Costco 2012 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2012 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

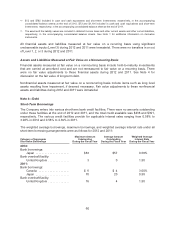

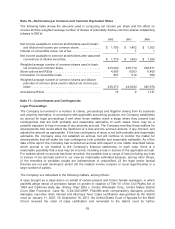

Certain leases may require the Company to incur costs to return leased property to its original

condition, such as the removal of gas tanks. Estimated asset retirement obligations associated with

these leases, which amounted to $44 and $31 at the end of 2012 and 2011, respectively, are included

in deferred income taxes and other liabilities in the accompanying consolidated balance sheets.

Note 6—Stockholders’ Equity

Dividends

The Company’s current quarterly dividend rate is $0.275 per share.

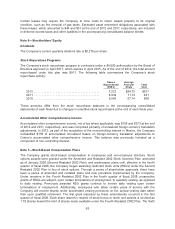

Stock Repurchase Programs

The Company’s stock repurchase program is conducted under a $4,000 authorization by the Board of

Directors approved in April 2011, which expires in April 2015. As of the end of 2012, the total amount

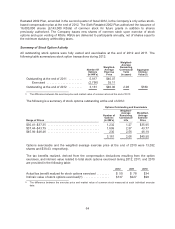

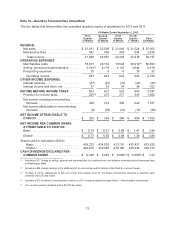

repurchased under this plan was $911. The following table summarizes the Company’s stock

repurchase activity:

Shares

Repurchased

(000’s)

Average

Price per

Share

Total

Cost

2012 .......................................... 7,272 $84.75 $617

2011 .......................................... 8,939 71.74 641

2010 .......................................... 9,943 57.14 568

These amounts differ from the stock repurchase balances in the accompanying consolidated

statements of cash flows due to changes in unsettled stock repurchases at the end of each fiscal year.

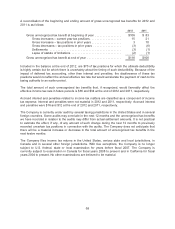

Accumulated Other Comprehensive Income

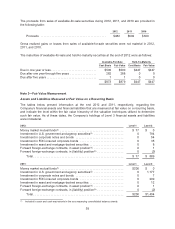

Accumulated other comprehensive income, net of tax where applicable, was $156 and $373 at the end

of 2012 and 2011, respectively, and was comprised primarily of unrealized foreign-currency translation

adjustments. In 2012, as part of the acquisition of the noncontrolling interest in Mexico, the Company

reclassified $155 of accumulated unrealized losses on foreign-currency translation adjustments to

Costco’s accumulated other comprehensive income. This balance was previously included as a

component of non-controlling interest.

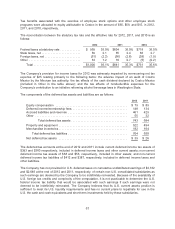

Note 7—Stock-Based Compensation Plans

The Company grants stock-based compensation to employees and non-employee directors. Stock

options awards were granted under the Amended and Restated 2002 Stock Incentive Plan, amended

as of January 2006 (Second Restated 2002 Plan), and predecessor plans until, effective in the fourth

quarter of fiscal 2006, the Company began awarding restricted stock units (RSUs) under the Second

Restated 2002 Plan in lieu of stock options. Through a series of shareholder approvals, there have

been a series of amended and restated plans and new provisions implemented by the Company.

Under revisions in the Fourth Restated 2002 Plan in the fourth quarter of fiscal 2008, prospective

grants of RSUs are subject, upon certain terminations of employment, to quarterly vesting, as opposed

to daily vesting. Previously awarded RSU grants continue to involve daily vesting upon certain

terminations of employment. Additionally, employees who attain certain years of service with the

Company will receive shares under accelerated vesting provisions on the annual vesting date rather

than upon qualified retirement. The first grant impacted by these amendments occurred in the first

quarter of fiscal 2009. Each share issued in respect of stock bonus or stock unit awards is counted as

1.75 shares toward the limit of shares made available under the Fourth Restated 2002 Plan. The Sixth

63