Costco 2012 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2012 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.December 12, 2012

Dear Costco Shareholders,

We are pleased to report that we had a very successful fiscal 2012. Despite an environment of ongoing

economic challenges, and an ever-changing, but always fierce, competitive landscape, our Company

achieved record sales and earnings for the third consecutive year. These accomplishments are the

result of the hard work of the more than 170,000 Costco employees around the world; our agility and

innovation in the marketplace; and an unwavering commitment to provide our members with the best

value for high quality goods and services. While we are not impervious to tough economic conditions,

great companies can grow and increase market share during economic downturns; and we believe

Costco achieved just that in 2012.

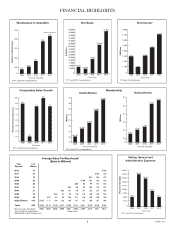

Costco’s 2012 operating performance was successful in many areas:

• Net sales for the 53-week fiscal year were up 11

1

⁄

2

percent, to $97 billion, from the prior

52-week fiscal year sales of $87 billion; and adjusting for the extra week, up 9

1

⁄

2

percent.

Comparable sales in warehouses open more than one year increased seven percent.

• These sales results were positively impacted by increases in both shopper frequency and the

average amount spent by members on each visit.

• Membership fees increased more than 11%, due to the impact of raising our annual

membership fees in the U.S. and Canada last year; strong member renewal rates; good

sign-ups at new warehouses; increased penetration of the Executive Membership program;

and the extra (53rd) week of operations in 2012. We were particularly pleased that our

membership renewal rates increased to our highest rate ever – nearly 90% in the U.S. and

Canada and over 86% on a worldwide basis.

• Our gross margin (net sales less merchandise costs) as a percent of net sales decreased in

fiscal 2012, largely due to our investment in lowering prices, which is consistent with our goal

of maintaining price and value leadership. This is what we do…each and every day!

• Our selling, general and administrative (SG&A) expenses as a percent of net sales

decreased by 17 basis points (from 9.98% to 9.81%). This is especially gratifying, since

driving down our expense ratios was a key goal for Costco in 2012. This decrease was

largely due to improvement in our warehouse operating costs (particularly payroll) and the

leveraging of operating expenses with strong sales results.

• Overall, our 2012 net income increased 17% to $1.71 billion, or $3.89 per share, compared

to $1.46 billion or $3.30 per share in 2011. These were the best results in Costco’s 29-year

history.

Our cash flow remained strong in 2012, and was highlighted by the following:

• Our world-wide operations generated over $3 billion in operating cash flow;

• Capital expenditures totaled nearly $1.5 billion in 2012, for new warehouses and depots, as

well as for expansion of our ancillary business operations;

• In March, we paid down $900 million of 5.3% senior notes, reducing our interest expense by

approximately $45 million per year;

• In July, we purchased the 50% interest in our 32-warehouse Costco Mexico operation from

our joint-venture partner for $789 million; and

• We returned to shareholders over $1 billion, in the form of dividends ($446 million) and share

buy-backs ($632 million) of over seven million shares in 2012.

2