various tax related items including amounts

deposited with taxing authorities in connection with ongoing income tax audits and long term deferred

tax assets. The Company adjusts the carrying value of its employee life insurance contracts to the net

cash surrender value at the end of each reporting period. Goodwill resulting from certain business

combinations is reviewed for impairment in the fourth quarter of each fiscal year, or more frequently if

circumstances dictate. No impairment of goodwill has been incurred to date.

Accounts Payable

The Company’s banking system provides for the daily replenishment of major bank accounts as

checks are presented. Included in accounts payable at the end of 2012 and 2011 are $565 and $108,

respectively, representing the excess of outstanding checks over cash on deposit at the banks on

which the checks were drawn.

52