Costco 2012 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2012 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

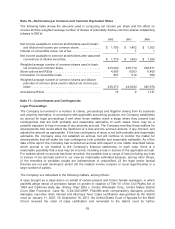

Note 8—Retirement Plans

The Company has a 401(k) Retirement Plan available to all U.S. employees who have completed

90 days of employment. For all U.S. employees, with the exception of California union employees, the

plan allows pre-tax deferrals which the Company matches (50% of the first one thousand dollars of

employee contributions). In addition, the Company provides each eligible participant an annual

discretionary contribution based on salary and years of service.

California union employees are allowed to make pre-tax deferrals into the 401(k) plan which the

Company matches (50% of the first five hundred dollars of employee contributions) and provides each

eligible participant a contribution based on hours worked and years of service.

California union employees participate in a defined benefit plan sponsored by their union under a multi-

employer plan, and the Company makes contributions to this plan based upon its union agreement.

The Company’s contributions to this plan are not material to the Company’s consolidated financial

statements.

The Company has a defined contribution plan for Canadian and United Kingdom employees and

contributes a percentage of each employee’s salary. Certain other foreign operations have defined

benefit and defined contribution plans that are not material. Amounts expensed under all plans were

$382, $345, and $313 for 2012, 2011, and 2010, respectively, and were included in selling, general

and administrative expenses and merchandise costs in the accompanying consolidated statements of

income.

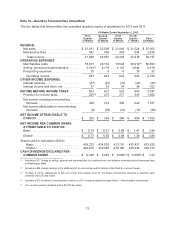

Note 9—Income Taxes

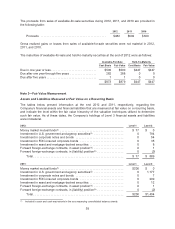

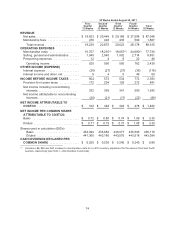

Income before income taxes is comprised of the following:

2012 2011 2010

Domestic (including Puerto Rico) ................... $1,809 $1,526 $1,426

Foreign ........................................ 958 857 628

Total ....................................... $2,767 $2,383 $2,054

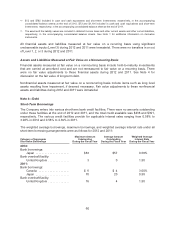

The provisions for income taxes for 2012, 2011, and 2010 are as follows:

2012 2011 2010

Federal:

Current ..................................... $ 591 $409 $445

Deferred .................................... 12 74 1

Total federal ............................. 603 483 446

State:

Current ..................................... 100 78 79

Deferred .................................... 2 14 5

Total state .............................. 102 92 84

Foreign:

Current ..................................... 312 270 200

Deferred .................................... (17) (4) 1

Total foreign ............................. 295 266 201

Total provision for income taxes .................... $1,000 $841 $731

66